Latest MtGox Transfers Mark The Beginning Of The End Of Bitcoin's Darkest Days

KEY POINTS

- MtGox moved over 14,000 Bitcoins so far this week – one transfer was $784.20 million

- The defunct exchange said it has completed repayments to more than 19,000 creditors

- AMLBot's Slava Demchuk said MtGox transfers will have less of an impact as crypto becomes more resilient

Fallen Bitcoin exchange titan MtGox has once again transferred a significant amount of $BTC as part of its repayments to creditors, and while the exchange's repayment activity has often been a source of FUD (fear, uncertainty, and doubt) within the broader crypto community, the latest move just could be the first ray of sunlight for a community battered by a pricing storm since the halving.

MtGox moves over 14,000 $BTC

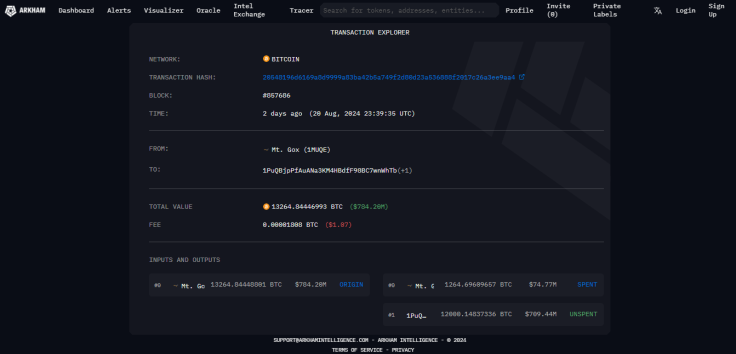

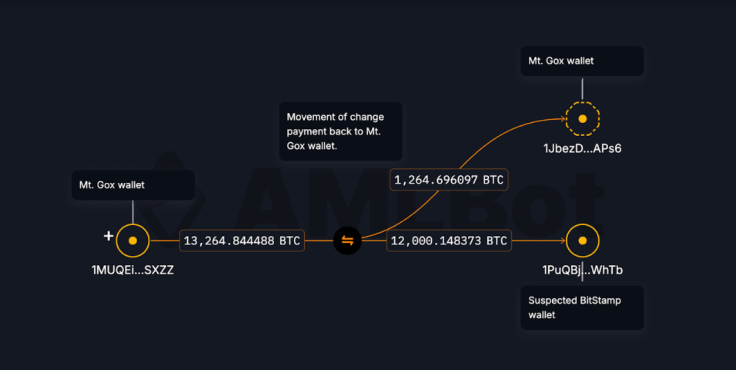

The defunct cryptocurrency exchange moved over 13,000 Bitcoins worth $784.20 million Tuesday, marking one of its largest transfers yet since it started repaying creditors last month, as per data from blockchain analytics firm Arkham Intelligence. Overall, MtGox is expected to repay its creditors 142,000 Bitcoins and 143,000 in the forked cryptocurrency Bitcoin Cash. It also has to pay back 69 billion Japanese yen (approximately $474 million based on current prices).

Blockchain forensic and compliance firm AMLBot said the funds moved Tuesday went to a wallet associated with crypto exchange Bitstamp, one of the exchanges supporting the rehabilitation process of MtGox creditors.

"The address 1PuQBjpPfAuANa3KM4HBdfF98BC7wnWhTb could be associated with crypto-exchange BitStamp, while address 1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6 is another Mt. Gox address that received change payment," AMLBot told International Business Times in a statement.

Again on Wednesday, the bankrupt exchange transferred over 1,200 $BTC worth $75.36 million to Bitstamp. Following the latest move, MtGox said it has made $BTC and Bitcoin Cash repayments to more than 19,000 creditors. There are an estimated 24,000 customers worldwide who lost their funds when the exchange collapsed in 2014.

Bitcoin's dark days are over?

Even before MtGox started its repayments, there were fears in the crypto community about the activity's potential impact on Bitcoin prices. Many expected that repaid customers and creditors may dump their Bitcoins simultaneously, triggering a possible plunge in the digital currency's prices, especially as it still reels from the effects of the German government's massive selloffs.

On the other hand, there are hopes that as MtGox nears the end of its repayment activities, the world's largest digital asset by market value may finally begin a significant uptrend.

"MtGox FUD has been around for a very long time, with each transfer triggering some market reaction. As the time passes and the crypto market becomes more resilient, each MtGox-related transfer triggers less reaction," Slava Demchuk, the co-founder and CEO of AMLBot, told IBT on Thursday.

Demchuk isn't alone. Eugene Matsulevych, the CEO of trading platform Collective Forecast, said the latest MtGox transfers signal that "the worst times of Bitcoin, at least from that front, are behind us."

The total number of victims from the MtGox hack is estimated to be around 24,000. So, it seems like the worst times for #Bitcoin, at least from that front, are behind us.

— Eugene Matsulevych (@bescharov) August 21, 2024

Who else needs to sell for a real bullrun to start in crypto? pic.twitter.com/AoDNpNfPn1

@Kyledoops of popular crypto-focused YouTube channel Crypto Banter said, "Bitcoin's darkest days could be history" as MtGox closes its repayment chapter.

MtGox has settled debts with over 19,000 of its 24,000 creditors, paying them in Bitcoin and Bitcoin Cash.

— Kyledoops (@kyledoops) August 22, 2024

As this chapter closes, Bitcoin's darkest days could be history.

The big question now: who's next to sell before the crypto market ignites a major bull run? pic.twitter.com/3rMJ02FLt6

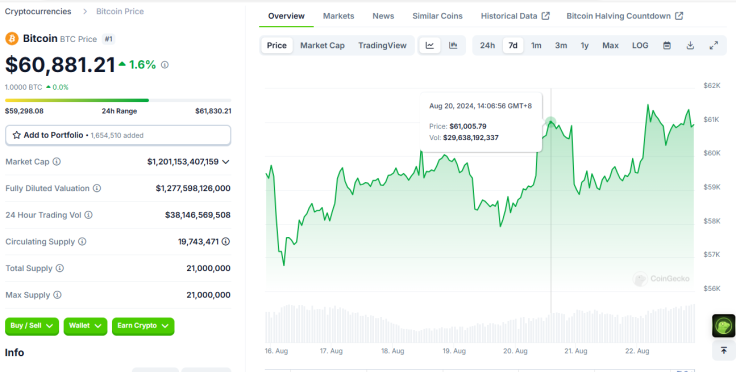

Notably, $BTC prices didn't fall even when news about MtGox's $700 million transfer spread across social media. In fact, the digital coin hit $61,000 at one point Tuesday after starting the day at around $58,000, data from CoinGecko shows.

Bitcoin's current price at $60,000 is still well below its all-time high above $73,000, but with the halving behind and some industry experts previously saying that huge dumps are over, the world's first decentralized cryptocurrency may have already started walking the path to recovery.

MtGox has an October deadline for completing its repayments.

© Copyright IBTimes 2025. All rights reserved.