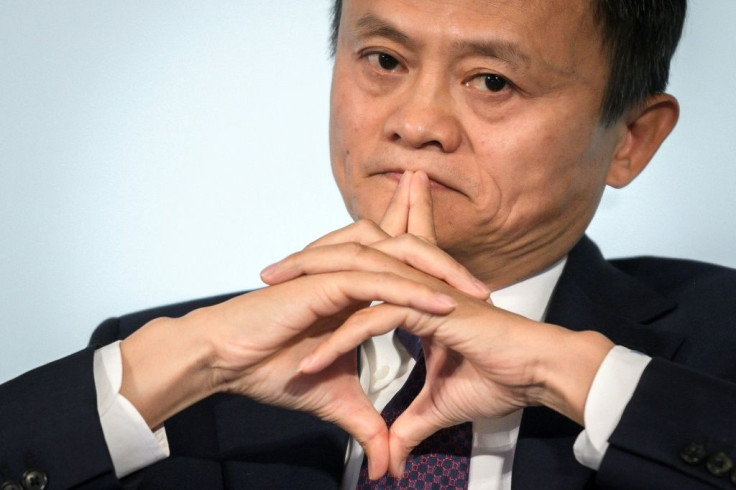

Jack Ma Makeover: How The Chinese Billionaire Wants To Revamp Ant

Jack Ma’s Ant Group will undergo an overhaul as it looks to conform to Chinese financial regulations after coming under fire by the country's government over concerns of possible monopolization.

The company will restructure into a financial holding company that is overseen by China’s central bank, sources for The Wall Street Journal reported.

The news of Ant Group’s restructuring comes as Ma was called into a private meeting with Chinese officials a day before the company’s IPO was to be dual-listed on the Hong Kong and Shanghai Exchanges.

Regulators called off the IPO on Nov. 3, which was on track to bring a valuation of more than $300 billion, amid handing down violations to Ant Group as it looked to prevent financial tech firms in the country from becoming monopolies.

Regulators handed down a series of violations on the company while also requiring it to restructure its credit rating business.

Ant Group, at the time, said it would set up a “rectification” working group to meeting the regulatory requirements, CNBC reported. Ma also offered the government interest in the company for as long as it needed it, the Journal reported.

While the government declined the offer, it has been speculated that comments that Ma made at a forum in Shanghai in October 2020 did not sit well with officials as he said the country had “no financial risks” because “there’s no financial system in China. The risks are a lack of systems.”

Ma, who has a net worth of $54.5 billion, according to the Bloomberg Billionaires Index, was then not seen publicly for at least two months following the private meeting with Chinese regulators, canceling an appearance on the “Africa’s Business Heroes” show that he created and was to appear on as a judge, The Financial Times reported.

As concern increased over Ma’s whereabouts, he resurfaced in a video posted on a Chinese social media site discussing teachers in rural China as part of the annual Rural Teacher Initiative.

Now Ant Group is succumbing to Chinese regulator pressure, submitting a restructuring proposal to authorities, which would create a financial holding company – something that was not on the table for the company in its earlier plans, sources told the WSJ.

As a financial holding company, Ant Group would now be subject to a plethora of regulations that are similar to the ones that govern the countries banks, which could affect its growth and profitability going forward, the news outlet said.

While the restructuring plan is still in the deliberation phase, it is thought to be finalized before the Chinese Lunar New Year in mid-February and would need approval from the Financial Stability and Development Committee, sources told The Wall Street Journal.

Under the governance of the Chinese Government, Ant Group could see its IPO revived as People’s Bank of China. Gov. Yi Gang said during the virtual meeting of the World Economic Forum (via WSJ) that the company could be listed on the exchange if laws and regulations are followed.

China has issued a series of new regulations for financial-holding companies that took effect on Nov. 1.

© Copyright IBTimes 2024. All rights reserved.