IBM Shares Stay Above $200 As New CEO Predicts Further Profit Gains

Shares of IBM set a new high of $201.57 after new CEO Virginia Rometty said the No. 2 computer services company was uniquely positioned to deliver benefits of a gusher of data flowing into the global economy.

Rometty, 54, who became CEO on Jan. 1, published her first shareholder letter ahead of the Armonk, N.Y. technology giant's April 24 annual meeting scheduled for Charleston, S.C.

IBM's financial performance will be governed by earning-per-share roadmaps first introduced in 2007 which surpassed 2010 objectives, she wrote. Further leverage will come from our continuing shift to higher-margin businesses and improving enterprise productivity.

By 2015, the former IBM Executive VP predicted $8 billion in leverage will be created by buying back as much as $50 billion worth of shares with $20 billion in dividends.

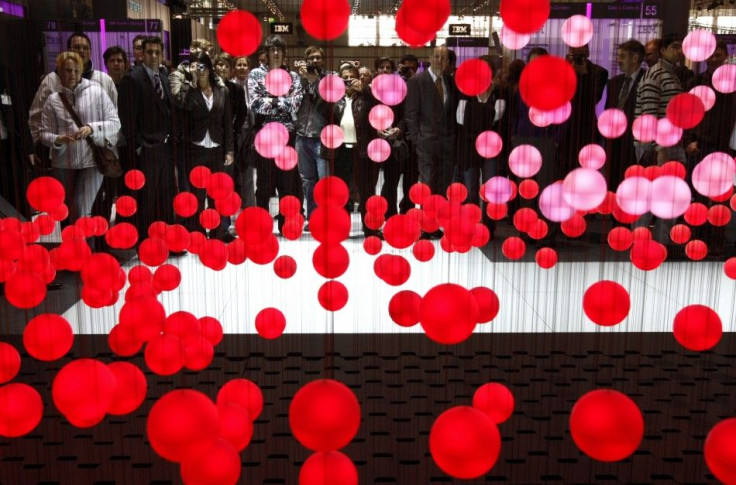

Rometty said her strategy would target growth markets; business analytics; the Cloud, or Internet-based computing and the company's smarter planet initiative in which municipalities like Rio de Janeiro have acquired huge IBM systems to manage their data and management.

While the computer executive didn't predict sales targets, she wrote the 101-year-old company possess technologies to keep differentiating value in a field where the world is undergoing disruption.

In his note, Chairman and former CEO Samuel Palmisano, 60, credited the company's shift to high-margin sectors beyond the PC for delivering enormous value to our clients.

Good technology, a focus on software and services, fusing business with good citizenship and creating a better workplace helped achieve many of the goals during his nine-year tenure as CEO, Palmisano said.

Since Palmisano succeeded Louis Gerstner as IBM CEO, its shares have nearly tripled. Since Rommety succeeded him, they've risen more than 9 percent.

However, during Palmisano's tenure, IBM lost its No. 1 computer revenue crown to Hewlett-Packard (NYSE: HPQ) and also watched as Apple's (Nasdaq: AAPL) revenue exceed $100 billion for the first time last year.

IBM's annual revenue was $106.9 billion, compared with HP's $127.2 billion and Apple's $108.2 billion.

IBM shares closed at at $201, up 38 cents, on Monday..

© Copyright IBTimes 2024. All rights reserved.