If Elected, Buttigieg First President To Have Student Loan Debt

South Bend, Indiana Mayor Pete Buttigieg, in addition to being the first openly gay presidential candidate, also is likely the first candidate to have a six-figure student loan debt while on the campaign trail.

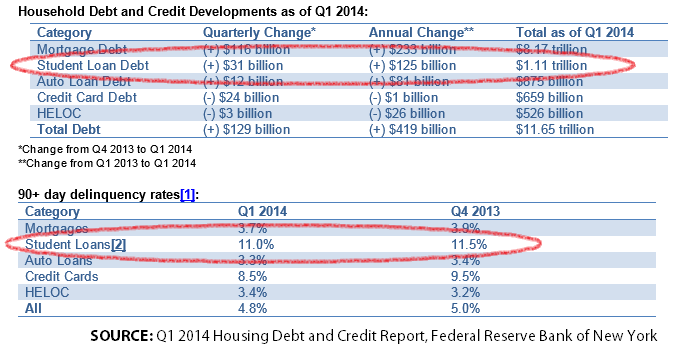

With loans totaling more than $130,000 Buttigieg and his husband, Chasten, are among the 43 million Americans who owe federal student loan debt. While virtually all of the Democratic frontrunners have rolled out plans for addressing the high cost of higher education, and dealing with the estimated $1.447 trillion owed by student borrowers, Buttigieg appears to be the only candidate still paying back the cost of education.

At HBCUs, crushing student loan debt is a symptom of even bigger problems. https://t.co/zzdPxYl164

— NBC News (@NBCNews) June 9, 2019

While student loan debt is often discussed as an issue facing mostly millennials and GenXers, those 49 and younger, the burden of college costs also is shouldered by older Americans. Federal statistics show 7.8 million people 50 and older owe a combined $291.9 billion in student debt. Former students between the ages of 35 and 49, which include older millennials and Generation X, number 14 million and owe a total of $584.4 billion.

Massachusetts Senator Elizabeth Warren has outlined a plan to forgive 75% of existing student loan debt while making public colleges and universities free. She intends to pay for the plan by taxing ultra-millionaires, households with a net worth of $50 million or more. Warren intends to cancel $50,000 in student loan debt for borrowers with an annual income of $100,000 or less. The level of forgiveness would decrease for households with higher incomes.

If Buttigieg received the full benefit of Warren’s plan, he would still owe $80,000.

Sen. Bernie Sanders of Vermont also has called for free tuition to the nation’s public institutions, and adds he wants to lower interest rates on student loans, which range from a low of 4.25% and rise as high as 11.85%, for variable and fixed-rate loans, as well as forgive "substantial" student loans.

Our country now has more student loan debt than credit card debt. We should allow Texans who commit to working in in-demand fields and in underserved communities the chance to graduate debt free.https://t.co/6DCNmssk7d

— Beto O'Rourke (@BetoORourke) March 21, 2018

Former Rep. Beto O’Rourke of Texas has said he wants to offer students two years free tuition at the community college, and no-cost university education for middle- and low-income students. Instead of forgiving student debt outright, O’Rourke calls for graduates to fill positions in short supply in rural areas and professions where there’s a shortage of manpower.

Likewise, Julian Castro, former housing secretary in the Obama administation, also wants to eliminate tuition at public colleges and universities, and not require borrowers to be required to pay back loans until their income is 250% of the federal poverty, currently $25,750 for a family of four. Castro also would cap monthly loan payments at 10% of income.

California Sen. Kamala Harris is for debt-free college, and wants to allow existing borrowers to refinance debt at lower interest rates and base repayment on income.

If Buttigieg, 37, makes it to the White House, he will be the first president to enter the White House owing student loan debt. Former President Barack Obama and his wife, Michelle, indicated they had repaid their education debt in advance of Obama’s election to the U.S. Senate in 2005.

Buttigieg graduated from Harvard in 2004, and then won a Rhodes Scholarship to Oxford and graduated in 2007. While Buttigieg has said he got through school with little debt, his husband apparently incurred some while earning a bachelor’s and master’s degrees to become a teacher.

In his financial disclosure to the Office of government Ethics in May, Buttigieg reported student debt between $110,000 and $265,000. The report requires a range rather than an exact figure but campaign spokesman, Chris Meagher, said the exact amount was $131,296.

The average debt for American students is $33,000, but that may not account for borrowers who earn multiple degrees. There are about 2.8 million Americans who owe more than $100,000 in education debt.

© Copyright IBTimes 2024. All rights reserved.