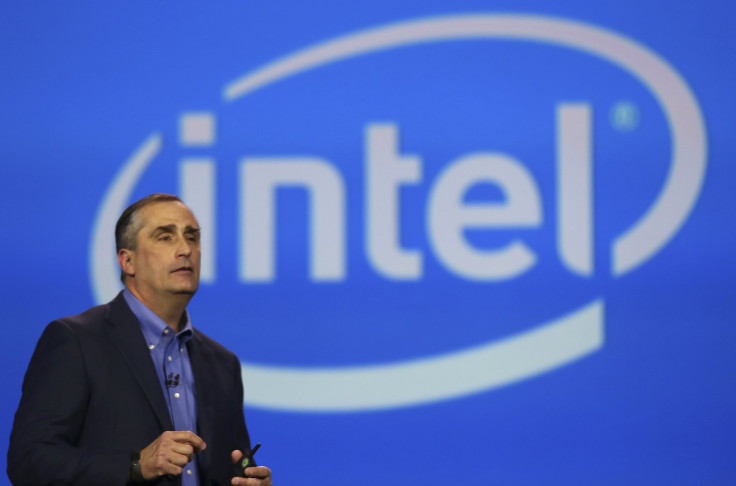

Intel Corporation Nears Deal To Buy Chip Designer Altera Corporatoin For $17B: Reports

Intel Corp. is expected to announce plans Monday to buy semiconductor chip designer Altera Corp. for about $17 billion, the Wall Street Journal reported Sunday. The acquisition would continue a wave of semiconductor consolidations as companies seek to boost revenues and profits while defending market share.

The deal follows an earlier round of talks between the two Silicon Valley companies that began March 27 and ended in April. The New York Post first reported late Thursday Intel and Altera had restarted talks for a deal valued around $15 billion.

Sources cautioned the Post and Journal talks could still fall apart.

Altera stockholders will receive about $54 a share, about the price the chip company rejected last month, people familiar with the matter told the Journal. If the acquisition goes through, it will likely be the biggest in Intel's 47-year history, the Associated Press reported.

Intel sells more than 90 percent of the semiconductor chips used in servers, which store reams of data such as email and Internet communications. The Santa Clara, California, company's revenues come mostly from general-purpose chips used in personal computers, but its Xeon chips for servers are much more profitable, the Journal noted.

Altera's chip designs are better suited for data-storage and processing tasks, including in phones and cars. By acquiring this technology, Intel can generate more value from its server ventures, according to reports. The acquisition would also allow Intel to protect its stronghold in the server-system chip business as Altera and rival Xilinx Inc. grow their market share.

The Intel-Altera merger would be the industry's second megadeal this year and will unlikely be the last, analysts told Reuters Friday. Avago Technologies Ltd. agreed last week to buy its semiconductor design rival Broadcom Corp. for $37 billion in the largest merger of chipmakers ever.

© Copyright IBTimes 2024. All rights reserved.