International Energy Agency Says Oil Price May Have Bottomed As Shrinking US Supply Erodes World’s Crude Glut

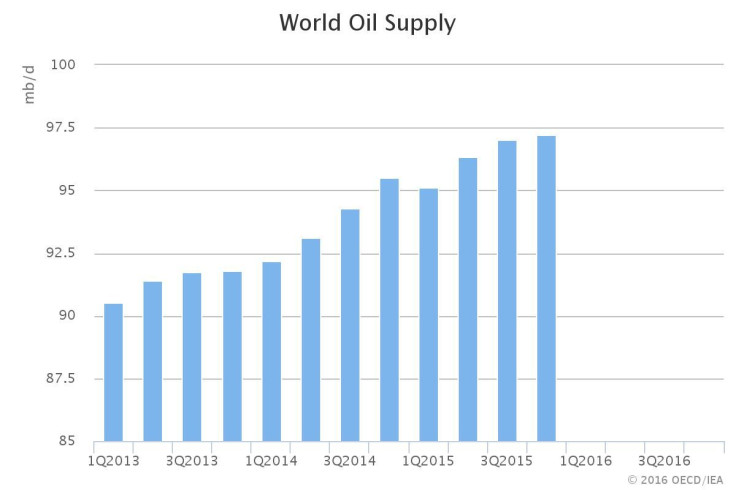

Oil prices might have already “bottomed out” as shrinking global supplies — particularly from the U.S. — erode the world’s glut of crude.

The Paris-based International Energy Agency said Friday there are signs that oil prices passed their lowest point at $28.50 a barrel in mid-January. Since then, Brent crude, the global benchmark, has surged to around $40 a barrel, spurred in large part by declining output across America’s energy patch.

The hunch that oil supply and demand might soon rebalance point to the outsize role the U.S. plays in the global oil market, analysts said.

America's hydraulic fracturing, or fracking, boom unleashed unprecedented volumes of U.S. shale oil and natural gas into the global supply, helping to feed a global oil glut that drove crude prices down by 70 percent in the span of 18 months. Now those same low prices are forcing U.S. companies to shelve projects, postpone drilling and lay off thousands of workers. As oil production slides, and supply tightens again, oil prices rise.

“The market is looking at the U.S. as being somewhat of a swing producer, kind of like the role OPEC played over many years,” said Dominick Chirichella, co-founder of the Energy Management Institute in New York. “I don’t think anybody expected the U.S. would ever have a significant impact on [global] production.”

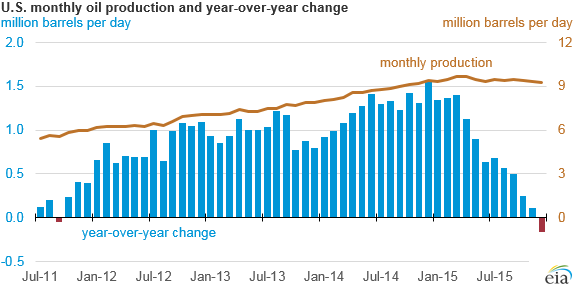

U.S. production dropped by 150,000 barrels a day between January and the end of February, the U.S. Energy Information Administration estimated this week. Total output for the year could slide 7.4 percent, from 9.4 million barrels a day last year to 8.7 million barrels a day in 2016, the agency projected. Next year’s output could decline further to 8.19 million barrels.

Those declines helped push the International Energy Agency (IEA) to lower its projections for non-OPEC oil output. The IEA said production outside OPEC would decline by 750,000 barrels a day in 2015, about 100,000 barrels more than the agency projected in its February oil market report.

OPEC members Iraq, Nigeria and the United Arab Emirates have also experienced output losses. Iran, which rejoined the global oil market this year after Western sanctions were lifted, will likely produce only about half the oil the country promised, at about 220,000 barrels a day, the IEA said.

Market forces are “working their magic and higher-cost producers are cutting output,” the IEA said in its monthly oil market report. “For prices there may be light at the end of what has been a long, dark tunnel.”

“This should not, however, be taken as a definitive sign that the worst is necessarily over,” the agency added.

While production is falling globally, Chirichella said only U.S. output is projected to decline significantly as drillers grapple with plunging profits, looming bankruptcies and higher costs. Other oil-producing nations are driven by national policy more than the the market, and those countries have indicated they’re unwilling to cede more market share to the U.S.

Saudi Arabia, Venezuela and non-OPEC member Russia are pushing a global agreement to freeze production at January levels — but not actually reverse output. Iranian oil officials said the country would only consider pausing its production once it regained the 1 million barrels a day it lost in recent years due to sanctions.

“With shale oil starting to decline, that’s a signal that supply and demand may rebalance in six months from now, or a year from now,” Chirichella said.

The U.S. could also influence global markets on the demand side. Lower oil prices have spurred cheaper gasoline and diesel, prompting more Americans to hit the road and buy fuel-guzzling cars. Fuel demand could surge by 750,000 barrels a day this year, helping to further diminish the global supply glut, said Jay Hatfield, president of Infrastructure Capital Advisors, a New York investment company.

“We consume over 15 percent of the total of world [fuel] products,” he said. “What goes on in the U.S. is critical.”

Hatfield’s projection for climbing demand is significantly higher than the U.S. Energy Information Administration’s own forecast. The agency said total U.S. liquid fuels consumption could rise by 90,000 barrels a day, or 0.5 percent, this year. Hatfield argued official data underestimate the extent to which lower fuel prices are boosting Americans’ thirst for fuel.

He said it was too soon to know if the IEA was right that oil prices bottomed out in January. Better evidence will emerge in May, when the U.S. summer driving season begins and refineries complete spring maintenance. If production falls and demand picks up as expected, then U.S. inventories of crude and refined fuels should decline significantly that month.

“That’s when we’ll declare victory and say, ‘OK, we’re heading back to $50 to $60 a barrel,” Hatfield said.

Chirichella said America’s rebalancing act might not last for long if rising oil prices lure drillers back to the oil patch. U.S. producers have drilled more than 4,000 oil and natural gas wells that are currently not producing but could be tapped quickly once prices return to more profitable levels. New rigs could emerge in highly productive shale regions like the Permian Basin in Texas.

“At minimum it puts a cap on the rally and results in a bit of a retracement, too,” Chirichella said. “That risk is out there for those who are very bullish on the market.”

Despite the short-term ups and downs, the U.S. oil and gas sector is only expected to grow its role as one of the world’s top energy players in coming decades, the analysts said.

The U.S. is already expanding its toehold in the market thanks to a recent shift in domestic energy policy. President Barack Obama in December signed a bill lifting a 40-year-old ban on American crude exports, giving shale producers direct access to overseas market. The first shipment of U.S. crude oil since the ban arrived in Europe in late January. A February shipment of U.S. liquefied natural gas became America’s first shale gas export, sailing from Louisiana to Brazil.

Hatfield said he expected U.S. shale oil will eventually crowd out more expensive production, including offshore drilling near Brazil, parts of Africa and the North Sea, as well as Canadian oil sands drilling — all projects that thrived when oil was above $100 a barrel but have suffered the most from the oil price plunge.

“The U.S. is going to dominate global production,” Hatfield said. “I believe that the U.S. will become the world’s largest oil producer within three to four years.”

Brent crude futures were up 0.6 percent to $40.30 a barrel by 11:25 a.m. EST Friday following the report's release. West Texas Intermediate, the U.S. oil price gauge, was up 1.85 percent to $38.54 a barrel.

© Copyright IBTimes 2024. All rights reserved.