Gold Down on Sense That Bernanke Will Signal Support for Economy

World stocks edged up on Thursday while gold fell sharply as investors took an optimistic view of how clearly the Federal Reserve will commit to supporting the economy at a gathering this week.

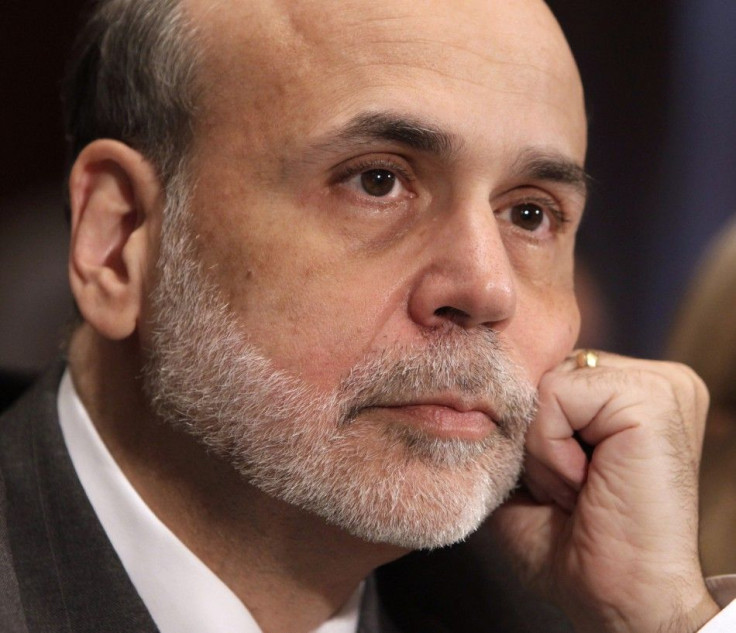

Fed chief Ben Bernanke is due to address central bankers at an annual symposium in Jackson Hole, Wyoming, on Friday. His speech last year laid the groundwork for the Fed's $600 billion bond-buying program to revive a sputtering U.S. economy.

While many doubt Bernanke will immediately commit to conducting a third round of quantitative easing, investors generally expect him to stress that the central bank stands ready to act if necessary.

Everyone is waiting to see what comes of the Wyoming meeting. I would be uncomfortable being aggressively short going into the weekend. And corporate results don't look too bad, said Andy Lynch, fund manager at Schroders.

MSCI world equity index rose 0.3 percent. The benchmark index is on track to post its first weekly gain in five weeks, having hit an 11-month low earlier in August.

European stocks added 0.6 percent while emerging stocks gained 0.2 percent.

French bank Credit Agricole and Austria's Raiffeisen Bank both rose after reporting better than expected quarterly earnings.

U.S. stock futures were up 0.1 percent, pointing to a slightly firmer open on Wall Street.

Technology shares will be in the spotlight after Steve Jobs resigned as chief executive of Apple. Apple shares fell more than 4 percent in Frankfurt after a 7 percent tumble in after-hours trade on Wall Street.

London Brent oil rose 0.5 percent to $110.70.

Bund futures fell 33 ticks.

Against a favorable backdrop for markets, jitters remained over the euro zone debt problem, especially in Greece.

Greek two-year bond yields rose to 44.77 percent after rising more than 400 basis points on Wednesday on uncertainty over implementation of its second rescue package.

Greece agreed last week to provide cash collateral for triple-A rated Finland's loans in a bilateral deal that sparked requests for similar treatment from Austria, the Netherlands and Slovakia. This prompted rating agency Moody's to warn that Greece's bailout payments could be delayed.

Greece is missing, in the first seven months of the year, its deficit reduction targets as the recession reduces the tax receipts for the government, said ING rate strategist Alessandro Giansanti.

In this environment, the odds of a full default event for the Greek bonds have substantially increased.

The dollar .DXY fell 0.1 percent against a basket of major currencies. Any round of more money printing by the Fed would pressure the dollar, potentially triggering a spike in commodity prices as it did last year.

The euro rose 0.1 percent to $1.4427.

Gold extended its sharp decline, after a wave of profit-taking triggered the biggest daily drop in futures since 1980.

Spot gold slipped to $1,707 an ounce, taking losses to more than $200 since it hit a record high of $1,911.46 earlier in the week.

The fall came after COMEX futures for the precious metal fell over $100 on Wednesday, the biggest one-day drop since 1980. Gold faced renewed pressure on Thursday after CME Group raised trading margins on bullion futures by about 27 percent, the biggest hike in more than two and a half years and the second increase in a month.

Gold prices had jumped $400 since July as worries about a global recession sent investors scrambling for the safe-haven asset.

© Copyright Thomson Reuters 2024. All rights reserved.