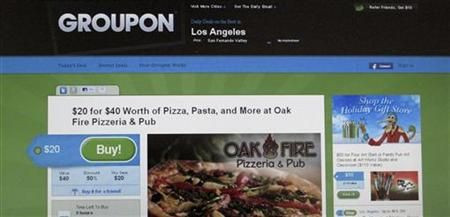

Investors Should Avoid Groupon IPO: Report

Investors may want to avoid Groupon Inc's high-profile IPO this week because the deals and coupon Web site operator has an unproven earnings record and slow growth, according to Barron's newspaper.

Groupon is considering raising the price range in its initial public offering, set for Thursday, as underwriters grow more confident about demand. If the company raises the IPO price range, it could file an amended IPO prospectus early next week, a source told Reuters this past week.

But Groupon's lack of earnings, slowing growth and challenges from competitors, including Google and Facebook, cast a shadow on any initial rise in the shares, Barron's said.

Any price gain would have less to do with the company's strategic plan than its strategy to milk its IPO for all it's worth, the newspaper said in its Oct. 31 issue.

A $10 billion market value is a lot for a company with no profits and an unproven business model, it added. This IPO is one deal to avoid.

(Reporting by Jonathan Spicer)

© Copyright Thomson Reuters 2024. All rights reserved.