International Tax Evasion Crackdown: Slow, Tricky, And Only First Step in FATCA Legal Reform

Efforts by the U.S. Treasury to crack down on U.S. tax evaders are slow, complicated and only the initial steps in a years-long strategy to recapture $100 billion in lost offshore tax revenue, according to remarks at a recent New York tax conference.

Attempts to implement the 2010 Foreign Account Tax Compliance Act (FATCA) have repeatedly stalled, partly because the sweeping law raises privacy and diplomatic concerns.

The law requires foreign financial institutions, such as banks and investment funds, to hand over information on all U.S. clients who may maintain non-U.S. accounts or funds. Otherwise, they face a 30 percent withholding tax on all U.S. income, a steep penalty banks want to avoid.

Hundreds of thousands of financial institutions are expected to register with the IRS to disclose this information in coming months, according to one senior IRS official. Already, dozens of firms from more than 150 countries have started registration.

“It’s in the hundreds of thousands at least. Probably somewhere more than 100,000 and it could be a million, it could be five million,” said Ted Setzer, an IRS official working on FATCA implementation, to IBTimes. “Nobody really knows for sure.”

Institutions must register by July 2014, a six-month postponement from the original deadline, partly because banks complained that IRS guidelines were unclear. But FATCA reform won’t be fully finished until at least 2017, according to Deloitte LLP.

It’s not as simple as waiting until 2017, though. Banks have skirmished with regulators over reform details for the past three years.

Banks first refused to easily yield up client information, in part because local privacy laws often prohibit that. So the U.S. is negotiating inter-governmental agreements with 80 or so jurisdictions, whereby banks submit data to local tax authorities, who then share information with the IRS.

But only one country – the U.K. – has actually imposed a tax sharing regime, and 10 signed agreements have yet to be implemented. More than 30 agreements are under negotiation, which could take years to complete.

“It is disturbing. It does cause concern,” said attorney John Staples, of London-based international tax firm Burt, Staples, & Maner LLP, at the industry conference. “The pace of IGA [agreement] implementation has been slow… It’d be nice to have some of the other major economies coming into play.”

He said satisfying political sensitivities in two countries on touchy issues like financial privacy has slowed negotiations.

In any case, FATCA is only the first step in eliminating tax evasion, Staples told International Business Times after his presentation.

The eventual goal is “a multilateral exchange of information framework,” said Staples. He described that future model as more robust and less U.S.-centric.

That global tax data sharing system could take years to appear. Meanwhile, FATCA is expected to raise only $7.6 billion in tax revenue over 10 years, according to an industry report by New York tax attorney Dean Marsan, who has advised Lloyds Banking Group PLC (LON:LLOY) on FATCA.

It’s too soon to tell whether FATCA will claw back the $100 billion in lost revenue from offshore abuses, Marsan told IBTimes.

IRS officials will be able to compare personal tax returns with assets disclosed by foreign banks, and then investigate if there are red flags.

But disclosure will only rarely result in investigation or prosecution of tax evasion tactics, said Anchin, Block & Anchin LLP tax partner Larry Feibel. “We already have considerable exchanges of information, in agreements and treaties,” he said. “In my experience, the IRS doesn’t really use them, except if they’re investigating… There’s very little that they can unearth from this stuff that comes over. It’s actually kind of an information overload.”

U.S. legislation will also target only U.S. tax evaders, leaving a huge swath of international tax evaders untouched, added Feibel. The Organisation for Economic Co-operation and Development (OECD) and the G-8 group of nations have, however, vowed to clamp down on tax evasion this year.

The U.S. tax reform legislation also has unintended consequences, and compliance isn't easy. Compliance and related technology expenses could cost UK banks 1.6 billion pounds ($2.5 billion) in one-time costs, and 90 million pounds annually, according to UK revenue and customs officials.

Many foreign banks are preventing wealthy Americans from opening foreign bank accounts, fearing regulatory penalties, Ryan Dudley, an international tax partner with Friedman LLP, told IBTimes.

“A number of our clients are being told – the foreign banks are telling them – ‘We don’t want your business anymore,’” said Dudley. “They’re having their bank or investment accounts closed by the foreign banks.”

Small and midsized American businesses expanding into foreign markets face a similar chill, he said.

“The government has created an enormous amount of paperwork and filing requirements for people who may have only very modest offshore investments, subject to extraordinarily high levels of penalties,” said Dudley. “There’s an enormous burden.”

Thanks to the international agreements, other countries are likely to adopt similar tax reporting systems. The European Union also proposed a savings directive for tax data sharing about a decade ago, which the U.S. declined to participate in, but which survives in versions today.

Country-specific standards for international banks could become a huge compliance headache, UBS bank managing director Chip Collins told IBTimes.

“It’s not limited to accounts where you have U.S. income,” said Collins, stressing the scope of the reform. “It’s for every account, regardless of where it is.”

Even as banks complain, though, local tax authorities have warmed to FATCA, because they stand to learn more about their own taxpayers and evaders, and potentially collect revenue.

That means that if Edward Snowden, say, were to open a bank account in Russia, U.S. regulators under FATCA could hear about it quickly, joked panelists at the New York tax conference.

“So right now, Edward Snowden is in Russia. Russia will not give us Snowden. But by God, if he opens a bank account in Moscow, the IRS will know about it,” said Staples.

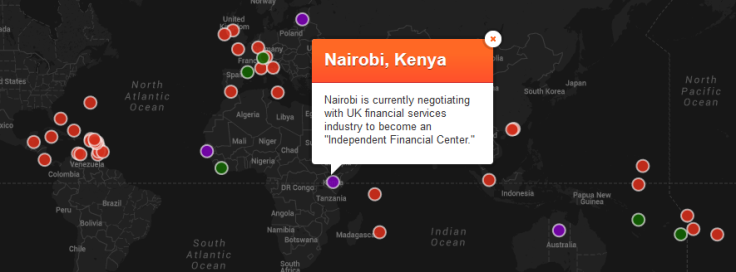

FATCA’s global scope also raises the question of where exactly fresh offshore tax havens will appear and how they will survive. Traditional tax havens like the Cayman Islands will probably begrudgingly obey FATCA rules, to maintain access to crucial U.S. capital.

For clients seeking secretive bank accounts, displaced from their favorite haunts, there’s still a serious question left.

“I guess the question is: Where do they go?” said Marsan. “Every jurisdiction will be facing the same kind of issues if they choose not to enter into an agreement. I don’t know which country will say that they ultimately don’t want to participate.”

According to Staples, too, the U.S. Department of Justice is likely to step up investigations in popular offshore havens like Hong Kong and Singapore as it continues a probe into Switzerland.

IRS official Setzer is satisfied with the pace of reform. But he conceded that banks and tax accountants are still waiting on crucial guidance from the U.S. Treasury, already weeks late.

“We can’t ask somebody to do something, that we haven’t told them how to do,” said Setzer to IBTimes. “Those guidance items are the instructions…to comply with FATCA. And we need that information.”

Financial institutions registered with the IRS, and disclosing about U.S. clients, will be public information. But names of noncompliant firms that haven’t signed up could stay confidential.

The next key deadline is July 1, 2014, by which date financial firms worldwide must register and start due diligence on customers with new accounts, to determine if they are U.S. persons. That's also when the Treasury will start penalizing non-participating firms, with a 30 percent withholding measure.

And it’s all still moot whether the reform will actually eliminate much tax evasion.

“If people really want to break the law in order to save on taxes, there will probably be new smart ways,” tax attorney Dudley told IBTimes. “It was illegal before, it’s illegal now, it will be illegal under FATCA. FATCA simply makes it more challenging for people who want to break the law.”

© Copyright IBTimes 2024. All rights reserved.