Housing vs. Stock Markets (vs. The Economy): S&P’s Take

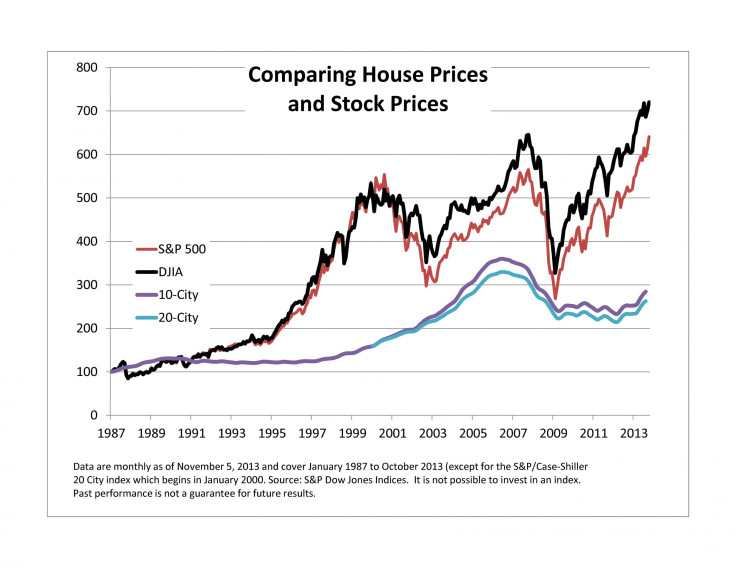

Comparing revivals in the housing and stock markets, and trends from 1987 to present can’t easily push investors to prefer one or the other, according to an interesting note by Standard & Poor’s Financial Services LLC (NYSE:MHFI) economist David Blitzer.

After tech stocks collapsed in 2000, investors put their faith in the housing market. But then the housing market collapsed in mid-2006 as prices plunged on dubious mortgage activity. Stocks fell 50 percent again after that, for the second time in a decade.

Given all that, Blitzer said investors are likely to be bewildered about where they can get the best bang for their buck.

“Are houses a better bet because they suffered only one collapse since the turn of the century or are stocks preferred because the rebound is more dramatic?...What happened to diversification by spreading one’s wealth across houses and stocks?” asked Blitzer.

Unfortunately, there’s no clear answer for your typical investor.

For those betting on the economy, stocks and housing market trifecta there may be bad news, though.

“The subsequent recovery in the economy, houses and stocks disappointed at least two of the three: the economy is lackluster and housing is coming back but remains about 20 percent below the peaks set seven years ago,” wrote Blitzer.

Stock markets have been more buoyant, hitting new highs this year – but even those levels are only 12 percent higher than 2007 peaks, which is little progress over six years.

Stocks are more volatile and tend to plunge more deeply, said Blitzer, a point which often weighs on investors’ minds.

“Peaks and troughs of houses and stocks do not line up,” wrote Blitzer. “The numbers don’t, and can’t, answer the question of which is the better choice between houses and stocks.”

S&P produces the monthly benchmark Case-Shiller home price index, which tracks U.S. home prices nationally, as well as the benchmark S&P 500 stock index.

© Copyright IBTimes 2024. All rights reserved.