Intel Fights Back: 3 Core Strengths No. 1 Has To Recover

How Intel Can Regain Momentum

Intel Corp. (NASDAQ:INTC), the No. 1 chipmaker, as expected, reported a dismal fourth quarter, as earnings plunged 27 percent and revenue fell 3 percent in what traditionally has been its strongest quarter.

As well, partner Microsoft Corp. (NASDAQ:MSFT), the No. 1 software company, started shipping Windows 8, which should have been a spur to new sales of PCs and servers, fattening Intel’s bottom line.

That didn’t happen in 2012. Instead, the Santa Clara, Calif., company looks dead in the water, at least temporarily. CEO Paul Otellini, 62, will retire in May, but the company hasn’t designated a successor. Meanwhile, Intel shares plunged more than 6 percent on Friday, lowering the semiconductor giant’s market value to only $105.9 billion.

That only sharpens the pain for investors, whose shares have lost 13.4 percent in the past 52 weeks, including dividend payments. Without them, the shares have declined more than 16 percent. They fell to $21.25, down $1.43, in Friday trading.

“The trends are pretty clear,” Otellini told investment analysts after the dismal results emerged. There was no rush for Windows 8. The industry is at an inflection point between traditional PCs and laptops, so Intel’s Ultrabooks haven’t made a mark yet. And the new Atom chip for smartphones has only started to ship, giving rival Qualcomm Inc. (NASDAQ:QCOM), the No. 1 developer of mobile chips, a big edge.

“Intel has nowhere to go but up, said Francis Sideco, analyst for IHS iSuppli, who notes that Atom and another chip, Lexington, targeted for mobile markets in developing countries, have great potential for revenue and profit through 2016.

Here are three core strengths for Intel’s next boss to focus on:

Manufacturing competence. Unlike Qualcomm or many companies active in mobile including ARM Holdings (NASDAQ:ARMH), the main partner of Apple Inc. (NASDAQ:AAPL), the most valuable technology company, Intel makes all its own chips.

Rather than outsource manufacturing to an Asian company, Intel keeps core competence inside, allowing its designers to prove a new chip works immediately. Then building to huge scale assures high-quality production.

“Intel’s leadership in process technology allows it to ship its most advanced products by process node 12 to 18 months ahead of the competition,” said Jefferies analyst Mark Lipacis, who kept a “hold” rating on the shares, with a price target of $24.

As well, the prowess has now started to pay new dividends: Cisco Systems Inc. (NASDAQ:CSCO), the No 1 provider of Internet products, announced Intel will manufacture chips for it for the first time, perhaps leading to further collaboration. Otellini and CFO Stacy Smith said the company expects to win more contracts.

Windows 8 will catch on. Intel controls 90 percent of the global PC market through the so-called “Wintel” alliance with Microsoft. Otellini said he believed consumers and businesses bought the remaining inventory of Windows 7 equipment last quarter, which suggests all new growth will be for Windows 8 systems.

That should benefit Intel, which also derived about 20 percent of 2012 revenue of $53.3 billion from data centers, the hubs of corporate networks that are then connected to its PCs. As enterprises resume spending, revenue for these higher-margin systems should rise. As well, if Ultrabook chips are trimmed as mass manufacturing ramps up, they may become more competitive with tablets.

Intel has attracted virtually all its customers, headed by the Big Three -- Lenovo Group (PINK:LNVGY), the No. 1 PC maker; Hewlett-Packard Co. (NYSE:HPQ) and Dell (NASDAQ:DELL) – for Ultrabooks. Once the prices fall from around $650 more toward the average $350 for a tablet, sales should surge.

Research and development. Intel has a tradition of innovation, stemming from its founding by electrical engineers like Robert Noyce and Gordon Moore. Noyce was the co-inventor of the integrated circuit.

Last year, Intel spent $10.1 billion on research and development, nearly 22 percent more than in 2011. Even in the fourth quarter, which management knew would be slow, the company spent $100 more.

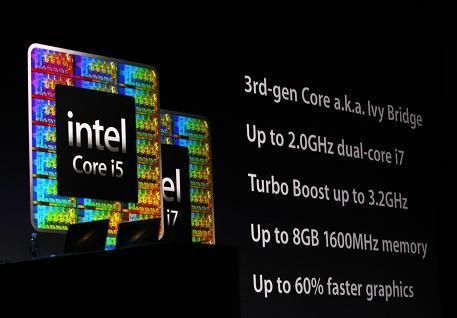

That’s where the chips of 2014 and beyond come from. There will be new ones for LTE (long-term evolution) phones and tablets, the “Haswell” line of low-power and long-life chips to replace, the Centrino line embedded in wireless laptops for years as well as new family of chips built smaller than ever, at 14 nanometers, compared with the current 22 nanometers.

© Copyright IBTimes 2024. All rights reserved.