Global Wealth Hits All-Time High, Largely From US Growth: Credit Suisse (CS) Global Wealth Report

Global wealth grew 4.9 percent from last year to an all-time high of $241 trillion, with the U.S. accounting for 72 percent of the rise, according to Credit Suisse Research’s 2013 global wealth report, which also predicts there will be 11 trillionaires within two generations.

Average global wealth reached a high of $51,600 per adult, the first time average global wealth has passed $50,000 since 2007.

According to the report, this is the fifth successive year that overall personal wealth has risen in the U.S. The rise has been fueled by a recovery in the housing market and the bull equity market.

The analysts' report, released Wednesday, predicts global wealth will grow nearly 40 percent over the next five years, reaching $334 trillion by 2018. The Swiss bank's analysts expect 29 percent of that growth to come from emerging markets, with China accounting for nearly half of emerging markets’ growth. Middle-income earners will push most of that growth, though they also predict the number of millionaires worldwide will rise markedly.

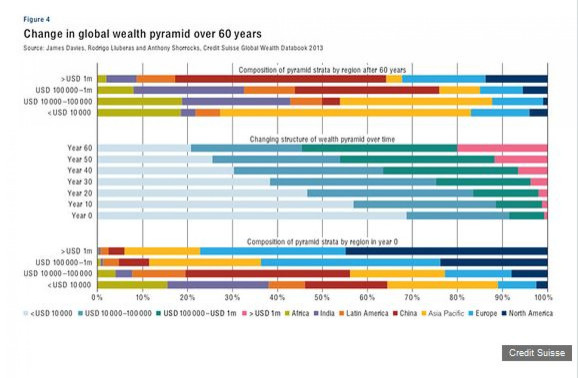

Still, vast global inequality persists. According to the report, the wealthiest 10 percent of the world’s population owns 86 percent of global wealth, compared to only 1 percent of the wealth owned by the bottom half of adults.

But every region has grown significantly since 2000, when global wealth totaled $113 trillion. Every region apart from North America and Asia-Pacific has more than doubled their wealth. North America’s wealth has risen 88 percent, and Asia-Pacific’s has risen 74 percent. In the same period, personal wealth in India rose by 211 percent and in China by 376 percent, and even with population growth occurring, net worth per adult rose 68 percent.

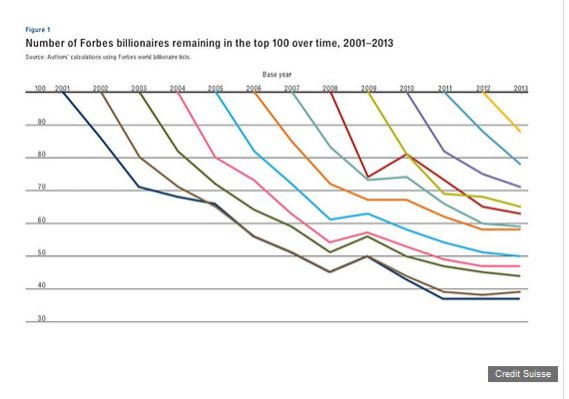

The Credit Suisse report also documents the turnover in the financial stratosphere. For example, of the top 100 billionaires on the 2001 list, only 37 were on this year's list.

© Copyright IBTimes 2024. All rights reserved.

Join the Discussion