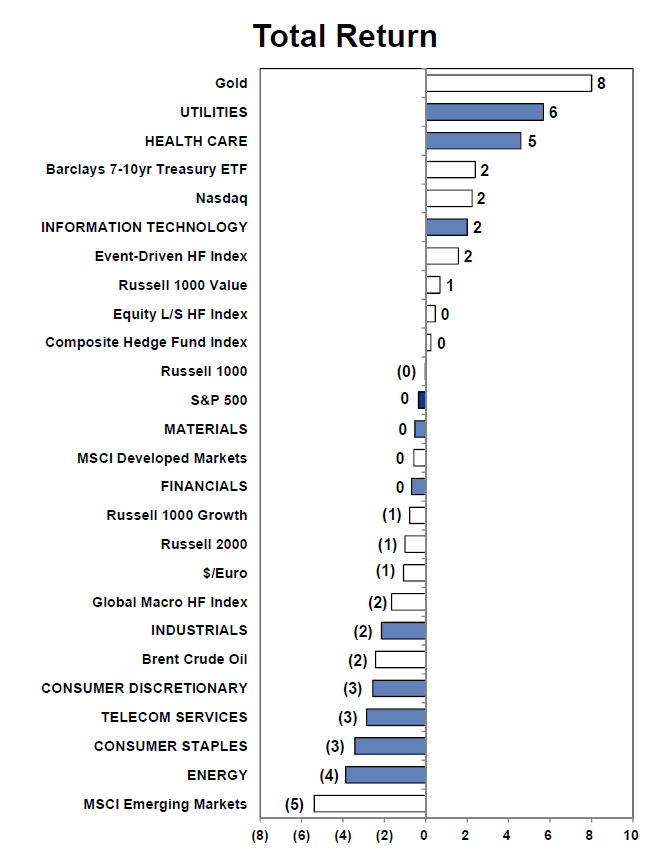

Gold With Best Returns For Year To Date, In Strange Twist: Goldman Sachs (CHART)

After a dismal 2013, gold has actually offered the best returns for the year to date among all asset classes in 2014, according to a Goldman Sachs Group Inc. (NYSE:GS) chart from Monday.

That comes on the heels of a 28 percent decline in gold prices in 2013, its worst year since 1981. Stock markets have been sluggish in early 2014, however, pulling out the brakes after a bullish 2013 gave rise to talk of potential market corrections in 2014.

Still, like many Wall Street analysts, the New York-based investment bank’s metals analysts maintain a dim view of gold prices for the upcoming year. Goldman Sachs’ Jeffrey Currie sees gold averaging $1,050 over 2014, down significantly from its current $1,318 per ounce.

In the research note sent out Sunday, Goldman Sachs also discussed global equities. It held global macroeconomic conferences in Tokyo and Hong Kong last week, and said the majority of the 2,000 attendees were most bullish on equities, relative to other assets, and specifically European equities.

In contrast with Asian investors and portfolio managers, Goldman Sachs predicts that the Japanese stock market will post the strongest returns in 2014.

“It became apparent that Europe is viewed as the ‘default option of choice.’ Past experience has led us to expect a bias in favor of local [Asian] equity markets, but the pattern did not occur this year,” wrote the Goldman Sachs analysts.

There is much apprehension over a Chinese economic slowdown and Japan’s “third arrow” of Abenomics reforms, which has dampened local sentiment, said the analysts.

“Most clients subscribed to our view that the current high valuation of the S&P 500 will result in only modest returns for the index in 2014. By process of elimination, clients believe European equities have the best near-term return possibilities.”

Asia-based equity investors also have a dimmer view of potential gains in the S&P 500 for 2014, relative to their American counterparts, according to the note.

“American home-bias exists. Many U.S.-based investors with whom we have met recently expect the S&P 500 will climb to 2000 - 2200 by the end of this year (+10% to +20%). No investor we met at the macro conference expressed such a positive view of the U.S. stock market,” read the note.

Goldman Sachs forecasted that Japan would post the best total return in 2014, at 23 percent, followed by Asian markets excluding Japan (16 percent), and Europe (12 percent), with U.S. equities in last place at a projected 6 percent return.

© Copyright IBTimes 2024. All rights reserved.