Goldman Sachs Analysts Warn US Manufacturers That Performing Better Than Europe And Japan Is Nothing To Get Excited About

Goldman Sachs has a sober analysis of the U.S. manufacturing renaissance.

In its new report, "The U.S. Manufacturing Renaissance: Fact or Fiction?" Goldman's chief economist, Jan Hatzius, said that U.S. manufacturing's positive figures are a good sign but warns that such recent figures actually show cyclical behavior that should be expected -- not structural behavior that could be considered extraordinary.

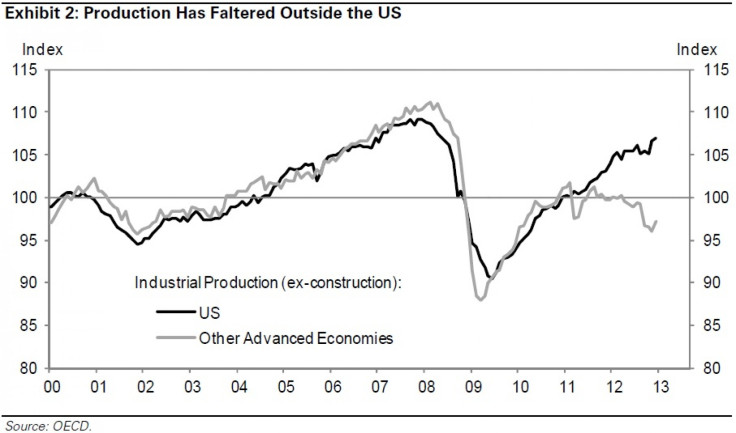

One of the main points he makes in the study, which was released Monday, is that the industry's growth in the U.S. compared with the performances of manufacturing in other countries says more about the weakness in other parts of the global economy than about the strength of U.S. manufacturing.

"Outside the goods-producing sector, U.S. real GDP has grown just 0.5 percent (annualized) since the start of the recovery in the middle of 2009, by far the slowest rate of any postwar cycle," Hatzius said. "And of course, the gap between U.S. and foreign industrial output mostly reflects the weakness in Europe and Japan following the intensification of the European financial crisis and the Japan earthquake in early 2011."

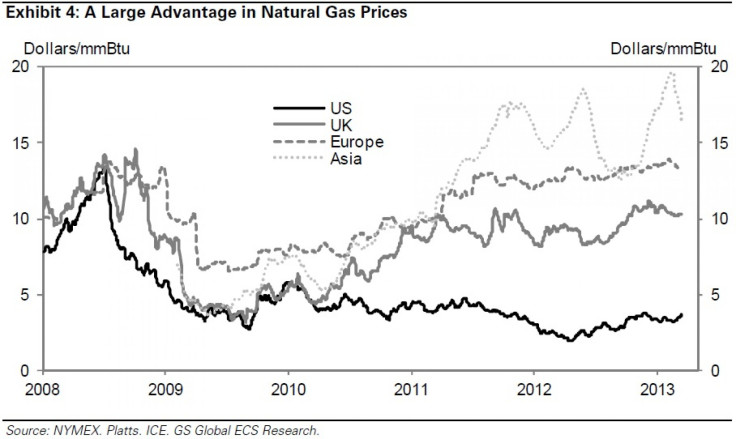

Hatzius' report also says there has not yet been a significant output pickup in the production of aluminum, steel, plastics, basic chemicals and fertilizer production as one would expect from currently low natural gas prices.

"Total output in the truly energy-sensitive sectors shown account for 7 percent of overall industrial production, or around 1 percent of GDP," Hatzius said. "So unless the impact of low U.S. energy prices on output growth in these sectors is dramatic, the macroeconomic repercussions are likely to be fairly limited."

"Over the next few years, the manufacturing sector should continue to grow a bit faster than the overall economy. But the main reason is likely to be a broad improvement in aggregate demand, rather than a structural U.S. manufacturing renaissance," he added.

© Copyright IBTimes 2024. All rights reserved.