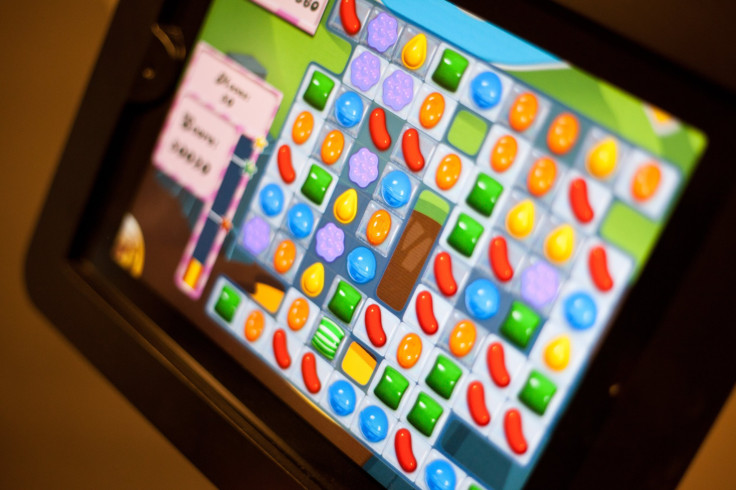

King Files $500 Million IPO: 'Candy Crush Saga' Creators May Face Several Risks In Volatile Mobile Free-To-Play Market

The maker of “Candy Crush Saga,” the popular mobile game for Apple iOS and Google Android devices, is reportedly looking for investors to take part of its “sweet” enterprise.

King Digital Entertainment, the Dublin based online and mobile game giant formally filed its initial public offering, or IPO, on Tuesday. According to their Securities and Exchange Commission filing, King Digital Entertainment is hoping to raise $500 million in its IPO.

While the substantial growth of King is an attractive prospect for investors, the fact that its growth is largely based on the success of its hit mobile game “Candy Crush Saga” is a huge risk.

King addresses this as well in its SEC filings:

“The growth and expansion of our business and headcount create significant challenges for our management and operational resources. We cannot assure you that this level of significant growth will be sustainable in the future."

Among other risks, King recognizes that its small intellectual property portfolio may be a potential weakness:

“During 2013, we had fewer games launched on the mobile channel than on the web channel. In future periods, we expect 'Candy Crush Saga' to represent a smaller percentage of our total mobile channel gross bookings as we diversify our mobile game portfolio."

Currently, King attracts an average of 128 million daily active users that play games such as “Candy Crush Saga” over 1.2 billion times per day.

Among King’s IP assets, “Candy Crush Saga” has consistently brought in the bulk of King’s revenue, with the candy-themed mobile game accounting for 78 percent of “gross bookings” in Q4 2013.

When “Candy Crush Saga” revenue is combined with “Pet Rescue Saga” and “Farm Heroes Saga,” the three assets account for 95 percent of King’s earnings in Q4 2013.

Despite these risks, King has proven itself to be quite profitable in such a short time, reversing its $1 million loss in 2011 to a massive $568 million profit in 2013 from $1.8 billion in revenue.

Will King remain profitable? It’s possible. However, revenue data provided in King’s SEC filing is a cause for concern. While King generally saw huge revenue and profit growth in 2013, revenue between Q3 and Q4 2013 dropped from $621 million to $601 million.

Aside from King’s own risks, it also faces a highly competitive mobile and online game market with several free-to-play IPs available in the market from game publishers such as Electronic Arts (NASDAQ:EA) and Zynga (NASDAQ:ZNGA).

King has also earned a negative reputation with the indie game developer community earlier this year due to several of its legal filings, which claim exclusive trademark usage of the word “Candy” and the word “Saga” in IP titles.

There's also some doubts about the longevity of the free-to-play model, which has seen some backlash in recent months, particularly with EA's reboot of the "Dungeon Keeper" franchise.

The creators of "Candy Crush Saga" intends to trade on the New York Stock Exchange using the stock ticker “KING,” according to SEC filings.

JPMorgan Chase (NYSE:JPM), Credit Suisse (NYSE:CS) and Bank of America Merrill Lynch (NYSE:BAC) are the leading underwriters of King’s IPO.

© Copyright IBTimes 2024. All rights reserved.