Gold Hedging: The Discussion Heats Up, As Gold Miners' Shares Continue Fall

Gold analysts are hedging about whether gold mining companies could or should hedge on the price of the yellow metal, delivering output at current gold prices to protect against future losses and volatility.

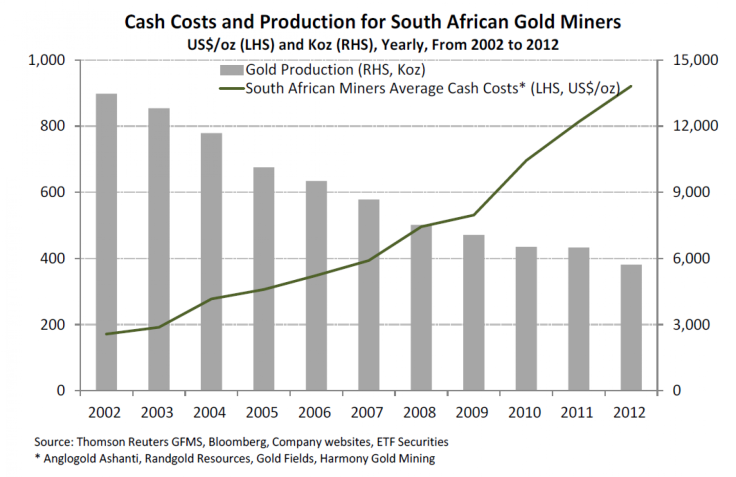

In a research report Friday, Barclays’ analysts wrote: “Gold cash costs have more than trebled over the past 10 years and with prices tumbling by a third this year, the margin between costs and prices has narrowed significantly.”

But they added: “We do not expect a large-scale hedging of the magnitude seen during the 1990s.” Then they wrote: “… But signs of fresh hedging have materialized.”

A gold producer may choose to protect itself against lower future gold prices, by agreeing to deliver gold in future years at current prices. The conservative policy means they lose potential revenue if gold prices rise, but they also reduce exposure to heavy losses if prices plunge.

As gold prices have fallen over 20 percent this year, reaching lows last seen in 2010, talk about hedging has gradually crept back into investment conferences and corporate board rooms. The incoming chairman of Barrick Gold Corp. (TSE:ABX), the world’s largest gold producer, has raised the topic, saying hedging sometimes makes “great sense.”

Still, producers haven’t yet hedged in a big way and also have not reined production, in spite of lower prices, Barclays analysts point out. Instead, mining companies have sought to cut capital and operating expenses, after allowing these budgets to soar in a decade which saw gold prices rise from roughly $350 per ounce to peaks of $1,900 per ounce.

Price thresholds of $1,200 per ounce and $1,000 per ounce may have to be touched before serious hedging actually happens again, said the Barclays report. Smaller gold producers have started hedging, but major gold miners are reluctant to do so. That’s partly because they remember the great pain they suffered, after they freed themselves from unfavorable hedged positions in the 1990s and 2000s, when gold prices moved contrary to their expectations.

Hedging plays into the attractiveness of the shares of gold miners, but is less likely to heavily influence gold prices, in an environment where U.S. monetary policy is key.

“It’s unlikely to be a big swing factor to the gold price,” said Nicholas Brooks, head of research and investment with ETF Securities, at a New York industry conference on Thursday.

Hedging is usually done very gradually and there’s only been a “little bit of a tick up” on hedging, he continued. Even with the talk and interest surrounding gold hedging, producers actually de-hedged in early 2013, by a net of 26 tons, according to recent industry data.

Still, key pressure comes from the rising cost to produce gold, considered in per-ounce terms, which combines with lower prices to make miners sweat. In South Africa, a key mining hub, production among some miners has fallen as average cash costs have steadily risen.

Gold miners shares’ have also fallen steeply this year. Shares in AngloGold Ashanti Limited (ADR) (NYSE:AU) and Gold Fields Limited (ADR) (NYSE:GFI) are “trading like they’re going to go out of business,” observed one audience member at a recent investment conference. AngloGold’s stock has fallen 61 percent percent for the year to date, with Gold Fields declining 71 percent.

The extent of gold hedging indicates the level of confidence gold miners maintain about gold prices, some say. Still, shareholders of gold miners may argue against hedging, since they want to potentially benefit from gold price rallies.

The World Gold Council, an industry group made up of gold miners, told reporters in late October that net hedges have been down, and added that hedging has little effect on mine production, which has stayed stable in the past decade. The council doesn’t provide advice to its members on hedging.

Goldman Sachs Group Inc. (NYSE:GS) analysts had a more definite view, though. They told producers in September that they should lock in 2013 gold prices.

Gold opened in New York on Friday at $1,225 per ounce on the COMEX exchange. A strong U.S. jobs report, which saw 203,000 jobs created in November, may drive gold prices in the next few days.

© Copyright IBTimes 2024. All rights reserved.