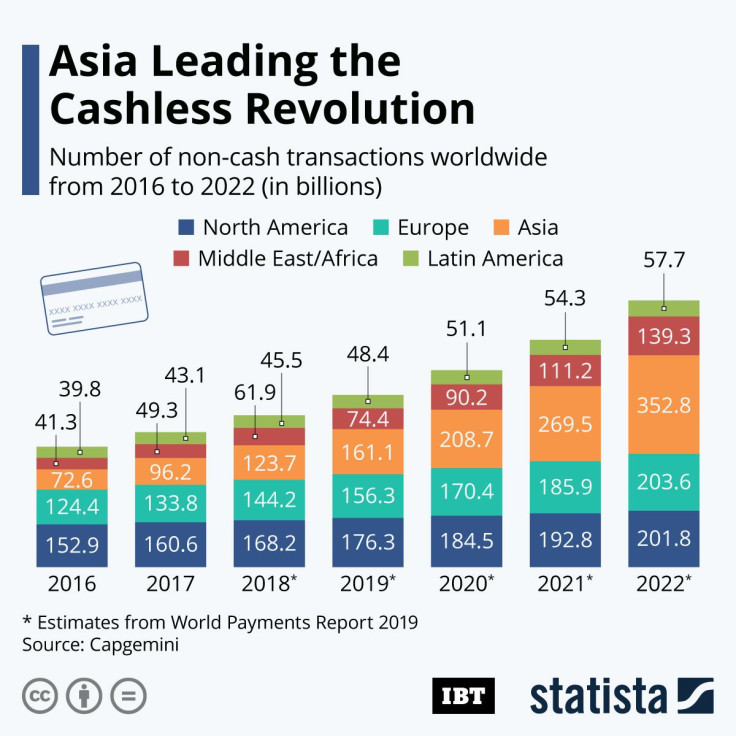

Infographic: Asia Leading The Cashless Revolution

New York City followed in the footsteps of San Francisco and Philadelphia on Thursday by voting to require all brick-and-mortar stores to accept cash, specifically U.S. bills and coins, as a form of payment. The city council passed the legislation almost unanimously, with a primary focus being to control the “excesses of the digital economy.”

The ban will implement fines for any businesses, including stores and restaurants, that refuse to accept cash payments.

Those calling for the ban on cashless businesses say electronic payment systems discriminate against underprivileged and marginalized groups, such as the poor, minorities and minors, who don’t necessarily have great access to banking systems and electronic systems like Apple Pay.

The bill is waiting for approval from Mayor Bill de Blasio, who is a noted supporter of the ban, and will likely go into effect by the end of the year.

Digital payments have been increasing steadily in the U.S. and North America over the past decade, however the greatest growth in cashless payment resides in Asia. The market for digital payments is estimated to grow from $96.2 billion in 2017 to $352.8 billion in 2022 for emerging Asian countries. Other regions in the world do see growth, but many people around the globe are still finding uses for traditional forms of cash payment.