As Hillary Clinton Prepares To Unveil New Tax Plans, Previous Proposals Have Occupied A Political Middle Ground

Less than a month before Iowa voters head to the polls and officially kick off the long-awaited presidential primary season, Democratic front-runner Hillary Clinton is preparing to unveil tax proposals designed to raise rates on the wealthiest Americans. “As president, I’ll do what it takes to make sure the super-wealthy are truly paying their fair share,” the former secretary of state said in a statement Saturday. “In the coming weeks,” she added, “I will be laying out additional proposals that go beyond the Buffett rule.”

Named after billionaire business magnate Warren Buffett and backed by the White House, the rule refers to a proposed 30 percent tax rate on people making more than $1 million a year. Buffett has famously noted he pays a smaller percentage than his secretary in taxes — an example that has come to epitomize the inequality of the existing U.S. tax code.

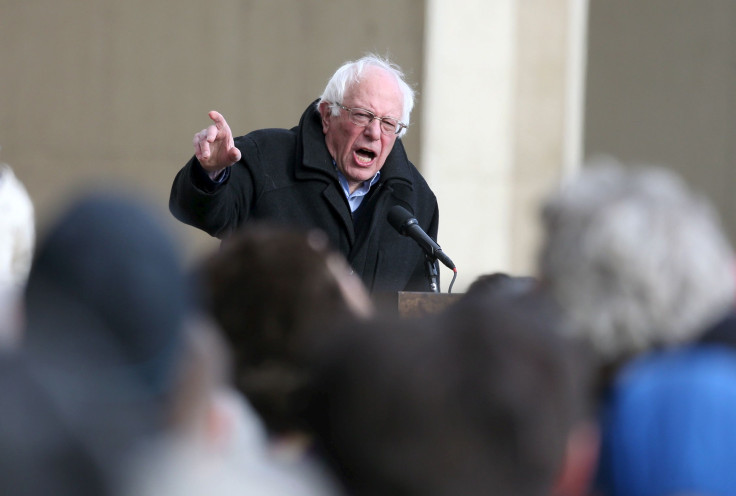

It remains unclear what Clinton’s forthcoming plans will entail. What is clear at this stage of this campaign is her proposals thus far have occupied a sort of political middle ground. While often populist in tone, the plans are arguably more generous to the richest Americans than comparable plans from her chief primary opponent, Sen. Bernie Sanders of Vermont. At the same time, they mark a significantly more aggressive approach to the super-wealthy than anything proposed by her Republican competitors.

Outflanked On The Left

As economic inequality looms large on the campaign trail, both Clinton and Sanders have talked about the importance of “leveling the playing field.” Neither has released a comprehensive tax plan — Sanders told CNN Sunday he would do so before the Iowa caucus Feb. 1 — but key differences have nonetheless emerged.

The self-described democratic socialist has called for a financial transactions tax of 0.5 percent on most stock trading and a smaller tax rate on bond and derivative transactions. The so-called Robin Hood Tax, the senator has said, would fund his campaign proposal to offer free tuition at every public college and university. (Clinton’s campaign has said she supports a smaller tax on a more limited range of certain high-speed, computerized trades but hasn’t released any details.)

Also in contrast to Clinton, Sanders has advocated raising taxes on high-income earners to pay for Social Security. Under the current system, only the first $118,500 of income is subject to Social Security payroll taxes. Sanders has called on lawmakers to “scrap the cap” and has introduced legislation that would raise the payroll tax on income above $250,000.

Clinton has declined to endorse such a plan — something that has raised the ire of progressive groups.

The former first lady has also vowed not to raise taxes on families earning less than $250,000. While she’s pitched that as a boon to middle-class families, critics have said it’s just the opposite.

Writing in the New York TImes last week, Bryce Covert slammed Clinton’s working definition of what constitutes middle-class income as “completely out of touch with reality.” The most recent Census Bureau data, Covert noted, found median household income to be roughly $54,000.

But Still in Stark Contrast to the GOP

Nevertheless, Clinton’s tax proposals place her well to the left of each of the leading Republican candidates.

The former secretary of state has already unveiled plans designed to crack down on so-called corporate inversions, controversial deals that allow U.S. companies to merge with companies based overseas to reduce their tax obligations: That includes an “exit tax” to penalize employers that engage in the practice and an increase in the share of stock companies need to sell to foreign shareholders to change a tax address.

She has also called for increases in taxes on capital gains, lifting the rate by as much as 16 percent in certain cases. Combined with any sort of proposal that resembles that Buffett rule, the platform stands in sharp contrast to Republicans who favor tax reductions across the board.

Leading Republican candidate Donald Trump supports lowering individual income taxes and corporate income taxes. Like Clinton, he has bashed inversions but says the solution is lower taxes. The real estate mogul wants to lower corporate taxes from 35 percent to 15 percent.

“There is no way you can stop it really other than lowering the taxes because right now…it is prohibitive to bring that money in,” Trump told Bloomberg about inversions in November.

Sen. Ted Cruz of Texas supports an even more dramatic reduction in taxes on the richest Americans. The Republican presidential candidate wants a flat tax of 10 percent on all income — including capital gains. He also supports abolishing the corporate income tax and replacing it with a business flat tax of 16 percent. According to the conservative-leaning Tax Foundation, the plan would reduce government revenue by $768 billion over the next decade.

Under his plan, Cruz has said Americans could fill out taxes “on a postcard on [an] iPhone app” and has called for “abolishing the IRS [Internal Revenue Service] as we know it.”

Sen. Marco Rubio of Florida also wants to reduce taxes on the richest Americans, eliminate taxes on capital gains and dividends and lower the top corporate tax rate to 25 percent. Likewise, former Florida Gov. Jeb Bush supports lowering taxes on the highest income earners, reducing the top rates on capital gains and dividends and lowering the highest corporate tax rate to 20 percent.

It’s unwise to expect anything of the sort from Clinton in the next month. When the IRS released data last week that showed the nation’s top 400 earners paid an effective tax rate of 22.9 percent, Clinton said that wasn’t enough.

“That’s not fair, and it’s not good for our economy, placing burdens on middle-class families and holding back investments that would help us grow.”

© Copyright IBTimes 2024. All rights reserved.