January US New Auto Sales Preview: Historically Slow Month, But Highest January Sales In Years; Ford, GM Lost Market Share While Chrysler Gained Most From Last Year

UPDATE: Click here for a roundup of the Big 8 auto dealers January U.S. sales. Click here for the results.

Original story starts below:

U.S. car buyers ended 2013 with a bit of a wintertime whimper, though sales were robust enough to push December’s new-auto sales volume to a six-year high for the month.

We’re now in the post-holiday doldrums known as January, but compared to average sales in January overall, some market-watchers describe this month’s sales as doing fairly well, while others think it may be the best January since the 18-month recession that kicked off in December 2007 began and drove auto sales through the floorboard.

Possibly, but not definitively.

Most forecasts expect year-over-year sales this month to be between 1 percent and 2 percent above last year’s 1.04 million total of new-vehicle units sold, which was the first time in five years that sales in the month topped a million units. January new-auto sales hit a 10-year peak in 2006 with 1.14 million units. The last time auto sales were below a million units prior to the Great Recession was in 1993, according to data from the U.S. Bureau of Economic Analysis.

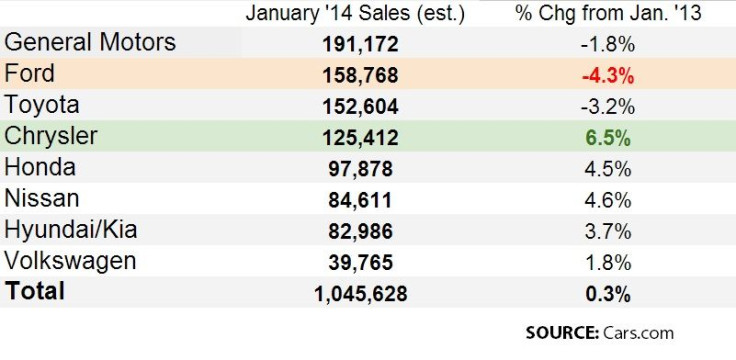

The automotive pricing site Cars.com said Monday it predicts new-vehicle sales in the U.S. this month will number nearly 1.05 million, putting the total so close to last year’s figure (up only 0.3 percent) that if sales don’t meet that estimate, then we’re likely looking at roughly tying last year's January sales.

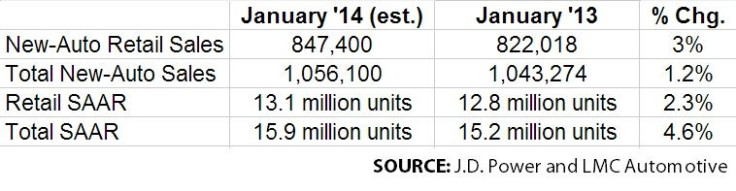

But other forecasters are more bullish, albeit not very much more so. Marketing information firms J.D. Power and LMC Automotive see total new-vehicle sales at 1.06 million units, or up 1 percent from last year. Automotive intelligence and pricing provider Kelley Blue Book’s estimates are similar, with a 1.6 percent increase from last year. If auto sales tie with last year, it will be viewed as a slowdown in sales.

A virtual tie is better than a retreat, but slowing sales momentum heading into the new year will have to be made up later to grow annual sales over last year's levels. Most analysts predict the seasonally adjusted annualized rate of new-vehicle sales -- a key metric that gauges the monthly health of the auto market overall -- will be about 15.9 million cars sold in January.

"We expect the total sales to grow by nearly 900,000 units (5.7 percent) in 2014, fueled by new products, an improved macro-economic landscape, and attractive lease and finance specials,” said Jesse Toprak, Chief Analyst for Cars.com.

Most analysts see this year’s sales reaching 16.4 million units, which means they expect better sales in upcoming months compared to those expected for this month.

“Low interest rates, longer term loans, and leasing will continue to be a major factor in the market this year,” said Alec Gutierrez, a senior analyst at Kelley Blue Book. “With transaction prices currently at more than $32,000 ($32,086 in 2013) per unit, consumers have relied on attractive and affordable finance options to offset rising prices. There is some downside risk in this area if the Fed starts to increase rates, which will drive up the cost of financing and potentially push some consumers out of market.”

And therein lies a key to the health of the automotive industry: cheap credit. Most new car purchases are financed, so lending policies are an important incentive. And lenders’ interest rates for car loans remain well below 5 percent, compared to more than 7 percent before the last recession. Auto lending default rates remain low and are trending downward even as borrowing increases, according to the Federal Reserve's latest Household Debit and Credit Report. As long as Americans can make their car payments, cheap credit is a good thing for the industry.

Retail new-auto sales companies are seen growing better than total auto sales -- the former are sales that exclude public and corporate bulk purchases and fleet sales to auto rental companies, and they offer a better glimpse into consumer sentiment. “We are forecasting January 2014 to have the strongest level of retail sales for a January since 2004, and transaction prices will be the highest on record for the month of January,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power.

Retail sales are predicted to grow as much as 3 percent compared to last year, to nearly 850,000 units.

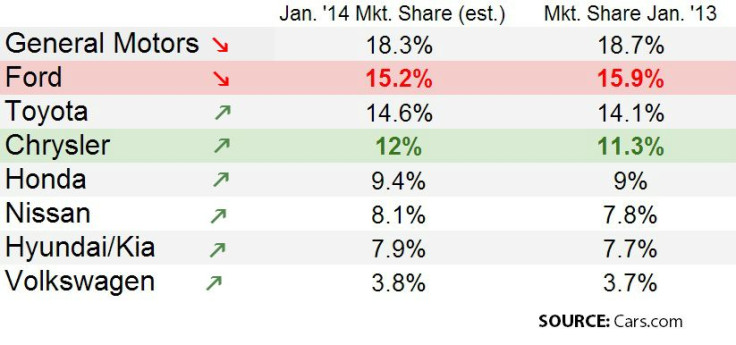

Highlights to watch out for this month: Chrysler should see a bump from its new jeep Cherokee crossover, and the RAM truck brand should continue its tear that resulted in a 22 percent spike in 2013. Chrysler, the wholly owned subsidiary of Italy’s Firat SpA (BIT:F), likely grew market share the most over the past 12 months.

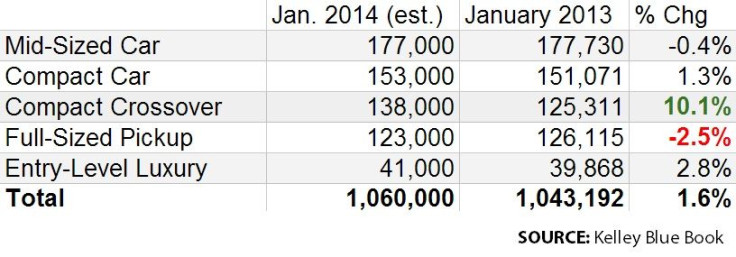

- Truck sales may decline by as much as 2.5 percent, according to Kelley Blue Book, which could dampen sales for GM and Ford, whose best-sellers are the Sierra and GMC pickups for GM and the F-150 truck for Ford.

- Crossovers, luxury and entry level, will see their reign continue, so automakers with strong presences in this segment will benefit.

- General Motors and Ford likely lost market share in January compared to last year on robust offerings and growing incentive spending from Japanese automakers.

- Ford has likely had the biggest year-over-year decline in sales, while Chrysler likely had the biggest increase. Toyota and General Motors also probably saw sales volumes decline.

© Copyright IBTimes 2024. All rights reserved.