How Sheldon Adelson Could Save $2.3 Billion Under Romney Tax Plan

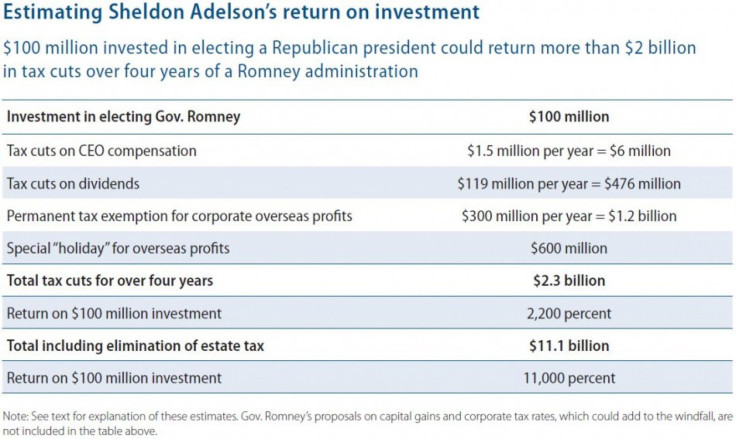

The fact that Sheldon Adelson has pledged to spend $100 million this year toward Mitt Romney's election probably seems excessive to most Americans, no matter what their income is. But that could potentially be an investment with an incredible 2,200% return if the Republican presidential nominee takes the White House in November, according to a new report from the left-leaning Center for American Progress Action Fund.

Assuming Romney's tax reform proposals were put into place, the billionarie casino magnate Adelson potentially stands to receive tax cuts adding up to more than $2 billion in savings.

According to Seth Hanlon, the director of fiscal reform at the Center, the Romney tax plan would benefit Adelson in the following ways:

- Cut top tax rates, saving Adelson approximately $1.5 million on his annual compensation as chief executive of his casino company.

- Maintain the special low rates on dividends, potentially saving Adelson nearly $120 million on a single year's worth of dividends, more than enough to recoup his political donations.

- Maintain the special low rates on capital gains, allowing Adelson to make back his political donations in capital gain tax cuts just by selling a fraction of his stock.

- Provide a tax windfall of an estimated $1.2 billion to Adelson's company, Las Vegas Sands Corp., on untaxed profits from its Asian casinos, as well as a tax exemption for future overseas profits. Adelson's casinos already enjoy a special foreign tax exemption from the Chinese administrative region of Macau, and Gov. Romney would make those foreign profits exempt from U.S. taxes as well.

- Eliminate the estate tax, potentially providing a staggering $8.9 billion windfall to Adelson's heirs.

Hanlon used public information regarding Adelson's income and wealth, and the profits of his company, Las Vegas Sands Corp., to estimate his potential tax savings. But, as the report notes, the publicly available information likely does not paint a full picture of Adelson's finances, particularly his annual income.

Over a four-year period, Adelson could, by the Center's estimate, receive about $6 million in tax cuts on his executive compensation alone, in addition to $476 million from tax cuts on dividends, and $1.2 billion in permanent tax exemptions for corporate overseas profits -- coming out to a total of $2.3 billion in tax savings.

But even that figure is dwarfed by the potential savings that could come Adelson's way -- or rather, his family's way -- via the elimination of the estate tax, a key part of Romney's tax reform proposal.

Until the end of this year, only estates valued at more than $5.12 million are subject to an estate tax up to a 35 percent top rate; unless there is congressional action on the issue, next year all estates worth more than $1 million will be subject to a top rate of 55 percent.

In comparison to President Barack Obama, who has proposed reinstating the estate tax at 2009 levels (those worth more than $3.5 million subject to tax, with a top rate of 45 percent), Romney said he would completely repeal the tax. For Adelson, who had a net worth estimated at $19.7 billion, his heirs would receive $8.9 billion from estate tax cuts under that plan. That's 89 times more than Adelson is planning on spending to put Romney in the White House.

According to the report, $8.9 billion could fund a variety of federal programs, including Pell Grants for more than 2 million students, the entire Head Start early education program, or all of the activities at the National Science Foundation for a year. Or, of course, it could be used to reduce that federal budget deficit we keep hearing about.

Romney has proposed permanently extending all of the George W. Bush era individual income tax rates, eliminating the taxation of investment income for most taxpayers, reducing the corporate income tax from 35 to 25 percent and allowing several tax provisions in the 2009 stimulus bill -- including those that particularly benefit the middle clas, such as the American Opportunity credit for higher education and the expansion of the earned income tax credit -- expire in 2013.

The nonpartisan Tax Policy Center reports the Romney plan would actually increase the tax burden on those making less than 200,000 per year (95 percent of the population) by more than $500.

"It is not mathematically possible to design a revenue-neutral plan that preserves current incentives for savings and investment and that does not result in a net tax cut for high-income taxpayers and a net tax increase for lower- and/or middle-income taxpayers under the assumptions we have described above. This means that even if tax expenditures are eliminated in a way designed to make the resulting tax system as progressive as possible, there would still be a shift in the tax burden of roughly $86 billion from those making over $200,000 to those making less than that amount," the organization reported.

Although Romney, over the weekend, told NBC's Meet The Press that his proposal would not ultimately cut taxes for the rich because it would eliminate loopholes that reduce their tax bills. But he has refused to identify just what loopholes he would eradicate.

© Copyright IBTimes 2024. All rights reserved.