July 2014 US New Auto Sales Forecast: Record High Auto Lending Pushing US New Car Sales To Highs Unseen Since 2006

UPDATE Aug. 1, 2014 3:22 p.m.: U.S. new auto sales results are in. Scroll down for forecasting data, or click here to read the U.S. auto sales live blog.

Original story begins here:

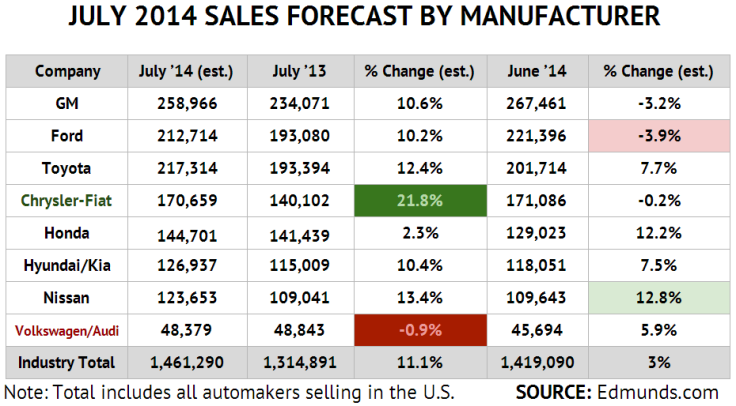

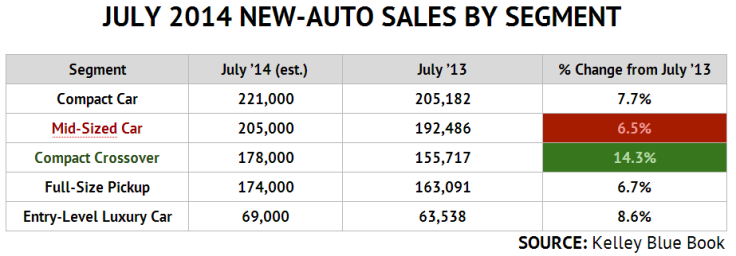

Fueled by a record high level of borrowing for car purchases, Americans probably bought about 1.4 million motor vehicles this month, pushing sales up more than 10 percent from July 2013. By most forecasts this will be the best July on record since 2006, more than a year before the start of the Great Recession that sent the suto industry into a crisis.

The actual July 2014 figures will be announced Friday, Aug 1.

“Shoppers are looking past news of recalls and rising gas prices and they’re finding affordable interest rates and other incentives that make it easier to buy a new car,” Jessica Caldwell, senior analyst for automotive pricing and information provider Edmunds.com, said in an email.

The seasonally adjusted annualized rate, an important monthly snapshot of a 12-month running average, is seen coming in between 16.5 million and 16.8 million, well above the 16.1 million reached in 2007 before the collapse of the auto industry sent annual sales to 10.4 million in 2009. This year, new auto sales in the U.S. will finally reach pre-recession levels.

But at what cost?

According to Equifax, a credit reporting agency, auto lending hit an all-time high of $902 billion in the first half of the year, a 10 percent jump from the same period last year.

"Auto lending continues to thrive, accounting for more than 50 percent of all new non-mortgage lending through April of 2014," Dennis Carlson, economist at credit reporting agency Equifax, said in a statement announcing the latest data (pdf). Helping this lending surge: record low rates under the Fed’s quantitative easing policy of buying up debt and lending money to banks at near-zero percent interest.

“When the bubble pops, the effect won't simply come in the form of losses on the loans themselves,” Edward Niedermeyer, an auto industry consultant, writes in Bloomberg View. “As repossessed vehicles flood the market, used vehicle values will drop to the point where they begin to lower new car demand. By juicing short-term sales, automakers and new-car dealers have been robbing from their own futures.”

If the bubble bursts, not only will the market be flooded with repossessed vehicles, but as reported recently in the New York Times, insurance companies, mutual funds and public pensions that have been buying bonds backed by subprime lending (giving loans at higher rates to consumers who have a high risk of default) could lose fortunes as they did buying home-mortgage backed securities in the runup to the Great Recession.

But for now, it’s party time. Equifax says auto lending delinquencies remain low, and as long as they stay there auto manufacturers, suppliers and dealers will continue to see sales growth.

Chrysler Group LLC, the Auburn Hills, Michigan, company owned by Italy’s Fiat SpA (BIT:F), has been enjoying strong demand for its Jeep brand. The newly redesigned Chrysler 200 mid-sized sedan that recently went on the market will help momentum.

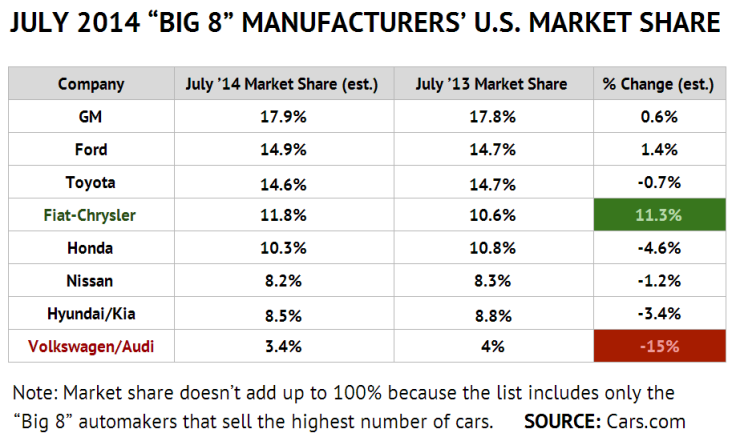

“Fiat-Chrysler is projected to post the largest increase in sales amongst the major automakers,” Jesse Toprak, chief analyst for online car seller and auto marketing company Cars.com, said by email.

General Motors Co. (NYSE:GM) is expected to boost sales in July by more than 10 percent despite the raft of auto-safety recalls of about 30 million of its vehicles, mostly in the U.S. Despite the hit to some of GM’s Chevrolet sedan sales, the company’s new K2XX platform in its trucks and full-sized SUVs has attracted buyers to the company’s best-selling behemoths.

Meanwhile, Volkswagen AG (FRA:VOW3), the world’s second-largest automakers by deliveries, continues to rely on strength in Audi sales in the U.S. to offset losses in VW-branded sedans and compacts.

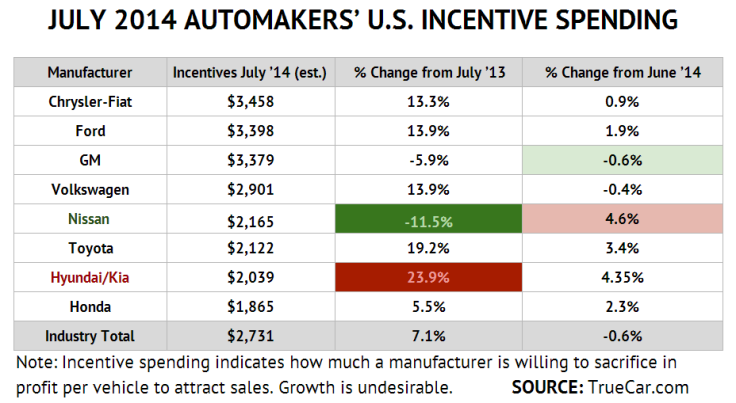

Nissan Motors Co. Ltd (TYO:7201) is seen dropping incentive spending the most compared to July 2013, according to a forecast from automotive data provider and online seller TrueCar.com, while the Hyundai Motor Co. (KRX:005389) and Kia Motors Corp. (KRX:000270) are predicted to have led in industry in incentives growth. The more a company offers in sales incentives, such as rebates and zero-percent financing, the less it earn in profit for the sale.

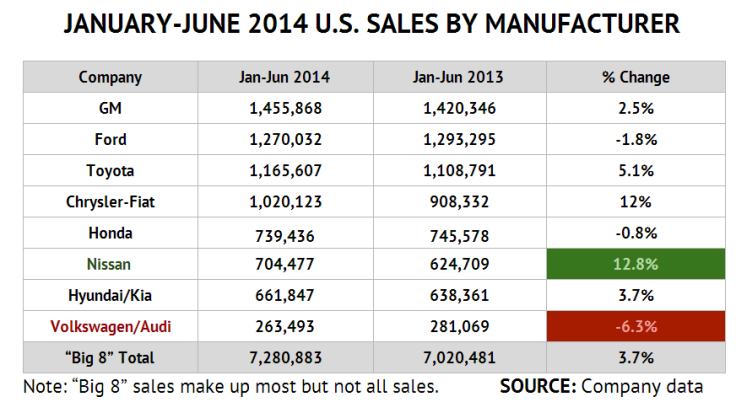

So far this year, GM, Toyota Motor Corp. (TYO:7203), Chrysler-Fiat, Nissan and Hyundai/Kia have increased sales while Honda Motor Co. Ltd. (TYO:7267), Ford Motor Co. (NYSE:F) and Volkswagen have seen sales decline since last year. Overall the world’s “Big 8” auto manufacturers have increased sales by 3.7 percent in the first six months of the year.

Low interest rates have helped spur the rebound in the auto industry. The question is: What happens when, as expected, interest rates begins to rise. And perhaps more important: What will be the future impact on the industry of auto financing that is rapidly approaching a trillion dollars?

© Copyright IBTimes 2024. All rights reserved.