International Business Machines Corp. First-Quarter Earnings: EPS Of $2.9 Billion Beats Street

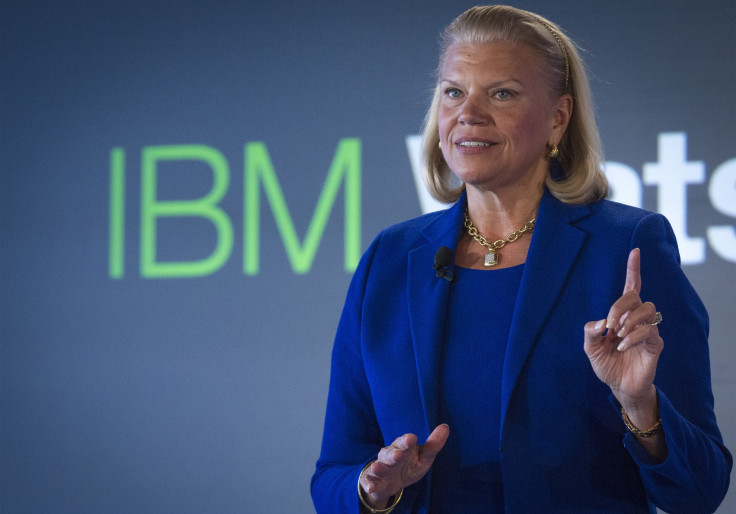

IBM continues to struggle with growth as it transitions its product line to the cloud. The company on Monday reported first-quarter revenue of $19.59 billion, which was flat compared with the same period a year ago. Sales were short of analysts’ expectations of $19.73 billion. The good news for CEO Ginny Rometty and company was that net income from continuing operations was up 4 percent, to $2.9 billion, while earnings per share surpassed expectations at $2.91.

“Our focus on higher value through portfolio transformation and investment in key areas of the business drove continued margin expansion,” Rometty said in a statement.

IBM is looking to build out its portfolio of products and services that facilitate cloud, mobile and social computing as well as security technologies. The company said sales in those areas increased 20 percent year over year. Cloud sales alone were up 60 percent, IBM said.

Still, that was not enough to offset significant declines in other parts of Big Blue’s business. The company continued to show signs that it’s not growing sales in new markets like cloud and mobile computing fast enough to make up for declines in traditional enterprise hardware, which still accounts for the bulk of its business. Hardware sales were down 23 percent to $1.7 billion, while services revenue was down 12 percent to $12.2 billion. Software revenue was off by 8 percent to $5.2 billion.

Now in her fourth year as IBM’s chief executive, Rometty needs to show she can position the company for a computing industry in which customers increasingly prefer to deploy applications on nimble, scalable cloud systems as opposed to on-premises data centers that are expensive to manage and maintain. To give herself more leeway, she recently abandoned a pledge by her predecessor, Sam Palmisano, to deliver earnings per share of $20 by the end of 2015.

IBM, like other major U.S. multinationals, also faces sluggish demand from slowing economies in Asia and Europe. The company’s revenues from Europe, the Middle East and Africa were off 19 percent, while sales in the Asia-Pacific fell 18 percent in the first quarter. The strong U.S. dollar, which has posted big gains against most major currencies in recent months, is also making IBM’s products more expensive abroad while reducing the dollar value of goods sold in foreign currencies.

“Everyone’s going to be looking past revenue,” Morningstar analyst Peter Wahlstrom told CNBC. “When you dive into a couple of the different segments for IBM, each one of them is going to feel pressure, whether it’s on the services side, the software side or the hardware side.”

IBM is forecasting operating earnings for 2015 of between $$15.75 and $16.50. Shares of the company (IBM:NYSE) were off a half-percent in after-hours trading.

© Copyright IBTimes 2024. All rights reserved.