Hedge Funds Invest Heavily In EBay, Facebook And Others

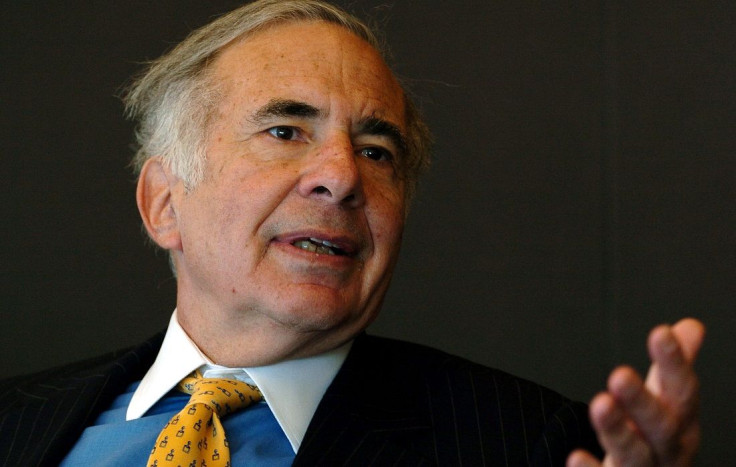

Ebay, the e-commerce consumer-to-consumer marketplace, became a favorite of investors recently, in advance of activist-investor Carl Icahn’s urgings to sell off its PayPal subsidiary. According to a CNBC report, leading hedge funds Farallon Capital Management and Omega Advisors both invested heavily in the company, with Farallon taking a new stake of 3,295,000 shares and Omega taking a new stake of 854,000 shares. Icahn’s proposal for the spinoff was nevertheless rejected by eBay.

Ebay is not the only company to win affection from hedge funds. Reuters reports that auction house Sotheby’s, General Motors and Facebook also received new positions from hedge fund managers. Mick McGuire’s Marcato Capital Management, for example, took on an additional 1.2 million shares in Sotheby’s, which represented a 35 percent increase in its holdings there.

After exiting Facebook during last year’s third quarter, Tiger Consumer Management has gotten back in the game. Recent filings from the Securities and Exchange Commission show that the Patrick McCormack-led firm now owns nearly 1.4 million shares of the social-media giant. Hayman Capital, led by Kyle Bass, took on approximately 4.6 million shares of General Motors, which represented nearly 25 percent of his portfolio, according to Reuters. Hedge fund Bronson Point Management upped its stake in the company by nearly 35 percent, purchasing an additional 400,000 shares. Bridger Capital went in the other direction, selling off 155,000 shares, but its remaining 1,695,000 shares account for the fund’s fourth-largest position.

Icahn’s interest in eBay comes on the heels of a “large position” he took with Apple last August, and at the end of the year his stake was 4.7 million shares. According to CNBC reports, Icahn boosted his stake with another half-billion dollars' worth of Apple stock. Known for his aggressive action for management changes in the companies he invests in, Icahn said he was abandoning his call to have Apple add another $50 billion to its buyback plan.

© Copyright IBTimes 2024. All rights reserved.