Gold Bubble For Real Says Societe Generale, Calling For $1,200/Oz. In Q4

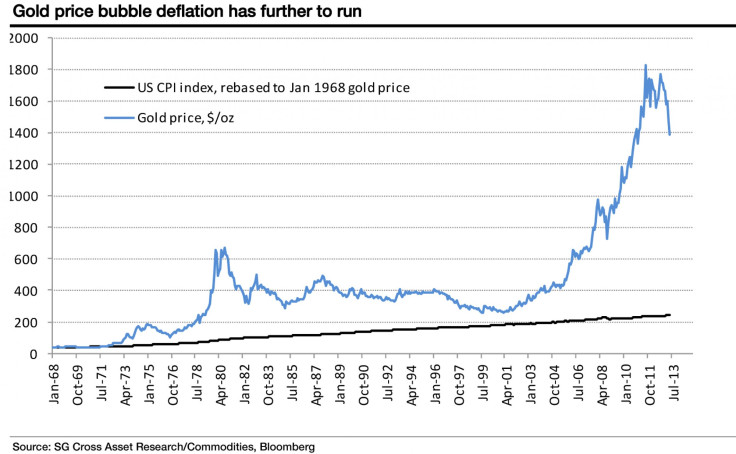

Gold is in a bubble after the best annual run in at least nine decades, according to research from Societe General, and the firm predicts the yellow metal will fall to $1,200/oz. by the fourth quarter of this year.

Prices will average $1,200/oz. in the fourth quarter, the bank said in a report Monday, compared with a previous estimate of a drop to $1,375/oz. by the end of the year.

“We believe that the dramatic price drop in mid-April was the beginning of the deflation of a bubble,” Robin Bhar and his colleagues said. “The gold price rally in the late 1970s turned out to be a bubble. We think this time is not much different.”

“The dramatic gold sell-off in April, combined with the prospect of the Fed starting to taper its QE program before year-end, has resulted in a paradigm shift in many investors’ attitudes toward gold,” analysts, including Robin Bhar, wrote in the report.

Gold is generally seen as a good hedge against the debasement of fiat money, and during the last big gold rally in the 1970s, investors pushed its price sharply higher in a context of very high inflation, partly driven by the oil supply crises. This time around, the rally was, as back then, initially driven by high commodities price inflation followed by inflation concerns on extraordinarily aggressive central bank quantitative easing since the 2008 financial crash.

Gold prices soared from $800/oz. in early 2009 to above $1,900/oz. in the fall of 2011. In April, gold futures took a sharp turn and tumbled into a bear market. Trading at $1,381.90/oz. on the Comex in New York, the metal is now 28 percent below its all-time high of $1,923.70/oz. reached in September 2011 and is heading for the first annual decline since 2000.

Inflation has so far stayed low – U.S. inflation has been trending lower since late 2011, and Societe Generale expects large-scale gold selling from investors who bought gold as a hedge against medium-term inflation.

Billionaire investor George Soros, who called bullion the “ultimate asset bubble” in 2010, joined Northern Trust Corporation (Nasdaq: NTRS) and BlackRock, Inc. (NYSE: BLK) in cutting holdings of exchange-traded products backed by gold before prices tanked in April.

Soros Fund Management LLC trimmed its investment in the SPDR Gold Trust (NYSEARCA: GLD), the biggest such fund, by 12 percent to 530,900 shares as of March 31, compared with three months earlier, a Securities and Exchange Commission filing showed. This reduction followed a 55 percent cut in the fourth quarter of last year. Funds run by Northern Trust and BlackRock reduced their positions in gold by more than half.

Hedge fund manager John Paulson, who made billions betting against subprime mortgages as the housing bubble burst, maintained a stake that lost about $165 million in the first quarter. Paulson & Co.’s $500 million Gold Fund tumbled 13 percent in May, extending this year’s loss to 54 percent.

For the first time in three weeks on mounting speculation that the Fed is moving closer to tapering QE, hedge funds and other large speculators have been trimming their bets on a gold rally. According to the U.S. Commodity Futures Trading Commission, they cut their net-long position by 4.1 percent to 54,779 futures and options by June 11.

ETF gold selling has averaged about 100 metric tons per month since the April sell-off. Societe Generale is calling for a further drop of 285 metric tons this year.

Moreover, further price drops could accelerate producer hedging, the researchers suggested.

Gold producers gradually unwound their hedges over the last 10 years as they got used to the gold price trending higher. The peak hedge position was in 2000, when gold was at $280/oz. At the time, the producers were hedging about $117 percent of their annual output.

“It is our impression that gold producers are starting to consider hedging and we would expect to see a substantial step-up in hedging this year compared to last year, which is likely to be the beginning of a new trend,” the bank said.

A sharp gold price decline could trigger a big increase in hedging, which would then put further downward pressure on prices and trigger further hedging, resulting in a self-reinforcing, accelerated collapse in the gold price, Societe Generale added.

And the official sector purchases won’t be enough to support the gold price.

The official sector has been adding gold reserves in significant volumes in recent years, but net buying is likely to slow going forward.

While the recent fall in the gold price is likely to have generated fresh official sector purchases, Societe Generale doubts that the level of last year’s net purchases, 533 metric tons, will be reached this year. Net buying will probably drop to 450 metric tons in 2013 and to 300 metric tons in 2014, they said.

The official reserves of global central banks have grown from $2 trillion in 2000 to more than $12 trillion in 2012, according to a World Gold Council report, as central banks try to diversify their assets. But “the pace of purchases from central banks is likely to slow as higher U.S. bond yields and a higher U.S. dollar will reduce the appeal of gold as a source of diversification for central bank reserves,” the analysts explained.

Russia had a reported increase of 34 metric tons from January-April this year, while other eastern European countries continue to buy, albeit in relatively small volume: these include Azerbaijan, Kazakhstan, the Kyrgyz Republic, Tajikistan and Serbia.

China is likely to limit its gold holdings to 2 percent of its total foreign exchange reserves, according to a recent comment by Yi Gang, a deputy governor of the People’s Bank of China. He said on March 13 that “We can only invest about 1 percent to 2 percent of the foreign exchange reserves into gold because the market is too small.”

Jim Rogers, co-founder of the Quantum Fund with George Soros, takes a different view. He told Fusion MarketSite in an interview last week that he’s “not selling [gold] and will buy more if it keeps dropping.” Rogers said he likes gold's fundamentals.

James Steel, HSBC Holdings PLC's (NYSE: HBC) chief precious metals analyst, also took the bull's view, telling Bloomberg in an audio interview that gold prices will rise to $1,600 per ounce in the second half of this year. Longer term, he is on record as saying that gold will rise to over $2,000 per ounce.

The SPDR Gold Trust (NYSEARCA: GLD) has dropped 0.5 percent to $133.80 on Monday, while the Market Vectors Gold Miners ETF (NYSEARCA:thi oGDX) has fallen 0.2 to $28.06. AngloGold Ashanti Limited (NYSE: AU) has gained 0.1 percent to $16.31, while Randgold Resources Ltd. (Nasdaq: GOLD) has dropped 1.5 percent to $74.25.

© Copyright IBTimes 2024. All rights reserved.