Indians Prefer Pizza, Specifically Domino’s (DPZ), Over McDonald’s (MCD), Subway And Everything Else, In Booming Fast Food Market

Pizza is one American export that India simply can’t eat enough of, according to leading Indian market research firm CRISIL Research, in a recent study of India’s flourishing fast food industry.

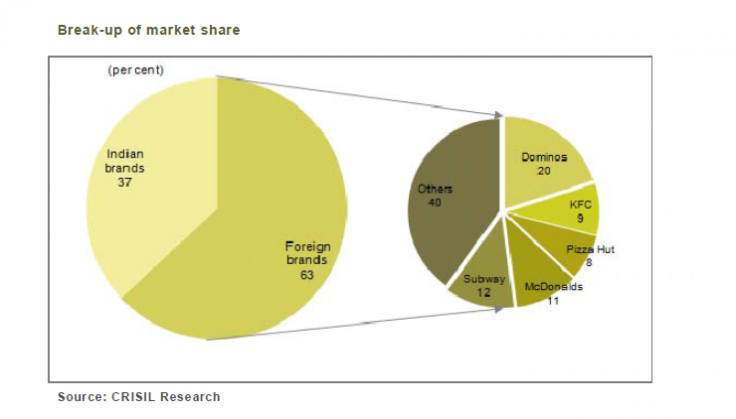

Michigan’s world famous Domino’s Pizza, Inc. (NYSE:DPZ) has the greatest market share of any foreign fast-food operator in India, cornerning 20 percent of the market owned by foreign brands -- about double that of McDonald’s Corp. (NYSE:MCD), Kentucky Fried Chicken (NYSE:YUM), Subway and Pizza Hut (NYSE:YUM).

“If you look at the number of stores, very clearly Domino’s is ahead,” said Ajay D’souza, a research director at CRISIL, a unit of Standard & Poor’s Financial Services LLC, to International Business Times.

Domino’s has adopted an aggressive approach of expanding into smaller and lesser-known Indian cities, where they can best rivals like McDonald’s because Domino’s typically needs less land and financing for a store, D’souza said.

That, in turn, is because Domino’s has focused on home delivery.

“In the case of McDonald’s, stores are larger, and to get those kind of outlets in tier 2 and tier 3 cities is likely more difficult,” he said.

Domino’s is also ahead in tweaking its menus so as to cater to local tastes, said Dsouza, a path McDonald’s has only just adopted. D’souza cited Paneer Tikka topping at Domino’s, which involves locally-styled cottage cheese and a so-called Manchurian pizza.

Domestic Indian companies have also cashed in on the pizza trend. Many local brands offer pizza, like Pizza Corner, Smokin’ Joe’s or US Pizza, besides South Indian fine diners who increasingly serve pizza.

According to market researcher Euromonitor International, which tracks fast food markets in several countries, pizza has boomed in the past three years especially.

Pizza Hut added 45 new outlets in 2012, while Domino’s opened 113 outlets in the year, reaching 522 outlets in 2012, the firm said.

As with much other fast food, urbanization and more households with two breadwinners have spurred this growth, wrote Euromonitor analyst Sunita Barlota in an email to IBTimes.

Pizza can also be compared specifically to chicken fast food, Barlota said. The chicken fast-food market is forecast to reach 13 billion rupees ($207 million) in 2013, while pizza consumers are projected to be worth 23 billion rupees in 2013.

One reason for the difference: “The size of pizza consumer foodservice is larger because of the huge vegetarian population in India,” Barlota wrote.

And other types of fast food are taking off in India, too, including Latin American fast food, spurred on by the recent success of Taco Bell Corp.

Still, according to CRISIL, pizza accounts for 47 to 50 percent of overall fast food revenue, compared to 36 percent from sandwiches. The remaining 14 percent is split by other assorted fast foods.

Competition between Pizza Hut and Domino’s has heated up, too, said Barlota. Domino’s launched its ‘Pehli Kamai’ campaign, offering pizza at 44 rupees (less than $1) each, just as Pizza Hut uses social media to offer 23 percent discounts. A constant flow of new products from both is also evident, she said.

“Both these brands have launched value for money food offerings which do not pressure on the consumer’s wallets,” wrote Barlota.

That mimics one trend in U.S. fast food, where giants like McDonald’s and Burger King Worldwide Inc (NYSE:BKW) offer dollar menus and steep discounts in an ongoing price war, to offset depressed consumer spending. Another similarity is expansion into offerings for all times of the day, so that breakfast and post-midnight options are on the table, as Domino’s has started to do in alliance with Dunkin’ Donuts (Nasdaq:DNKN) in India.

Neither Domino’s nor McDonald’s breaks out revenues specific to India. Representatives from the two companies didn’t return requests for comment on their Indian business strategy or on their next steps in the country.

India’s is Domino’s fastest growing market, Domino’s CEO Patrick Doyle told the Ann Arbor News in early September.

“Opportunity for us is largely now driven by sheer scale of population,” Doyle told the newspaper then. “The bigger the country, the bigger the opportunity.”

According to CRISIL’s report, the Indian fast food market will more than double to 70 billion rupees over the next three years, from 34 billion in 2012-2013.

© Copyright IBTimes 2024. All rights reserved.