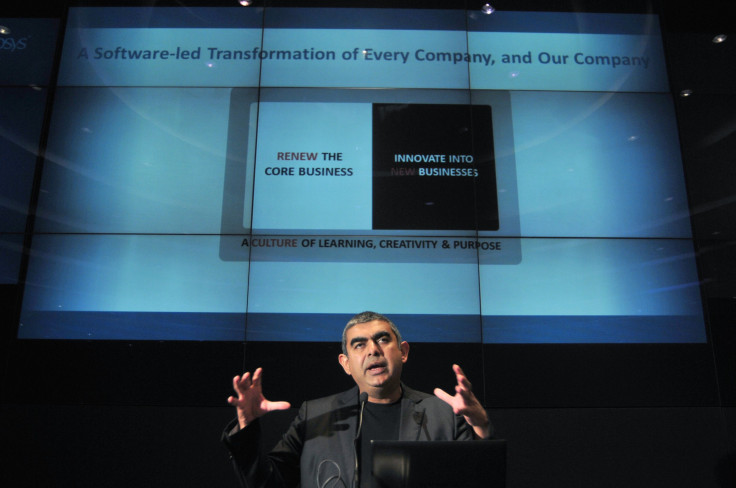

Infosys CEO Sikka Offers No Silver Bullets, But Incremental Improvements, Active Acquisition Strategy

Infosys Ltd.’s 70-day-old CEO Vishal Sikka held his ground on Friday, offering no silver bullets to analysts anxious to see a turnaround, but vowed to invest in growth, learning, incremental improvements and a return to basics. Sikka was speaking to analysts after Infosys, one of India's largest IT companies, announced its second-quarter results.

Some of the results of the ongoing effort could be seen in the company’s fiscal second-quarter earnings as profits for the three months ended Sept. 30 rose 33.4 percent over the same period last year, beating market expectations. Shares ended 6.5 percent higher in trading on stock exchanges in Mumbai. Fiscal second-quarter revenue grew almost twice as fast as it did in the previous quarter. Infosys also announced a bonus issue of shares, subject to shareholder approval.

Sikka, the former chief technology officer at SAP SE, is pushing a strong agenda at Infosys to enhance workers' skills to keep obsolescence at bay as the former bellwether IT company pushes back against competition after more than two years of stagnation and demoralization.

Infosys will be investing “in automation and innovation and improving operational efficiency in all walks of our company,” Sikka said, in his first earnings conference call as CEO with analysts on Friday.

At times when gaps cannot be plugged quickly with in-house efforts, “we will embark on an active inorganic acquisition strategy, not to achieve growth, but to focus on acquiring core capabilities,” he said.

The company will look to use artificial intelligence and automation to improve internal processes, which in turn will enhance the company's services, Sikka said. “We will double down on learning for all of us for life.”

Since taking over, Sikka has met about 100 customers and is engaging with employees to return Infosys to higher growth and stronger margins.

Operating margins for the three months ended Sept. 30 rose to 26 percent, but chief financial officer Rajiv Bansal expects margins for the full fiscal year, which ends March 31, 2015, to be in a narrow band around 25 percent as the company accelerates investments.

Interactions with clients and Infosys employees have resulted in a decision to build a data analytics platform for large businesses that would cost customers "a fraction of what previous generation analytics platforms did,” Sikka said.

Through the quarter, Infosys also announced alliances with Microsoft Corp, Hitachi and Huawei Technology Co, and expanded existing partnerships with Oracle Corp and SAP.

“In doing all of this, we believe we will greatly improve our competitiveness in the market, especially to win large transformational projects, expand our relationships with each of our clients and deepen this and achieve a disproportionate growth in emerging markets,” Sikka said, adding: Infosys is “aspiring and striving to become the next-generation IT services company.”

In the long run, a next generation company such as the one that Infosys is aiming to be can grow at 15 percent to 18 percent with margins of 25 percent to 28 percent, he said, adding that investors could expect more details on the company’s investment plans in April 2015.

Sikka, who lives in California, was named CEO in June, a year after founder Narayana Murthy returned from retirement to put the company back on track for growth. He took over on Aug. 1 and is the first non-founder to hold the top job at the company in its 33-year history.

© Copyright IBTimes 2024. All rights reserved.