Investors Fear Earnings Season Will Spark New Equities Selloff

The upcoming corporate earnings season could prompt another sharp fall in global share prices with profit forecasts looking far too upbeat given mounting recession risks, investors and analysts warn.

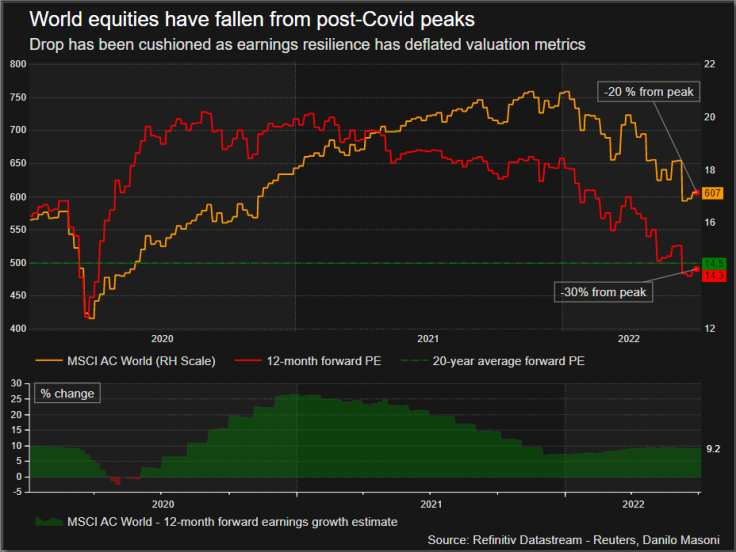

After shedding more than $20 trillion in value since hitting record highs in January, world stocks are stuck in a bear market as major central banks struggle to stem surging inflation without derailing fledgling growth.

Valuations have fallen below historical averages, which might tempt bargain hunters. However, recent profit warnings from U.S. retailers Target and WalMart and pandemic winners like Zalando and B&M have traders worried about a series of downgrades, as spiralling energy and other input costs bite and consumers cut spending.

Emmanuel Cau, a strategist at Barclays, said earnings were "taking over from valuations as the next market driver".

According to the British bank, equity markets may struggle to find a bottom until profit forecasts are reset lower. That's because high profit expectations "optically deflate" company valuations to levels which can mislead investors.

"There have been very few downward revisions of corporate earnings, there's still too much optimism. That's why we expect another correction when earnings are published and with this volatility, one really risks taking a beating," said Francesco Cudrano, advisor at Simplify Partners.

He said his firm had been cutting equity exposure and boosting cash in anticipation of a 15-20% market decline. JP Morgan kicks off U.S. earnings on Thursday, with the season in Europe starting the following week.

"Negative pre-announcements could occur now at any time. Revenues and margins are both at risk," said Eric Johnston, head of equity derivatives and cross asset at Cantor Fitzgerald.

"We don't see a scenario where the Fed is able to take its foot off the breaks for at least four months even as growth is weakening and even if equities move sharply lower," he added, referring to the U.S. Federal Reserve's current interest rate-hiking cycle.

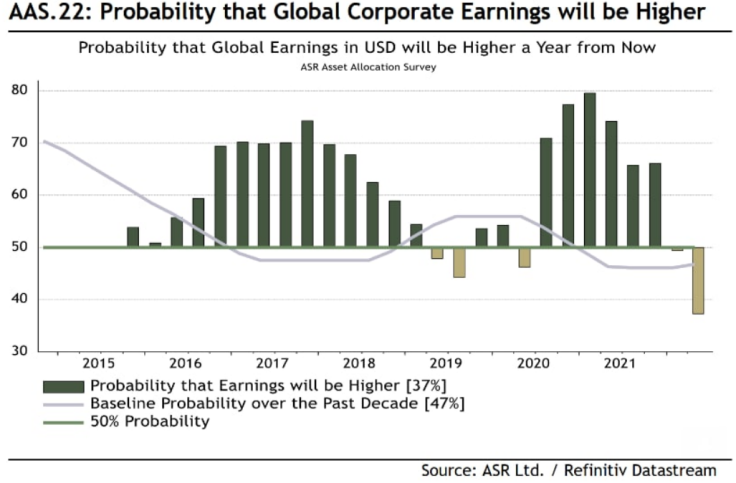

The probability global corporate earnings will be higher in a year's time has tumbled to 37%, the lowest reading since late 2015, according to Absolute Strategy Research, which surveyed investors managing $5.2 trillion of assets on their expectations.

The same survey found a record low 53% probability that investment returns on equities will trump bonds over the next 12 months.

Graphic: Probability of higher earnings - ASR survey,

Economists have raised the odds of recession in the United States and Europe, citing aggressive interest rates hikes and the war in Ukraine, yet earnings forecasts for this year have continued to rise since January.

According to Refinitiv, earnings in Europe should rise by 15.2% in 2022 and by 4.1% next year while in the United States they should climb 10.8% and 9.1% respectively.

Barclays sees an 8% downside for Europe's STOXX 600 index to 380 points. U.S. Bank Wealth Management has axed its year-end S&P 500 forecast by 16% to 4,050 points.

The MSCI AC World index trades at 14.3 times forward earnings, around 11% below the 20-year average. That does not reflect any negative earnings revisions that may come in the months ahead, however.

"A sharp fall in real income, deteriorating global activity, prolonged war and uncertainty are all reasons for concern," said Michele Morganti, senior strategist at Generali Investments, predicting possible cuts to earnings forecasts for the second half of 2022 and 2023.

Graphic: MSCI AC World price and PE,

© Copyright Thomson Reuters 2024. All rights reserved.