How Long Will Gas Prices Stay Low? Experts Say Oil Will Be Cheap For Months

The average U.S. consumer may not keep up to date on all the latest trends in the global oil market, but almost every American driver has had a little more money on hand in recent weeks as a result of plummeting oil prices. Oil prices fell to the lowest level in more than five years Monday, and gasoline is cheaper in the U.S. than it has been since 2010, with prices of less than $2 a gallon a reality in some areas of the country for the first time in years.

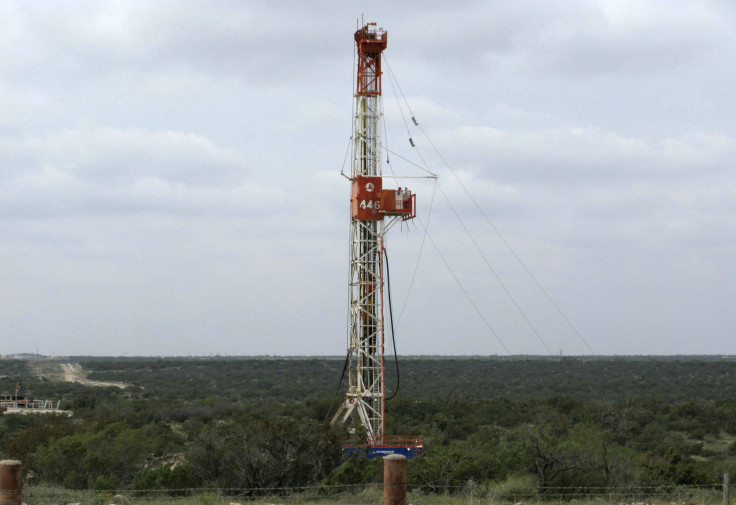

The severe drop-off in global oil prices has been driven in large part by the U.S. shale boom, which has been compounded by OPEC’s refusal to step in and cut production to balance out the market. That confluence of factors has come together to create what most Americans likely see as the best time to drive a vehicle in years, but $2 a gallon gas will not be around forever, experts and analysts say.

Prices should remain low for at least the next half-year, likely even falling further before they rebound, said Chad Mabry, an analyst in the energy and natural resources research department at the New York investment bank MLV and Co.

“As far as what that means for the consumer and for gas prices, I think we’ll be in these more depressed prices for at least the next two quarters, but I think we have to drift back higher over time,” he said. “I don’t see them spiking back up there next week or anything, but these prices are unsustainable.”

A gradual uptick in prices should accompany decreasing supply and increasing demand as producers cut production in response to negative incentives posed by the low price of oil in the next few months, predicted Dan Heckman, a national investment consultant at U.S. Bank Wealth Management in Kansas City, Missouri.

“In the immediate term we think the stage is being set for that reduction in production. That’s going to take some time but we believe that in January you’re going to hear more announcements about reduction in drilling and production,” he said. “Sometime in the second half of 2015 we’ll finally see some relief and prices moving up a little bit … but I don’t see us going back up to $100 a barrel over the long term -- I'm talking about in the next 18 months to two years.”

West Texas Intermediate crude was trading at $53.61 per barrel Monday, the lowest level since May 1, 2009, but consumers will likely begin using more gas as oil prices remain low, increasing demand and slowly driving prices upward.

Global geopolitical events and crises will likely also play a role in the expected rebound in the oil market over the longer term as evidenced by a brief uptick in oil prices Monday amid new worries militia conflicts in Libya will impact the nation’s oil production.

“Libya is exhibit A on what can happen when you have a major producer on the global scale have some major disruptions, and that’s finally giving us some support and that’ll push prices back higher,” Mabry said.

But Heckman said it's unclear how much of an impact interruptions of production by smaller producers will have on global price trends now that the U.S. is the dominant player in world energy markets.

“I harken back to earlier this summer when prices were over $100 with ISIS and almost the entire Middle East was in quite a bit of turmoil, and prices not only didn’t spike up, they ... fell,” he said of the ongoing uprising involving Islamic State militants in Iraq and Syria. “I think these geopolitical situations are important to be aware of, but the difference-maker as far as prices is now the U.S., not some of these smaller OPEC members, and there’s nothing politically going on here that I can see significantly undermining [U.S.] production.”

© Copyright IBTimes 2024. All rights reserved.