Here’s How King Compares To Other Mobile Gaming Companies [CHARTS]

The maker of the popular smartphone game Candy Crush Saga, King, just filed to raise $500 million in an IPO. And it’s financials look great.

Candy Crush Saga, the insanely popular and addictive game, was raking in just under $1 million a day in revenue for King by the end of 2013, and was the top-grossing app on the iTunes store.

So it comes as no surprise that King’s financials are pretty robust. Not only is the company making loads of money, it’s profit margins are pretty wide.

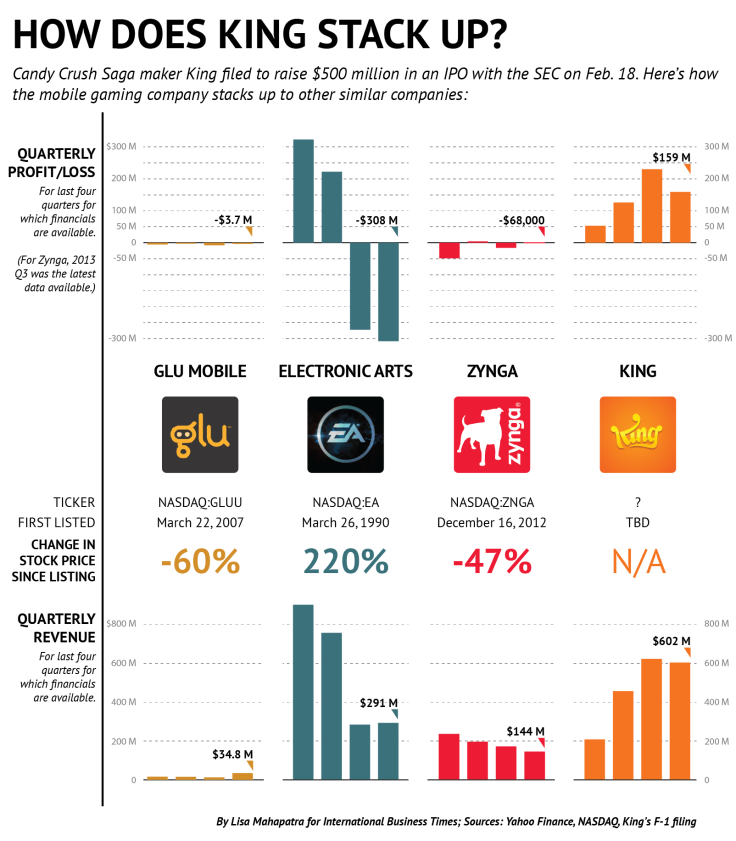

But how does it compare with other mobile gaming companies? Here’s a chart that looks at the quarterly profits or loss and quarterly gross revenue for King and three publicly held companies that see a significant amount of their revenues coming from the mobile gaming sector -- Electronic Arts, Zynga and the comparatively diminutive Glu Mobile.

These charts make it clear that King is outperforming all the others. But that doesn’t mean King stock will necessarily be a good buy when it’s finally made available to the public.

King makes most of its money from a small number of popular smartphone games, and there’s no guarantee that these games will maintain their popularity, or that King will be able to come up with more successful games and keep growing.

And along with King’s exponential growth have come increasing operating expenses. The company went from 144 employees in 2011 to 665 employees in 2013. King has also opened five more game studios in Europe in hopes of continuing growth.

King could be a one-hit-wonder, or it could keep evolving and growing.

Correction: An earlier version of this graphic reflected Glu Mobile's 2013 Q3 financials and the three quarters prior to that. This chart has now been updated to reflect Glu Mobile's 2013 Q4 financials.

© Copyright IBTimes 2024. All rights reserved.