Investors Anxious About A Recession Look To U.S. Companies For Guidance

As U.S. companies open their books on the second quarter in the coming weeks, investors increasingly worried about a recession will be anxious to hear what executives say about how demand is holding up in the face of higher costs.

Concerns over a possible recession have already driven a sharp selloff in stocks that resulted in the S&P 500's steepest percentage drop in the first-half of a year since 1970.

But earnings forecasts for the year have largely held up. That has raised questions among some investors about whether current earnings projections reflect those concerns and can remain strong enough to support the market.

Investors have been trying to to figure out whether an aggressive interest rate hike cycle by the U.S. Federal Reserve to tame inflation could tip the economy into recession.

With recession talk having increased in the market, upcoming corporate results and outlooks "are going to be the key catalyst going forward," said Alan Lancz, president of Alan B. Lancz & Associates in Toledo, Ohio.

Earnings from some of Wall Street's biggest banks will unofficially start off the earnings period when they report next week, with results from JPMorgan Chase due Thursday.

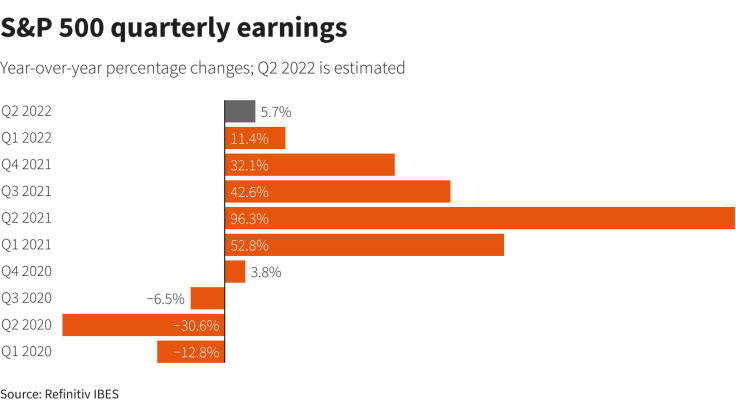

For the second quarter, analysts expect overall S&P 500 earnings to have increased 5.7% over the year-ago period, compared to growth of 6.8% expected at the start of April, while they see earnings for all of 2022 growing by 9.4% versus 8.8% expected on April 1, according to IBES data from Refinitiv as of Friday.

(Graphic: S&P 500 quarterly earnings:

)

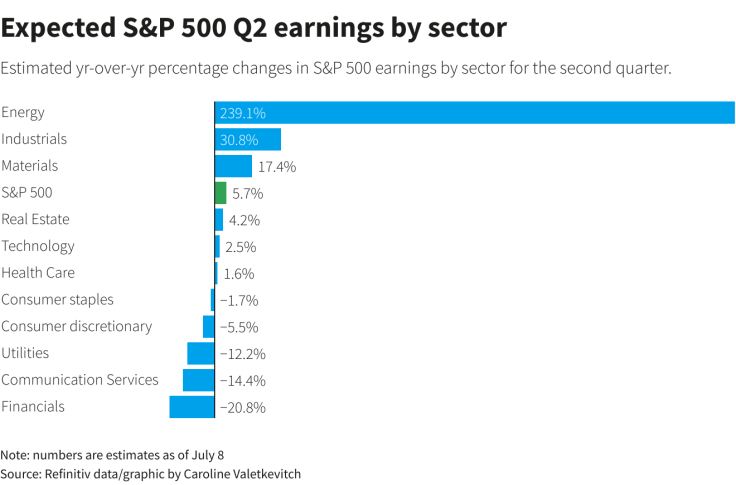

Those forecasts, however, are somewhat distorted by the energy sector, whose earnings are forecast to have jumped by more than 230% in the second quarter following a rally in oil prices. Without energy companies, second-quarter profits are expected to have declined 3% from a year ago, based on Refinitiv data.

"While companies may be able to deliver a decent second quarter, the outlooks are likely to be overall very conservative," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

Last week, Fed Chair Jerome Powell told a European Central Bank conference that "there is a risk" the U.S. central bank could slow the economy more than needed to control inflation.

Commodity and other costs have been rising, and companies have been grappling with how much of those price increases can be passed on to consumers or absorbed.

Among companies that have already reported, Micron Technology Inc recently projected a fall in current-quarter revenue, sparking concerns about demand in the chip industry.

Nike Inc forecast quarterly revenue below estimates as it expects to discount more.

Technology and growth stocks, whose valuations rely more heavily on future cash flows, have been among the hardest hit by concerns over rising rates.

Meta Platforms Chief Executive Mark Zuckerberg recently told employees to brace for a deep economic downturn. Its shares fell 27% in the second quarter.

Apple, whose shares slid about 22% in the second quarter, is due to report results July 28, while results for Alphabet, whose shares also dropped 22% last quarter, are expected July 26.

While higher energy prices are expected to be a drag on airlines and other transportation companies as well as some industrial firms, they are a positive for energy names. Chevron is due to report on July 29.

Goldman Sachs' brokerage recently trimmed its estimates for some consumer-exposed companies including Apple, citing demand concerns.

(Graphic: Expected S&P 500 Q2 earnings by sector:

)

Valuations have fallen with the market's selloff. The S&P 500's forward 12-month price-to-earnings ratio was at 16.2 as of Friday versus 22.1 at the end of December and was in line with its long-term average of about 16, Refinitiv data showed.

While the drop has made valuations seem more attractive to some investors, others worry about what's in store for earnings forecasts.

Market sentiment already has become more bearish and multiples have come down, said Matt Stucky, senior portfolio manager at Northwestern Mutual Wealth Management Company. "The next shoe to drop typically is a revision lower in terms of earnings estimates by the sell side."

© Copyright Thomson Reuters 2024. All rights reserved.