Infographic: Millions Of Americans Fear Eviction As Moratorium Expires

Following a failed last-ditch effort by the Biden administration to extend the nationwide ban on residential evictions, the moratorium that had been in place since September 2020 expired on Saturday, leaving millions of Americans at risk of being forced from their homes.

Originally ordered by the CDC to curb the spread of COVID-19, the temporary suspension of evictions was widely considered effective in providing housing stability during a time of mass unemployment, helping individuals to adhere to stay-at-home and social distancing directives instead of forcing them into living situations, where the risk of contracting COVID-19 would have been substantially higher.

Following the same rationale, the failure to come up with an adequate follow-up plan to the moratorium was widely criticized, especially in light of the surging Delta variant. "In every state in this country, families are sitting around their kitchen table right now, trying to figure out how to survive a devastating, disruptive and unnecessary eviction," Democratic Senator Elizabeth Warren said on Saturday.

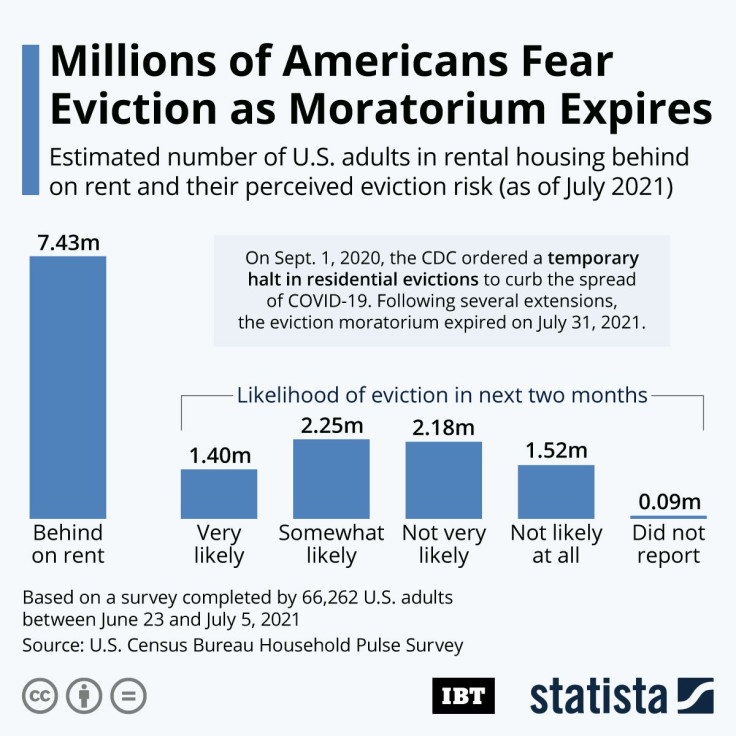

According to the latest results of the U.S. Census Bureau’s Household Pulse Survey, more than 7 million U.S. adults live in households that are currently behind on rent payments, many of which (3.65 million) consider it likely that they’ll be evicted in the next two months. Taking household size into consideration that puts more than 15 million people at risk of eviction. Non-white households are disproportionately affected by eviction risk, with 22 percent of black renters and 17 percent of renters of Hispanic or Latino origin behind on rent vs. 11 percent of white renters. Households with children are also overrepresented in the at-risk group, with 19 percent behind on rent compared to 12 percent of households without kids.