July Inflation to Pick up, Stoked by Poor Rains

Indian inflation probably crept up in July as poor monsoon rains drove food prices higher, a Reuters polls showed on Wednesday, giving the RBI less room to cut interest rates to revive a flagging economy.

The poll of 24 economists showed wholesale prices were 7.37 percent higher year-on-year in July, compared to 7.25 percent in June.

Forecasts in the poll were in a tight range from 6.90 percent to 7.59 percent, the narrowest in polls taken since January.

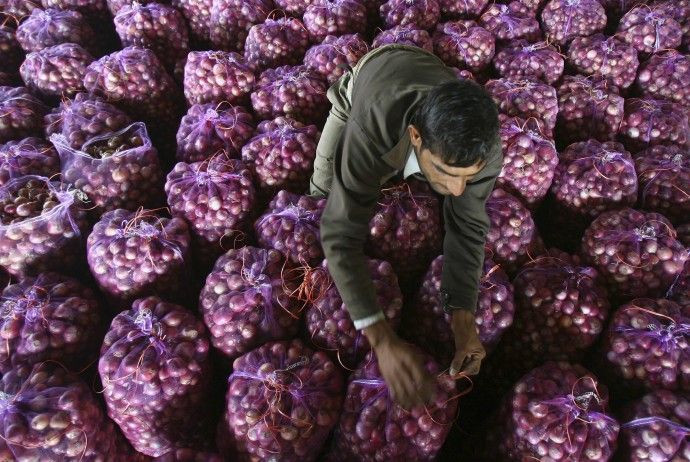

A below-average monsoon, which is vital for over half of India's farmland, is pushing up food prices which along with fuel makes up over a third of the wholesale price index.

"Food clearly is the big issue and the biggest swing factor and also the biggest risk to the forecast," said Robert Prior-Wandesforde, Asia economist at Credit Suisse.

Persistently high inflation has kept the RBI from lowering its interest rate even though growth in Asia's third largest economy slowed to its lowest in nine years in the quarter to March.

A headline inflation rate of around 5 percent is seen as the Reserve Bank of India's comfort level but it has stayed above that for over two and half years now.

Last month the central bank kept its key repo rate unchanged at 8 percent last month, citing risks to inflation even though economic conditions are deteriorating.

A weaker rupee, which hit a record low of 57.32 to the dollar in June, puts further pressure on an economy that is a major importer of pulses and edible oils.

A drought will make it more dependant on imports if the monsoon that runs broadly over a four-month period from June fails.

"Concerns regarding the magnitude of rainfall in the latter half of the monsoon season are expected to result in food inflation remaining firm in the near term," said Aditi Nayar, economist at ICRA.

Still, the inflation rate is much lower than the 9.52 percent average through 2010 and 2011 and a cut in interest rates by the end of the year to restore momentum to the economy cannot be ruled out, analysts said.

"We don't need to see inflation at 5 percent to get the RBI to cut (interest rates) in the context of what is very weak growth," Prior-Wandesforde said.

High interest rates and a policy gridlock on top of slowing demand in Europe and the United States have combined to drag down the Indian economy.

© Copyright Thomson Reuters 2024. All rights reserved.