JetBlue Airways Corporation Earnings: Profit Flies Higher

JetBlue Airways (NASDAQ:JBLU) posted a string of incredible earnings results following the rollout of its Mint premium transcontinental service in 2014. More recently, the popular low-fare carrier fell into a bit of a rut, with slowing revenue growth and rising costs combining to pinch profits. As a result, adjusted pre-tax income -- which peaked at $1.2 billion in 2016 -- receded to just $654 million last year.

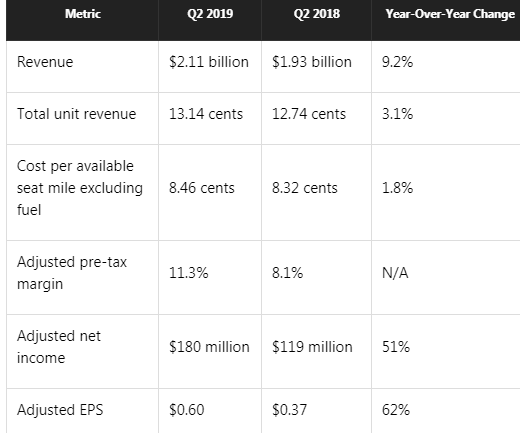

However, JetBlue is beginning to turn things around. A multiyear cost-cutting program is finally paying dividends, while unit revenue growth is starting to improve. Slightly lower fuel prices are helping, too. This allowed JetBlue to report stellar earnings growth in the second quarter -- and management expects similarly strong growth in the third quarter.

What happened with JetBlue Airways this quarter?

The main highlight of the second quarter was that JetBlue firmed up its long-haul expansion plans. In April, JetBlue announced that it would convert 13 Airbus (NASDAQOTH:EADSY) A321neo orders to the A321LR variant, which can fly hundreds of miles further. The carrier said it would use these planes to begin flying nonstop from Boston and New York to London in 2021, confirming what everyone in the industry had long suspected.

In June, JetBlue went even further by agreeing to convert another 13 A321neo orders to the new A321XLR model that Airbus launched at this year's Paris Air Show. The Airbus A321XLR will have enough range to fly much deeper into continental Europe from the Northeast than the A321LR. It will also be capable of flying from South Florida to all of the major population centers in South America. Airbus will begin delivering the A321XLR in 2023.

These moves show that JetBlue sees plenty of room for growth on longer-haul routes. They also signal that the carrier is serious about deepening its competitive advantage in Boston -- where it is already the largest carrier -- by adding service to the top destinations in Europe.

JetBlue also continued to make progress on its cost-cutting plan last quarter. It has now locked in annualized savings of $257 million, up from $199 million six months ago. All of these savings should flow through to the bottom line by next year.

What management had to say

JetBlue's management was understandably pleased with the carrier's sharply improving earnings trajectory. CEO Robin Hayes stated:

Thanks to the hard work of our crewmembers, JetBlue is consistently recognized as one of the best airlines in the world. We are excited with the progress we are making on our 'building blocks' and toward our 2020 financial goals. As we look to the second half of 2019, we expect a return to margin expansion and EPS growth.

CFO Steve Priest added:

We have made significant progress in our Structural Cost Program over the past six months. ... We are pleased to have recently signed a long-term engine maintenance agreement covering over half of our V2500 engines, which serve our current Airbus fleet.

Looking forward

JetBlue expects revenue per available seat mile (RASM) to rise 0.5% to 3.5% in the third quarter. At the midpoint of the range, that would be slower than the 3.1% RASM gain it reported for the second quarter. However, adjusting for a shift in the timing of Easter and Passover, JetBlue's unit revenue would have increased less than 1% last quarter.

Meanwhile, JetBlue expects a 0.5% to 2.5% increase in adjusted non-fuel unit costs, driven entirely by maintenance and marketing costs shifting from the first half of the year. Fuel prices are on track to decline again, falling to $2.18 per gallon from $2.32 per gallon a year earlier.

Based on the midpoint of this guidance, adjusted earnings per share would soar to around $0.67 from $0.43 in the prior-year period. EPS could plausibly vary from that estimate by about $0.10 in either direction, though.

Regardless, the forecast points to another quarter of strong earnings growth. And with cost trends on track for further improvement over the next several quarters, management is confident that JetBlue will reach its 2020 adjusted EPS target range of $2.50 to $3.00.

This article originally appeared in the Motley Fool.

Adam Levine-Weinberg owns shares of JetBlue Airways. The Motley Fool recommends JetBlue Airways. The Motley Fool has a disclosure policy.