Hong Kong, Shanghai Rally On China Optimism As Seoul Rebounds

Hong Kong and Shanghai stocks rallied Tuesday after China pledged to adopt a looser monetary policy to revive the stuttering economy, while Seoul rebounded after days of losses fuelled by the brief declaration of martial law by South Korea's president.

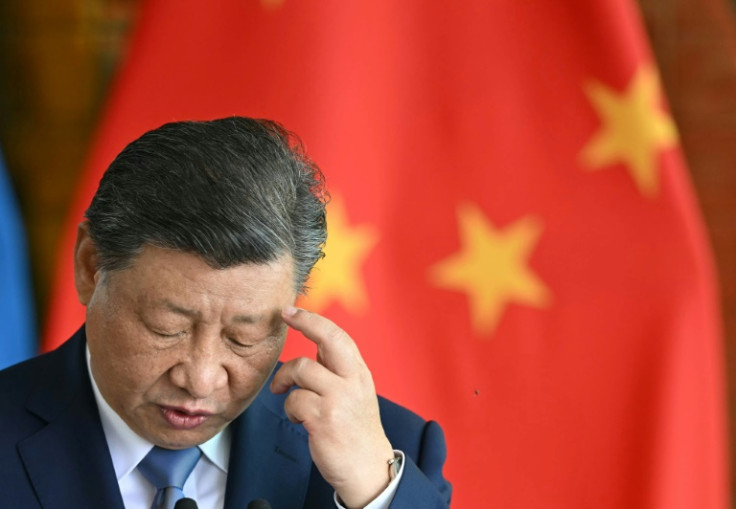

In the latest bid to kickstart growth, President Xi Jinping and other top leaders announced their first major shift in policy for more than a decade, saying they would "implement a more active fiscal policy and an appropriately relaxed" strategy.

The remarks, reported by state news agency Xinhua on Monday, represented a move away from their previous "prudent" approach, sparking hopes for more rate cuts and the freeing-up of more cash for lending.

The announcement comes as Beijing contemplates Donald Trump's second term in the White House. The president-elect has indicated he will reignite his hardball trade policies, fuelling fears of another standoff between the superpowers.

Leaders have battled for almost two years to kickstart the world's number two economy, which has been battered by weak domestic consumption and a debilitating property sector crisis.

"Beijing kept its stimulus measures very modest in 2024, because the goal was to stabilise the economy and rehabilitate confidence. And as a result, China reserved its firepower for an uncertain 2025," Shehzad Qazi, managing director of consultancy China Beige Book, said in a commentary.

"Now, Beijing is almost singularly focused on protecting China from the onslaught of forthcoming Trump tariffs."

Hong Kong stocks surged more than three percent at Tuesday's open, extending a rally of 2.8 percent Monday. Shanghai, which had closed before the news, gained more than two percent in early trade Tuesday.

However, analysts remained cautious after a string of previous announcements fell short of expectations or lacked detail.

"Monetary stimulus will only work if Beijing lifts broader business and household confidence. This puts a lot of focus on fiscal policy for 2025," Qazi said.

Pepperstone Group's head of research Chris Weston added: "The question that needs to be asked is whether these measures go anywhere near a 'whatever it takes' moment for China. Clearly, there is a commitment from the Chinese authorities to meet and exceed its growth targets.

"For many in the international investment community there is an inherent view that actions and substance speak louder than words, and many have been burnt getting set for a sustained rally in China risk driven by concurrent fiscal and monetary stimulus that perennially fails to materialise."

Gains in Hong Kong and Shanghai were only eclipsed by Seoul's Kospi, which rallied more than two percent after tumbling more than five percent since President Yoon Suk Yeol declared martial law on December 3.

While lawmakers forced him to rescind the order hours later, the move sparked a crisis in Asia's number four economy, which was already struggling and facing a tough outlook as Trump prepares to take office promising a return to his hardball trade policy.

Yoon narrowly survived an impeachment motion in parliament on Saturday even as huge crowds braved freezing temperatures to call for his ouster. However, a clutch of investigations has been closing in on him and his close allies, including a probe for alleged insurrection.

The South Korean won strengthened slightly against the dollar, though it remains stuck near two-year lows as uncertainty keeps investors on edge.

Most other Asian markets were mixed, with Tokyo, Singapore and Manila in the green, although Sydney, Taipei, Wellington and Jakarta fell.

The region was given a tepid lead from Wall Street, where the S&P 500 and Nasdaq pulled back from all-time highs as investors await key US inflation data later in the week.

Hong Kong - Hang Seng Index: UP 1.4 percent at 20,692.44

Shanghai - Composite: UP 1.5 percent at 3,492.45

Seoul - Kospi: UP 2.4 percent at 2,416.00

Tokyo - Nikkei 225: UP 0.1 percent at 39,197.42 (break)

Euro/dollar: DOWN at $1.0553 from $1.0555 on Monday

Pound/dollar: UP at $1.2747 from $1.2746

Dollar/yen: DOWN at 151.16 yen from 151.21 yen

Euro/pound: UP at 82.80 from 82.78 pence

West Texas Intermediate: DOWN 0.3 percent at $68.20 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $71.98 per barrel

New York - Dow: DOWN 0.5 percent at 44,401.93 (close)

London - FTSE 100: UP 0.5 percent at 8,352.08 (close)

© Copyright AFP 2024. All rights reserved.