Iceland Says It Was Bullied Over Bank Debt

Iceland's president accused European countries on Sunday of having bullied it into agreeing to guarantee repayment of the debts of a failed bank, reviving a dispute with Britain and the Netherlands whose citizens are owed billions.

When Iceland's banking sector collapsed in the 2008 global financial crisis, accounts were frozen at the bank Landsbanki, which had accepted deposits from British and Dutch savers through online funds called Icesave.

Iceland says the estate of the failed bank will be enough to repay about $5 billion of debt to the British and the Dutch. The two countries had wanted the government in Reykjavik to give a state guarantee to the repayment.

In a referendum earlier this year, Icelanders rejected for a second time giving a guarantee.

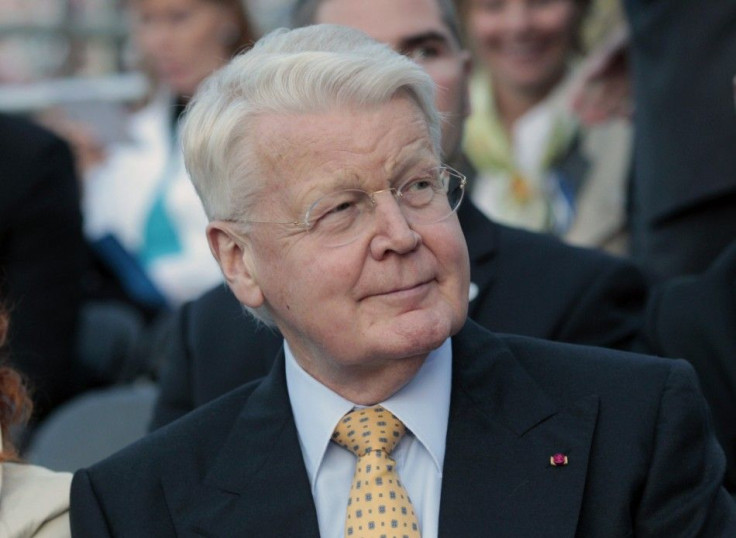

People (in the government) bowed to the bullying of the Europeans ..., President Olafur Ragnar Grimsson told RUV public radio. He said the British and Dutch demand that the government guarantee the debt had been absurd.

So, what is happening now is proving that if the issue had been handled sensibly here from the beginning, it would have been totally unnecessary to put the people of Iceland and our cooperation with Europe into this straightjacket, he said.

The EU should investigate and face up to how in the world it was possible that EU member states agreed to support this absurd claim against Iceland, he said.

The British and Dutch, with the support of other EU nations, had also persuaded the International Monetary Fund to pressure Iceland, Grimsson said, adding that former IMF managing director Dominique Strauss-Kahn told him in January 2010 he was unhappy that the Fund was being used as a fist against Iceland.

Since the 2008 global financial crisis, Iceland had to accept a bailout led by the IMF, accompanied by a programme of economic reforms which have just been completed.

The administrators of Landsbanki have said the estate of the bank can more than repay the British and Dutch. They have said the payments can begin later this year after final domestic legal action is out of the way.

© Copyright Thomson Reuters 2024. All rights reserved.