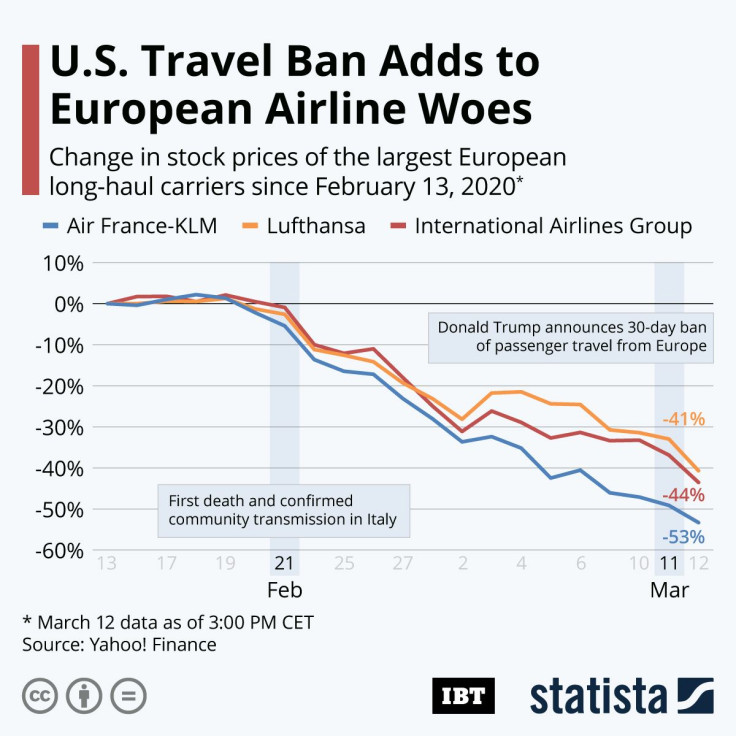

Infographic: US Travel Ban Adds To European Airline Woes

Shares of European long-haul airlines were in freefall on Thursday, after President Trump had announced a 30-day ban against travelers from large parts of Europe. The restriction, effective immediately, prohibits people who have recently been in one of the 26 European countries that are part of the Schengen Agreement from entering the United States. American citizens are exempt from the rule and will be directed to airports where screening can take place. They may have trouble catching a plane, however, as many flights between Europe and the United States will likely be cancelled.

Lufthansa, Air France-KLM and International Airlines Group (parent of British Airways and Iberia among others) all saw their share price crash on Thursday. As of 2:00 pm CET, shares of the three industry heavyweights were down between 6.7 and 9.0 percent, marking another bad day for an industry that has arguably been battered like no other as the coronavirus spread across the world in recent weeks. As the following chart shows, Air France-KLM saw its market capitalization cut in half over the past month, while Lufthansa and IAG suffered similar, if slightly smaller losses.

Even before Trump’s announcement of the travel ban, Lufthansa, Germany’s largest airline and the second largest European carrier in terms of passenger volume, announced the cancellation of 23,000 flights between March 29 and April 24 “due to the exceptional circumstances caused by the spread of the coronavirus”. Just last week, the that passenger airlines could lose up to $113 billion in revenue this year alone.