Lawmakers split as debt deadline looms, markets uneasy

A sharply divided Congress pursued rival budget plans on Monday that appeared unlikely to win broad support, pushing the United States closer to a ratings downgrade and debt default that would send shockwaves through global markets.

With an August 2 deadline little more than a week away, lawmakers have steadfastly refused to compromise and talks once again collapsed in acrimony at the weekend. Democrats and Republicans split into two camps to work on their own proposals.

Financial markets were uneasy in Asia and Europe on Monday about the prospect of a first-ever U.S. debt default, which Fed Chairman Ben Bernanke has said would be a "calamitous outcome" for the U.S. and the global economy.

European and Asian stocks fell 0.4 percent to 1 percent. U.S. stock futures prices were also down 1 percent, suggesting a weaker start on Wall Street later. Gold, the favored safe haven, rose 1 percent to a record high.

But there was no panic selling that some politicians in Washington had feared after the weekend talks broke down.

"There's an old saying that things don't matter until the day they matter; we're getting close to the day when it will matter," said Quincy Krosby, market strategist at Prudential Financial in Newark, New Jersey.

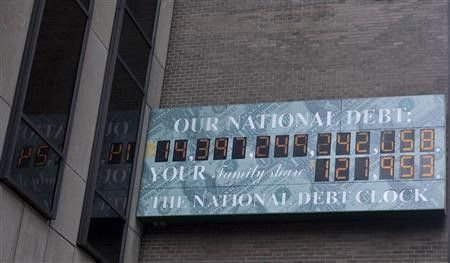

After weeks of rancorous talks, finger-pointing and political point-scoring, both sides appeared still far apart on a deal to reduce the budget deficit, which would clear the way for Congress to raise its $14.3 trillion borrowing limit.

President Barack Obama and congressional leaders have tried to reassure global markets that the country will be able to service its debt and meet other obligations after August 2, when the Treasury Department says the United States will run out of money to pay its bills.

It is not clear whether either plan would satisfy ratings agencies, which warn that the United States must take significant steps to get its long-term fiscal problems under control in order to preserve its top-notch status. A downgrade would raise costs for the government American consumers, whose spending helps drive U.S. economic growth.

Democratic Senator Harry Reid aims to raise the debt ceiling by $2.7 trillion, enough to cover the country's borrowing needs through the November 2012 elections. That would be paired with an equal amount in spending cuts over 10 years -- short of the $4 trillion in deficit savings that experts say will be necessary to keep debt at a sustainable level.

Boehner's plan would raise the debt limit in stages, forcing Congress to confront the politically painful issue again before the election. His plan could potentially deliver bigger budget savings through an overhaul of the tax code and a reform of expensive health benefits that are expected to balloon over the coming decade.

NO NEW TAXES

Neither plan would raise taxes, despite Obama's insistence that tax hikes need to be part of the solution. Democrats want to ease the pain of spending cuts by phasing them in gradually over 10 years and increasing taxes on the wealthy.

In a bid to retain the support of Tea Party-aligned conservatives in his party, Boehner's plan could also include some form of a balanced-budget amendment to the Constitution, even though the Senate voted down a similar bill last week.

"I do think there is a path, but it's going to require us to stand together as a team," Boehner told fellow House Republicans, according to several sources. "It's going to require some of you to make some sacrifices."

Reid said Boehner's plan will get nowhere in the Senate.

"Speaker Boehner's plan, no matter how he tries to dress it up, is simply a short-term plan, and is therefore a non-starter in the Senate and with the president," Reid said in a prepared statement.

Now the Republican-controlled House and the Democratic-controlled Senate appear to be heading for a showdown as their leaders develop competing legislation to resolve the crisis.

Ratings agencies have warned that even if Congress raises the debt ceiling and averts a default, they may still strip the United States of its AAA credit rating if lawmakers fail to agree on deeper long-term budget cuts.

A lower credit rating could raise borrowing costs not only for the U.S. government but also for other countries, companies and consumers because U.S. Treasuries are the benchmark by which many loans are measured.

Earlier this month, Bernanke warned against overzealous government spending cuts in the short term because it could derail an already fragile recovery from the global financial crisis and a default would be calamitous.

Democratic Senator Harry Reid aims to raise the debt ceiling by $2.7 trillion, enough to cover the country's borrowing needs through the November 2012 elections. That would be paired with an equal amount in spending cuts over 10 years -- short of the $4 trillion in deficit savings that experts say will be necessary to keep debt at a sustainable level.

Boehner's plan would raise the debt limit in stages, forcing Congress to confront the politically painful issue again before the election. His plan could potentially deliver bigger budget savings through an overhaul of the tax code and a reform of expensive health benefits that are expected to balloon over the coming decade.

NO NEW TAXES

Neither plan would raise taxes, despite Obama's insistence that tax hikes needed to be part of the solution. Democrats want to ease the pain of spending cuts by phasing them in gradually over 10 years and increasing taxes on the wealthy.

Boehner's plan could also include some form of a balanced-budget amendment to the Constitution, a bid to retain the support of conservatives in his party aligned to the Tea Party. However, the Senate voted down a similar bill last week.

"I do think there is a path, but it's going to require us to stand together as a team," Boehner told fellow House Republicans, several sources said. "It's going to require some of you to make some sacrifices."

Democrat Reid said Boehner's plan will get nowhere in the Senate.

"Speaker Boehner's plan, no matter how he tries to dress it up, is simply a short-term plan, and is therefore a non-starter in the Senate and with the president," he said in a prepared statement.

How quickly the negotiations can advance is less clear now that both chambers will be advancing rival bills. The Senate generally needs a week to pass any legislation unless opponents can be persuaded to drop procedural barriers -- an uncertain prospect on such a high-profile issue.

Ethan Harris, co-head of global economic research at Bank of America-Merrill Lynch, said he expected a temporary increase in the debt ceiling with the promise of up to $4 trillion in deficit reductions to be finalized six months later.

"The base case scenario can be summarized as 'appease and delay' -- appease the rating agencies and the market with the beginnings of a large plan, but in actuality delay the crisis further into the future," Harris said.

Robert Tipp, chief investment strategist at Prudential Fixed Income in Newark, New Jersey, said the U.S. Treasury may have a bit of wiggle room on the August 2 deadline because tax revenues had exceeded expectations. But that would buy a few days, not weeks.

He thought the most likely scenario is a small deal that averts default but bumps the United States down to AA status.

"I think that's what the agencies have signaled, and therefore that's what the markets are expecting," he said.

© Copyright Thomson Reuters 2024. All rights reserved.