Gold's Worst Quarter Ever Is Finally Over: Where Do Gold Prices Go From Here?

Whew! Gold has just slinked away, battered and beaten, from its worst quarter ever.

Once considered the perfect safe-haven investment, the precious metal can’t find any place to hide anymore. From exchanges in Hong Kong and Shanghai to markets in London and New York, the price of gold is getting clobbered.

As a result, retail investors are stampeding to the exits, nursing financial wounds that will take years to heal. Indeed, whether gold can ever regain its luster, let alone its former strength, is suddenly a very wide-open question.

Gold hit an all-time high in September 2011 when it touched $1,921 per troy ounce. In the next 13 months, the price was virtually flat, slipping a mere 2 percent.

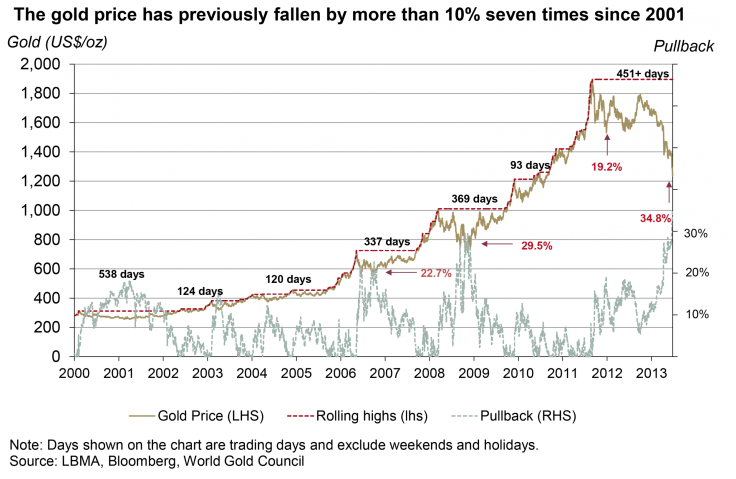

But from early October 2012 through June 2013, gold has tumbled 32 percent. Much of that decline began two months ago, early in the second quarter. On Thursday, April 11, the price closed at $1,566; by the following Monday, gold was selling for $1,362 -- a 13 percent drop that landed gold in bear market territory (generally defined as a 20 percent decline in value) for the first time in years. It was also the biggest single-day percentage drop for gold in recorded history.

For the entire quarter just ending, gold is on track to lose nearly 25 percent of its value. The last time gold fell anywhere near that sharply was in the first quarter of 1982 when it plunged 18 percent.

The upshot? Since the third quarter of 2011, the total value of all the gold mined in the world, about 171,300 metric tons, has dropped by more than $4 trillion.

This unexpected downturn is playing havoc with the balance sheets of mining outfits, some of which are finding that the cost of getting gold out of the ground exceeds its selling price. For example, Newcrest Mining Ltd. (ASX:NCM), Australia’s biggest gold producer with $7.3 billion in market capitalization, is taking an asset write-down of as much as $5.5 billion, because of “the current market environment and outlook,” the company said in a statement. Newcrest also plans to close its Brisbane, Australia, office to reduce corporate costs by as much as 20 percent, slash capital expenditures by a third and exploration expenditures by a half. Not surprisingly, investors will have to forgo their final dividend payment this year.

Meanwhile, Barrick Gold Corp. (TSE:ABX), the biggest gold producer in the world, is cutting 30 percent of the office staff at its Toronto headquarters and numerous jobs in Nevada and Utah.

Why Gold Is Falling

A perfect storm of conditions has traumatized the gold market, but at the heart of it all is the unprecedented steps taken by the U.S. central bank to swell the nation’s money supply.

In an effort to pull the economy out of the worst economic downturn since the 1930s, the Federal Reserve has for the past few years purchased huge amounts of Treasury bonds and mortgage-backed securities -- $85 billion worth each month since last September -- in what it calls “quantitative easing.” Under normal circumstances, pumping so much money into the economy would cheapen the dollar and drive inflation. Worried about this possibility, some investors responded by purchasing gold, which they assumed would be immune from currency inflation. But these concerns about inflation failed to materialize.

“Right now, we’re in a world of disinflation or low inflation, and we have been in this phase since 2009, after the economic crisis began,” Tim Kelly, founder and CEO of ForexTV, said. “So we find ourselves in a contrarian position vis a vis the perceived reason to invest in gold. [Now] there’s no reason to invest in gold.”

Another factor in the decline is the way gold responds to interest rates.

One intended effect of monetary easing has been greater demand for Treasuries and, hence, rock-bottom long-term interest rates. That has contributed to a reduction in the yield of most other types of debt as well. And the ever-increasing supply of money chasing a static number of securities has contributed to this year’s double-digit gain in the stock market.

All that changed, however, when Federal Reserve Chairman Ben Bernanke said on June 19, after the latest meeting of the central bank’s key rate-setting committee, that quantitative easing may be reduced later this year and, depending on how the economy’s recovery advances, abandoned completely at the end of next year.

His remarks convulsed the markets. Most significantly for gold, the interest rate on benchmark 10-year Treasuries shot up from 2.42 percent on Friday, June 21, to 2.63 percent on Monday, June 24 -- a two-year high. The Dollar Index, which gauges the currency against a basket of rivals, hit 83.07 on Thursday, June 27, from 81.32 on June 19.

As bond yields rose, investors had fresh incentive to sell gold and buy an asset that would produce a predictable return; and as the dollar strengthened, the price of gold, which is primarily purchased with the greenback, fell.

Bernanke’s statements unhinged markets outside the U.S., too. In the wake of the Fed’s hints about minimizing quantitative easing, Germany’s DAX fell 3.66 percent, France's CAC 40 was off 3.28 percent, and the UK's FTSE 100 dropped 2.83 percent. In Asia, losses were nearly as bad: Japan's Nikkei 225 index tumbled 1.74 percent, Singapore's Straits Times index plunged 2.51 percent, and Hong Kong's Hang Seng index gave up 2.88 percent.

For some equities investors, these precipitous declines triggered margin calls requiring them to come up with money to cover holdings they had purchased essentially with borrowed cash. In many cases, investors sold gold to make up the shortfall.

What’s Next For Gold

Most experts aren’t holding their breath for a return to gold’s recent glory days. Nouriel Roubini, a New York University economist influential in financial circles but usually pessimistic about global markets, sees gold headed further south to $1,000.

Goldman Sachs lowered its forecast for the price of gold at the end of 2014 to $1,050 from $1,270. For this year, the investment bank is cutting its forecast to $1,300 from $1,435.

“We ... expect that continued central bank gold buying will not be sufficient to offset this decline in prices,” Goldman Sachs said in a note. “While this forecast implies that the unwind of physical gold investments will push gold prices below its marginal cost of production, we expect that the ensuing likely decline in mined output will over the longer term maintain prices near $1,200 per ounce, which remains our forecast for 2015 and beyond.”

ForexTV’s Kelly, who uses technical analysis in his work as a currency trader, said the recent selling has been overdone. Pointing to a key metric called the Relative Strength Index, or RSI, a moving average that reflects the strength of price movements, he said that the RSI of gold is at 27, just beneath the 30 level at which point a security, in this case gold, is oversold.

“We’re almost at the exhaustion point,” he said. “The price is running way below the associated volume. When price action is not accompanied by corresponding volume, it is a bullish sign. I could see a retracement back to $1,400 by the year.”

On Friday, market watchers Capital Economics cut its gold price forecast for this year to $1,320 from $1,700 and to $1,400 from $1,500 for 2014.

“The recent slump in the price of gold to less than $1,200 per ounce, which regrettably we failed to predict, has prompted us to take a more cautious view of the prospects for the precious metal,” Julian Jessop and Ross Strachan, analysts for the firm, said in a note. “The traditional drivers of demand for gold have all weakened or reversed in the last few months.”

Jessop and Strachan added that their forecast would be lower but for the possibility that the “unprecedented expansion in the monetary base ... could yet feed through into higher inflation.”

Given the mostly dire predictions about gold, Edward D. Jones & Co. investment strategist Kate Warne believes that the precious metal’s volatility makes it unsuitable as a major part of an investor’s portfolio. Instead, she advises clients to invest in gold through a “broad-based commodities fund that comprises up to 5 percent of their portfolio. It should be seasoning, not the meat and potatoes.”

© Copyright IBTimes 2024. All rights reserved.