June FOMC Minutes: Half Of Fed Officials Want QE Taper, Bernanke Speech On Tap

The minutes from the June 18-19 meeting of the U.S. Federal Open Market Committee showed that about half the participants wanted to bring asset purchases to a close late this year.

At the June meeting, the “several” members (i.e. about four) who were keen to slow the pace of the monthly asset purchases “soon” were outgunned by the “many” (i.e. about five) who wanted to see further improvement in the labor market first. “The strength of June’s employment report, which was released last week, will surely satisfy those members who are more reluctant to pull the trigger,” Paul Dales of Capital Economists said in a note to clients. “The Fed will probably start to taper QE3 in September.”

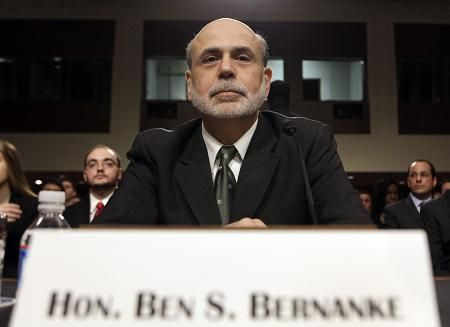

After markets close, Bernanke will speak on the topic of “A Century of U.S. Central Banking: Goals, Frameworks, Accountability” at a National Bureau of Economic Research Conference. The chairman is expected to release prepared remarks as well as take questions from the audience. Like the FOMC minutes, his comments will be eyed for clues about the Fed's stimulus plans.

The Fed has been buying $85 billion in government and mortgage bonds each month as a temporary measure to keep interest rates ultralow and stimulate the U.S. economy. Bernanke spooked investors last month, when he said the economy's expansion was strong enough for the central bank to start slowing the pace of its bond purchases later this year.

Stocks quickly tanked and interest rates soared as everyone tried to figure out what exactly Bernanke meant. Over the past five sessions, however, the S&P 500 (INDEXSP: .INX) has risen 2.73 percent, pushing the benchmark index to just about 1 percent below its May 21 all-time-high closing of 1,669.16.

On Tuesday, the International Monetary Fund reduced its 2013 gross domestic product projection for the U.S. to 1.7 percent from 1.9 percent, previously projected in April, while next year’s outlook was trimmed to 2.7 percent from 3 percent initially reported in April.

The Fed’s latest forecasts for the U.S. economy are more optimistic than those of the IMF. Policymakers in June projected U.S. growth of 2.3 percent to 2.6 percent in 2013 and 3 percent to 3.5 percent for next year.

The Fed has said it is waiting for the labor market to improve “substantially” before it starts to taper.

The Labor Department’s June nonfarm payroll showed that employers created 195,000 jobs last month. The figure is stronger than analyst expectations of 165,000 new jobs, but there were also significant revisions to the last two months of data, which added another 70,000 jobs to the total. The number of new jobs created in May was revised up 195,000 from 175,000, and April’s increase was raised to 199,000 from 149,000.

The economy created an average of 196,000 jobs per month in the April-to-June period, down just slightly from the 207,000 pace in the first quarter. Over the past year, job gains have averaged 182,000 a month.

The unemployment rate held steady at 7.6 percent as jobs growth was once again more than matched by an increase in the number of people looking for jobs. The labor-force participation rate ticked up to 63.5 percent, from 63.4 percent in May and 63.3 percent in April. During the boom years, it was in the 66 percent range.

Bank of America Merrill Lynch economist Michelle Meyer notes that the Bureau of Economic Analysis (BEA) will be announcing the results of its comprehensive benchmark revision when it releases the second-quarter U.S. GDP on July 31.

“We believe [the report] will reveal significant adjustments to GDP, personal income, the savings rate and corporate profits,” Meyer wrote in a note to clients.

These revisions will not go unnoticed by policymakers. “If we are right, the revisions will reveal a healthier economy than previously believed, suggesting positive momentum and reduced downside risks,” Meyer said.

According to Meyer, an upward revision to near-term growth will imply that the economy has made more progress in closing the output gap, which means less slack and greater risk of eventual inflation pressure. Moreover, the revisions will paint a different picture about the household sector -- stronger income growth, larger savings buffer and greater wealth accumulation.

“The Fed should be encouraged by these revisions. In fact, we suspect the Fed is already aware of the risks of an upward revision,” Meyer said.

The BEA has been public about the upcoming revisions and has likely briefed the Fed about the changes. This could be one of the reasons the Fed has emphasized the employment data over GDP recently and has discussed the likelihood of tapering before year-end despite recent weak GDP figures.

© Copyright IBTimes 2024. All rights reserved.