The ‘Goldilocks’ November Jobs Report: Is The Fed, Bernanke Market Dependent Or Data Dependent? [VIDEO]

Wall Street rose modestly in afternoon trading on Monday, as investors await speeches from Federal Reserve officials Jeffrey Lacker, James Bullard and Richard Fisher. They are hoping to hear clues to when the U.S. central bank will begin tapering its $85 billion-a-month bond-buying program.

U.S. stocks soared on Friday after the Labor Department reported U.S. employers added 203,000 jobs to nonfarm payrolls in November, topping economists’ forecasts. The unemployment rate fell to a five-year low of 7 percent last month, down from 7.3 percent in October.

“The Fed certainly watches the market to see what’s going on and gauges the market,” said Keith Bliss, senior vice president and director of sales & marketing at Cuttone & Co. Inc. “I think they watch the bond market certainly more than they watch the equity market, but they’ve stated all along, ‘We are data-dependent, we are data-dependent, we are data- dependent.’ So they look at the unemployment rate. They look at the inflation rate. Those are the two main data points that they look at.”

Both the Dow and the S&P 500 on Friday snapped a five-day losing streak after the better-than-expected employment report. The S&P saw its best day since Nov. 8, while the Dow recorded its largest gain since Oct. 16.

“What happened on Friday really was what I call the ‘Goldilocks’ jobs report,” Bliss added. “It was good enough to show that we’re still growing, but not so strong enough for people to think that the Fed was going to come in and taper at the Dec. 17 and 18 meeting. So the shorts who have to set really tight stops these days because they’ve been burned so many times in the past year, they got taken out on a stretcher again on Friday because they were so tight once the data came in on the jobs numbers, the market just took off. What you saw there was a good short covering rally.”

Fed policy-makers are scheduled to meet again on Dec. 17-18 for the Federal Open Market Committee’s final meeting of the year, and investors will be listening in on any hints as to when the central bank may begin to scale back on its stimulus measures.

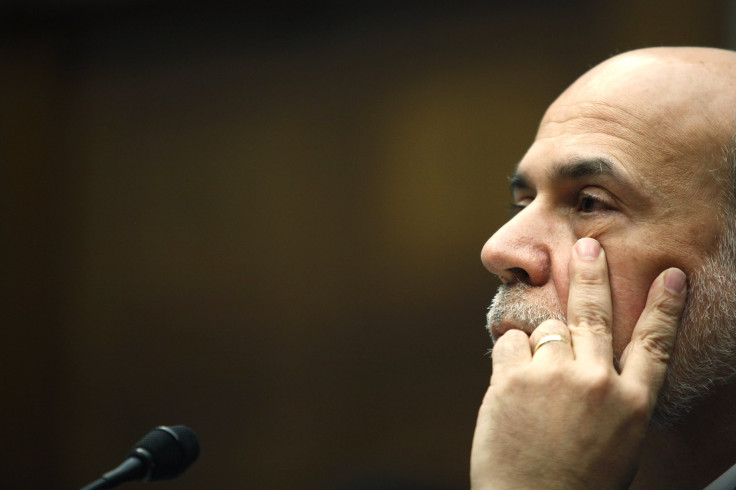

The financial markets were largely expecting a September taper, but to the surprise of many, the Fed decided to hold off. Fed Chairman Ben Bernanke reiterated policymakers need to see more "substantial" improvement and growth in the labor market before the Federal Reserve will begin to pull back on quantitative easing.

“That was September, and of course people got burned on that,” said Bliss. “The message that I got from the chairman back then was, ‘We told you it was going to be data dependent. Don’t try to front run us on this. We’ll get slammed.’ I think what people need to watch now is the 10-year yield. What was interesting is that 10-year yield…if it had spiked above 3 percent on Friday, it went above 2.9 but then it came back down around 2.84 or 2.85 now…If the 10-year yield gets above 3 percent before next week’s meetings, then investors are betting that they’re going to come out with some sort of taper talk. Watch the 10-year yield. That is your North Star.”

Ahead on this week’s economic calendar, investors will be looking to wholesale inventories on Tuesday, the federal budget on Wednesday, retail sales for November on Thursday and the producer price index on Friday.

The Dow Jones Industrial Average gained 29.67 points or 0.019 percent, to 16,049.87. The S&P 500 Index rose 5.45 points or 0.31 percent, to 1,810.76. The Nasdaq Composite added 7.68 points or 0.19 percent, to 4,070.19.

© Copyright IBTimes 2024. All rights reserved.