Hedge Funds Turn Tail As Commodities Crumble On Recession Rumble: McGeever

Buy and hold, maximum long.

That has basically been the strategy for commodity hedge funds for the last couple of years, but it is fast losing its luster.

Crude oil, industrial metals and a range of agricultural commodities are down significantly from their peaks earlier this year - in some cases by up to 50% - as rising interest rates increase the likelihood of U.S. and global recession.

For all that hedge funds are supposed to be quick-thinking, nimble operators with the freedom and flexibility to go short as well as long - they are the smartest guys in the room, after all - the reality is rather different.

Many are trend-spotting momentum players, betting on an asset appreciating in value and running with it. This approach is not all that different from any conventional buy-and-hold, long-only fund.

Going long - essentially a bet that a particular asset will rise in value - has been extremely lucrative in the commodities space thanks to the post-pandemic global economic recovery, subsequent supply-chain and bottleneck squeeze, and supply issues emanating from the Russia-Ukraine war.

Hedge fund industry data provider Preqin's commodities strategies index rose 13.8% from January through May, more than four times the 3.0% rise in the benchmark macro index, and three times the macros strategies index rise of 4.5%.

Similarly, rival industry data provider HFR's commodity index was up 12.1% in the first five months of the year, the main contributor to the (total) macro index's 9.35% gain. Commodities is a constituent part of the broader macro index.

But almost all of that impressive performance - 10.57% of it - was accrued in the first quarter. The index lost 0.46% in May, its biggest monthly fall since November 2020.

Thomas Thornton, founder of research firm Hedge Fund Telemetry, says a lot of funds have been caught out by the recent price decline across the commodity complex, which is eating into their previous gains.

"Commodity hedge funds don't short enough. They don't hedge enough. They're basically momentum traders," Thornton said.

"Hedge funds have chased performance, chased commodities higher. They have absolutely crushed it. But this last move down has really shaken some funds," he added.

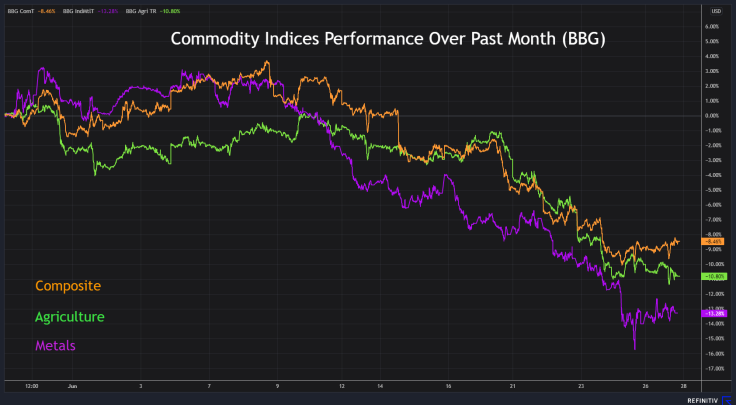

GRAPHIC: Commodities performance over past month (

)

LONG, LONG, LONG

Second-quarter and first-half performance figures will be released in early July. The HFR commodity index has posted only one quarterly loss since 2018, and that was a 0.57% decline in Q1 2020 at the onset of the COVID-19 pandemic.

It is unlikely to fall that much in Q2, but the peak definitely seems to have passed.

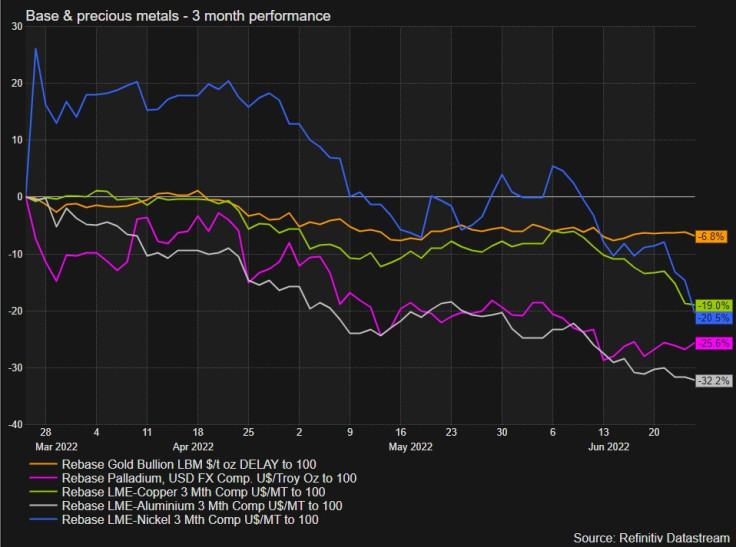

Brent crude oil futures are down around 20% from their March high, and benchmark London Metal Exchange copper futures last week hit their lowest level since February 2021. Copper has lost around a quarter of its value since hitting a record high in March.

Other industrial metals are also sliding sharply - tin fell 25% last week alone, its biggest weekly fall since at least 2005, and is now 50% off its March high.

GRAPHIC: Metals prices over past 3 months (

)

The Bloomberg agriculture index fell more than 7% last week, its biggest fall since 2011. The industrial metals index is down 25% in the April-June period, on track for its worst quarter since 2008 and second-worst since the index was launched over 30 years ago.

Speculators active in Commodity Futures Trading Commission futures are waking up to the shift. Funds sold oil in the latest week at the fastest rate in 15 weeks as the prospect of a U.S. recession sooner rather than later continued to intensify.

Saxo Bank's commodity analysts said on Monday that the total CFTC net long position across 24 commodity futures they track fell 5% to a 22-month low of 1.5 million lots in the last week. The biggest reductions were in WTI crude oil, natural gas, grains and sugar.

"Worries about growth and with that demand for commodities helped trigger long liquidation in energy and grains together with additional short selling in copper," they wrote on Monday.

The opinions expressed here are those of the author, a columnist for Reuters.

Related columns:

- Funds sell oil at fastest rate for 15 weeks as economic outlook worsens (June 27)

- Funds trim bullish CBOT grain bets ahead of steep selloff (June 27)

- Rate blitz a reminder the Fed doesn't target GDP (June 21)

(By Jamie McGeever in Orlando, Fla.; Additional contribution from Mike Dolan in London; Editing by Matthew Lewis)

© Copyright Thomson Reuters 2024. All rights reserved.