How A Potential Government Shutdown Could Affect Financial Markets

Once again the congressional merry-go-round has swung around to face a potential U.S. government shutdown. And although federal employees and state programs dependent on federal funding are nervous, most investors aren’t expecting panic in the markets -- at least not yet.

“I would expect that there would be some immediate reaction, but we have been through this before,” said Cheryl Smith, a managing partner at Trillium Asset Management. “Investors are tired of this game.”

The potential of a shutdown comes as congressional Republicans have tried to defund Planned Parenthood through a routine funding bill. But the announced resignation of House Speaker John Boehner, R-Ohio, and progress on funding bills in the House and Senate have raised hopes that a shutdown could be averted. The threat of a government shutdown, however, would rise again in December.

But nothing is certain in Washington.

If Congress falls short of a deal, so-called nonessential government functions like managing national parks and providing food assistance for 45 million people could be suspended. Military spending would also take a substantial hit, while Social Security and Medicaid payments would continue to flow.

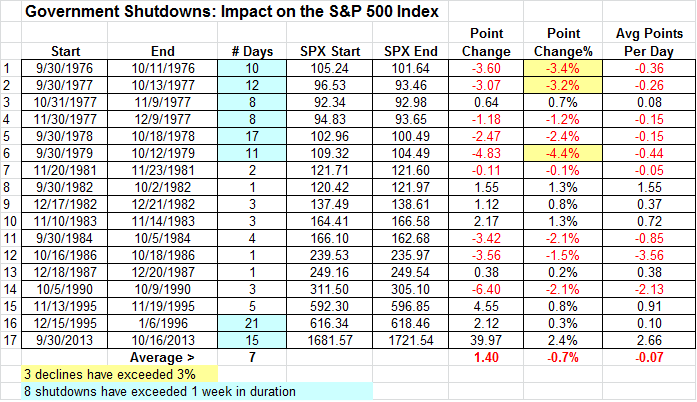

Wall Street analysts have largely dismissed the potential for a market rout, citing the mild effect of past shutdowns. The most recent, in 2013, coincided with a 2.4 percent bump in the S&P 500. Even as the economy lost 0.25 percent in GDP growth and missed out on 120,000 private sector job gains, according to White House estimates, Wall Street hummed along.

But Dan White, senior economist at Moody's Analytics, warned that this time might not be like the last. “Given the market volatility, the stock market could take a greater hit this year,” White said. “It all depends on the timing.”

Global economic worries stemming from China and other emerging markets have roiled stocks in the past month, while the biotech and commodities sectors have both taken major hits. It’s hardly the galloping bull market of 2013, which finished the year up nearly 30 percent.

“Stocks look to be a little overvalued. Investors are looking for a reason to sell,” White cautioned.

But if a government shutdown this week or in December touches off a bull run, it would be something of an anomaly. Of the 17 government shutdowns in the past 40 years, nine have left the S&P 500 basket of stocks negative. And only three of those declines, all in the late 1970s, depressed the market by more than 3 percent.

Smith, for her part, wasn’t concerned: “I think we’ve done quite enough selling off in the last month.”

The economic impacts of shutdowns don’t land evenly. Walmart, for instance, said sales fell short during the 2013 shutdown in areas populous with federal employees. And defense contractors like FLIR Systems, which manufactures infrared devices, reported disappointing revenues after weeks without new federal contracts.

White noted that a shutdown during the holiday buying season would carry further potential to inflict economic pain. “Having a shutdown in December could be more damaging because there’s a lot of discretionary spending,” White said.

The federal government is currently funded through Sept. 30. Congress must pass a bill by midnight Wednesday to keep things running -- at least until December rolls around.

© Copyright IBTimes 2024. All rights reserved.