IBT 1000: Whither China and India and Who's Hot and Why

Stark differences separate China and India - and nowhere is that more evident than in the ways that their economies are developing. Steered by government subsidies and support policies that favor certain industry sectors, China's economy is primarily driven by exports and foreign investment. Efforts to jumpstart consumer spending, for most countries the lever for sustainable economic growth, have floundered in China, so much so that the share of China's consumer spending to Gross Domestic Product fell from 45 percent to 35 percent in the last decade.

By contrast, India's economy has by and large sprouted from the ground up, business by business, aided by a little help from the government but not an inordinate amount. Compelled to compete on a relatively level playing field, India's companies have had to build their customer base inside and outside of the country the old fashioned way - that is, by trying to anticipate and then deliver what customers want -- or risk falling behind. Partly on the strength of that robust business-to-consumer relationship and the higher skilled jobs in product design and engineering that come with it, India's middle class has emerged at a faster pace than China's. In turn, its GDP gains have been primarily propelled by domestic demand (consumer spending accounts for nearly 60 percent of GDP).

For some experts, discrepancies in domestic consumer behavior could represent a warning flag for China and a welcome sign for India. Although China's growth has been remarkable and fast, the stronger fundamentals of India's more consumer-based economy could portend a less bumpy future. In other words, China may be in for a series of hard landings and busts and booms while India may enjoy steadier ride.

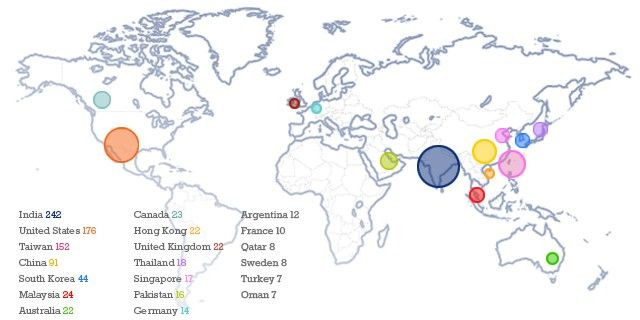

Unambiguous support for that conclusion is one of the most intriguing highlights to emerge from the 2012 IBT 1000, a ranking of the world's fastest-growing public companies gauged by average three-year revenue growth. This annual list, compiled by International Business Times, is designed to create a prism through which the most dynamic global enterprises can be studied and, perhaps, emulated. India dominates the IBT 1000 with 242 companies, followed by the United States (176), Taiwan (152) and China (91).

Recession Survivors

The three-year business cycle encompassed by the IBT 1000, from 2009 through 2011, was immediately preceded by the global credit collapse and subsequent recession. Among the few industries that have thrived since the financial downturn began are energy and mining. Since falling to $54.04 in February 2009, the price of a barrel of Brent crude oil has more than doubled and recently flirted with $113. Gold prices have climbed at an even faster pace, hitting a nominal record of $1,925 per troy ounce in September 2011. Not surprisingly, then, the IBT 1000 includes 69 companies engaged in oil exploration, metal mining or related fields like processing transportation or trading. Four of the world's 10 fastest growing companies fall into this category, including Hong Kong-based Brightoil Petroleum (No. 1), which ships, stores and develops oil and gas; Latin Gold (No. 3) and Eureka Energy (No. 5), both Australian; and natural gas shipper Qatar Gas Transport Co. (No. 10).

The IBT 1000 also contains 128 companies that do business with energy and mining companies, either as customers, service providers or suppliers. For example, Saudi Arabia's Alujain Corp. (No. 2) invests in both mining and energy and produces chemicals. U.S.-based Green Plains Renewable Energy (No.11) manufactures ethanol chemicals and Australian Laserbond Ltd. (No. 92) applies ceramic coatings to industrial machinery used in mining and other fields. Indeed, the growth in the mining sector reflected in the IBT 1000 may be just a small slice of the picture today, says Peter Thomas, director of business development at futures merchant PFG Precious Metals, as this three-year growth record could jumpstart a lot of speculation over the coming months and years.

There's a whole lot of stuff bubbling under the surface, adds Thomas. Miners, explorers, traders, we're all used to taking quantified risks. And in this kind of environment, it's worked out pretty well. We do our business model every year and every year we blow it to pieces.

China vs. India

But although speculation can affect economic conditions around the world greatly in the short term, the China-India rivalry holds far greater implications for global financial health over the long term. The rising purchasing power of India's emerging middle class and the booming demand for mid-market goods is reflected in the IBT 1000 by the fact that India-based companies comprise nearly a quarter of the list and by the types of companies that make up this group. Most of these companies either make or sell consumer goods and services within the Indian subcontinent. Examples include television content provider Nouveau Global Ventures (No. 7), milk distributor Kwality Dairy (No. 73) and chemicals manufacturer Vidhi Dyestuffs Manufacturing (No. 114), which makes non-toxic dyes for candy and other food products.

As Ruchir Sharma, a managing director at Morgan Stanley Investment Funds, wrote in Newsweek soon after the recession began to lift, The masses are firmly leading the recovery (in India) even as the upper classes remain conspicuous by their absence at stores. Two-wheeler sales are up nearly 15 percent, compared with an average growth of 5 percent over the past five years. Small-car sales have increased by 20 percent in recent months, while purchases of luxury cars are down 20 percent from a year ago. Consumer-goods companies are reporting a bipolar market: widely used products from hair oil to soaps are selling well, but more expensive skin-treatment items are not. The mounting realization that the real growth opportunity in India lies lower down the price curve is forcing many companies to rejigger their strategies.

Beijing's industrial policy, backed by subsidies and other benefits, has boosted Chinese industries that are not providing products or services to most residents in the country, like real estate (Chinese tend to be priced out of most property markets) and solar panel manufacturing. Well over half of the 25 real estate companies on the IBT 1000 are based in China. And two of the biggest Chinese solar panel players, Trina Solar and Suntech Power Holdings, rank No. 118 and No. 475, respectively.

As the world's largest supplier of solar panels, China's three-year record shows that the global solar industry is not a bubble about to burst, despite high-profile bankruptcies of solar companies in the West, argues Ben Rose, an equity analyst at Battle Road Research.

If you take your snapshot (in the IBT 1000), it certainly would underscore the growth of the industry over a period of time, which contrasts to people's view that the industry is boom-and-bust, Rose says.

Supply and Demand

China's outward looking economic model is punctuated by how well its companies navigate global supply and demand trends. For example, on the demand side, the U.S. appetite for consumer electronics lies behind the outsized representation of Chinese semiconductor companies on the list. A huge majority of the companies in the IBT 1000 involved in either semiconductor and electronic component manufacturing or proprietary software for consumer gadgets are Chinese (including Taiwan and Hong Kong). Among them: Taiwanese data disc maker Feng Sheng Technology Co. (No. 41), Hong Kong LCD manufacturer Global Link Communications (No. 186) and mainland-based Qiming Information Technology Co. Ltd. (No. 453), which develops software for automobile GPS products.

On the supply side, China continues to bloom as an outsourcing leader. But in part because of new free trade agreements being phased in now, Chinese outsourcers are doing business with countries besides the U.S., their traditional partners. For instance, the IBT 1000 includes a number of Chinese companies that are supplying finished products and parts for

Malaysian manufacturers. They include fire-fighting equipment maker Fitters Diversified (No. 211) and machining tools manufacturer K-One Technology (No. 282). Malaysia's outsourcing strategy boosted the top line for many of the country's companies: although relatively small, with just 833 companies listed on its national exchange, Malaysia has 24 companies on the IBT 1000 - more than resource-rich countries like Canada and Australia, and even than much larger economies like the United Kingdom.

Malaysian corporations are growing to be global players, says Marc Mealy, vice president of the US-ASEAN Business Council, a Washington business lobby that advocates for U.S. companies in Southeast Asia. It's not just about being big in Malaysia anymore.

The IBT1000 is full of beguiling insights that provide fodder for new ways to look at and understand international business and how it has developed over the past few years. One of our favorite examples: Tiny Bangladesh has three commercial banks on the IBT 1000, second only in that category to the United States. Such an accomplishment highlights the nation's highly innovative banking tradition, which models micro-finance strategies and Muslim-oriented financial services.

© Copyright IBTimes 2024. All rights reserved.