Is The 'Great American Job Creation Machine' About To Rev Up?

Analysis

The U.S. economy, which has been growing for about four years, is showing signs of an increase in the pace of commercial activity.

Corporate profits, housing, manufacturing, auto sales and jobless claims suggest that, while the current economic expansion is hardly robust, the sum of the recent, positive reports suggests a recovery that's beginning to gain its sea legs.

Further, the Dow's four-month staircase up to 14,500 is one expression by institutional investors that they see an improving economy and that better quarters are ahead for corporate earnings.

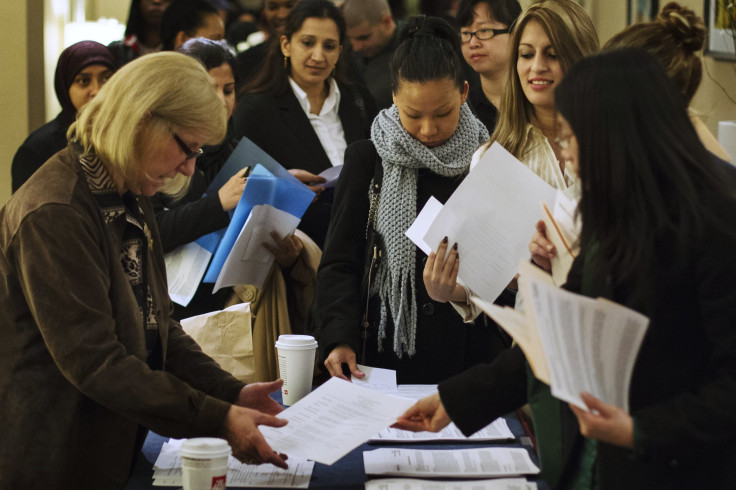

Still, throughout the recovery, business executives and certainly job seekers -- despite adequate corporate earnings growth -- have lamented the fact that the economic recovery has not been as strong as typical recoveries, with below-average job growth, consuming spending and household formation, among other key economic metrics.

Further, although the sub-normal recovery may puzzle some, the reason is crystal clear to economists and public policy professionals: The current recovery’s path is typical for expansions following a financial crisis, with classic factors constraining both U.S. GDP growth and job growth.

Those factors are:

1. Deleveraging: From 2001 thru 2007, Americans overconsumed and undersaved, resulting in high and, in many cases, unsustainable credit card balances. Further, even before the recovery started, these Americans started paying down that debt and rebuilding their balance sheets. The result: Less disposable income is being spent on consumer goods, and this has limited both GDP growth and job growth.

2. Stagnant/lower wages: The first two decades of globalization ushered in a period of declining wages in many U.S. job segments. As a result, real median incomes have been pressured. Combine the aforementioned with rising living expenses related to local/states taxes, food, insurance and fuel/energy, and the result is tight budgets for many families -- and, in some cases, no disposable income for households -- another constraint on GDP growth and job growth.

3. Smaller workforce: Finally, due to the Great Recession, 2007-2009, the U.S. civilian labor force still is smaller today (142.3 million) than it was at the start of the recession (146 million) in December 2007, according to data compiled by the U.S. Labor Department. Net result: The smaller workforce implies a lower number of households -- and that, too, has historically constrained both GDP growth and job growth.

The good news is, historically, the U.S.’s economic system has proven to be remarkably flexible and resilient -- able to withstand losses of whole sectors and, via ingenuity and new technologies, create new engines of both GDP growth and job growth.

The more sobering news is that those new sectors -- new engines of job growth -- have not made a pronounced entrance during this recovery. High-end manufacturing is capable of creating many jobs but so far has not. Energy (natural gas and, to a lesser extent, oil) has that potential as well, but it is not as labor-intensive as, for example, auto manufacturing. And while the 205,000-average monthly job gain during the last four months (November 2012 through February 2013) represents an improvement, compared to earlier recovery years, the reality is that the U.S. will need sustained job growth of more than 250,000 new jobs per month for years, not months, to erase the worst deficit in the economy: the jobs deficit.

How big is the jobs deficit? The Economic Policy Institute, a liberal, Washington, D.C., think tank, put the jobs shortage at 8.9 million jobs. That means that even at Feburary's job growth rate, the nation would not return to a pre-recession unemployent rate until February 2017. Bump the job growth rate up to 320,000, and the nation still doesn't return to a pre-recession rate until February 2016.

© Copyright IBTimes 2024. All rights reserved.