Leading Blockchain API Providers 2025: An All-Inclusive Study

The digital asset ecosystem has experienced a drastic change, with Statista's forecast to reach US$45.3bn before the end of 2025. For this reason, businesses face increasing pressure to integrate cryptocurrency capabilities into their operations.

Tons of Web3 and Web2 traditional businesses, including e-commerce and fintech platforms, now require crypto exchange and payment solutions to scale up. Yet, building these systems from scratch presents substantial technical, regulatory, and operational challenges that only a few companies can afford to undertake.

This surge in demand has also increased the demand for cryptocurrency infrastructure providers, offering specialized blockchain APIs and turnkey solutions that promise to bridge the gap between traditional finance and the crypto economy. These service providers offer everything from exchange functionality and fiat on/off-ramp capabilities to comprehensive payment processing systems, allowing businesses to focus on their core operations while leveraging battle-tested crypto infrastructure.

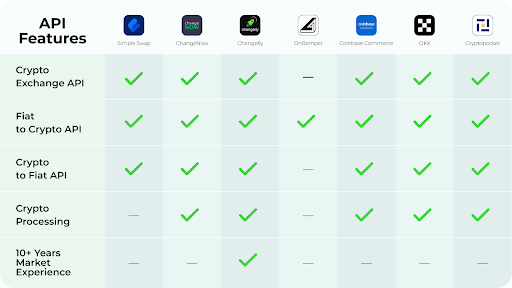

Comparison Matrix

Changelly

Changelly is a seasoned crypto exchange API provider with 10 years of market presence and serving over 7 million registered users with 99.9% uptime. Over 1,000 coins across 185 blockchains are supported on the platform, therefore allowing access to over 330,000 distinct trade pairs. Notably, its market power is shown by its partnership with 600+ companies and interaction with big sector players like Ledger, Tangem, Ellipal, Safepal, Tonkeeper, and Trezor, among hundreds of others.

Regarding operations and security, Changelly upholds rigorous security standards, including AML/KYC measures to prevent money laundering by verifying customer identity, ownership, and source of funds. Further, starting with a 0% cost offer for new integrations, its fee structure is significantly competitive; customizable fee structures go from $10 to $15 million in exchange limitations.

Supported by 200+ fiat currencies via its payment provider network, the platform provides both crypto-to-crypto swaps and fiat on/off-ramp services. Changelly partners with 10+ fiat providers, e.g., MoonPay, Revolut, Banxa, Topper, Unlimit, Tranzak, etc., and offers a fiat deal aggregator for finding the best match for every particular user to buy crypto while also helping businesses avoid multiple integrations with each provider available via Changelly's fiat API.

The platform offers 24/7 technical and user support and stresses technological performance with an average swap completion time of 15 minutes. Usually involving options for both API and widget implementations, its integration procedure takes three days. The platform also offers affiliate program and widgets. Notable success indicators show Changelly's efficacy in practical use: a partner reporting a 130% increase in monthly transaction volume in four months.

SimpleSwap

SimpleSwap offers integration possibilities for websites and platforms, therefore presenting itself as a go-to crypto exchange API solution. Its service provides access to about 300,000 trade pairs by supporting over 1,500 cryptocurrencies spread across 50+ blockchains. Combining CEX, DEX, and unique liquidity solutions makes the platform good for wallets, aggregators, and GameFi projects.

SimpleSwap follows KYC/AML rules as shown by its legal papers on security and compliance. Beginning with a 0.4% commission, its pricing system allows for rate customizing up to 5% via its affiliate program. The platform provides several API keys under one personal account and allows fixed and adjustable pricing.

Supported by positive Trustpilot ratings showing its rapid service and fast issue resolution, SimpleSwap stresses its technological dependability and customer assistance. For perfect integration, the platform offers thorough documentation, technical support, and partner help. Customizable commission structures, high rate limiting, and no monthly withdrawal restrictions are among notable features.

ChangeNOW

ChangeNOW is a crypto exchange API tool, offering access to over 900 crypto assets and 319,000 exchange pairs. With 99.99% availability, 350ms response time, and a 10-minute accident warning system, the platform keeps outstanding technical performance measures. Additionally, the platform partners with well-known industry participants such as Exodus, Trezor, Bitcoin.com, and several crypto wallets.

ChangeNOW offers a complete technical infrastructure and follows KYC/AML regulations regarding security and compliance. Starting at 0.4% commission, its pricing system lets partners adjust prices for particular assets and combinations with great flexibility. Available upon demand, the platform enables both fiat on-ramp and off-ramp services as well as aggregates liquidity from centralized (CEX) and distributed exchanges (DEX), therefore enabling cross-chain swaps.

Emphasizing its partner benefits—24/7 assistance, flexible withdrawal choices in 11 cryptocurrencies (including fiat), and free maintenance upon integration—the platform highlights its API documentation, which covers online as well as mobile apps, among other platforms. While giving partners customizing profit management tools and privileged privileges based on monthly volume, ChangeNOW offers several exchange flow alternatives, including conventional and fixed rates.

OnRamper

OnRamper is a fiat-to-crypto onramp aggregator including 25+ onramps and 130+ payment modalities using a single API. With coverage over 190+ countries, the platform claims to cut development time by 95% with its plug-and-play configuration. Its market position is confirmed by partnerships with prominent companies such as SushiSwap, Coinbase Wallet, and Bitcoin.com.

Regarding security, OnRamper stresses strict due attention to detail and security-by-design architecture. Using a complex routing engine that takes over 70 data points into account, the platform optimizes transaction success, including KYC reduction capabilities for smaller transactions. OnRamper saves users an average of 2.52% by fee-based routing and monetizes through referral fees from partner onramps instead of including direct fees to transactions.

Additionally, through its Terminal dashboard, the platform offers complete statistics that let partners track volumes, conversion rates, and performance across several geographies and payment systems. The platform provides direct access to supported onramps and 24/7 dedicated assistance with designated experts. Its white-label solutions increase transaction success rates by up to 80% by including a totally customizable widget.

Coinbase Commerce

Coinbase's Exchange API is a complete solution for high-volume trading activities, emphasizing its strong infrastructure and institutional-grade security features. Using its Liquidity Program, the platform provides competitive pricing and possible reductions together with a dynamic charge structure that grows with trade volume. While USD gains FDIC insurance up to $250,000 per user, its security system consists of complete insurance coverage for digital assets kept in online storage.

Technically, Coinbase Commerce offers several integration choices, including FIX and REST APIs, together with WebSocket feeds for real-time market data access. Deep liquidity pools help to enable these technical capabilities, hence facilitating effective order execution and competitive pricing for significant volume transactions. Using its developer platform, the platform's documentation stresses simplicity of integration and offers comprehensive technical resources and support.

Operating under pertinent regulatory control, Coinbase Commerce preserves a solid compliance structure. However, it clearly states its non-registration status with the SEC and CFTC. Its developer-centric approach is clear from thorough documentation, integration support, and a technical assistance Discord community.

OKX

OKX presents an API suite supporting trade integration across several product categories from spot, margin, contracts, and options for over 100 digital currencies. Offering three different API types— Trading API, Data API, and Investment & Services API—its API infrastructure is meant to serve retail developers as well as institutional clients. With trading fees set in line with its normal charge schedule, the platform keeps a zero-cost API access paradigm.

Technically and security-wise, the platform provides REST and WebSocket API implementations, the latter especially intended for market makers, brokers, and block trading activities. Its institutional-grade offerings include improved fee policies, higher trading limits, and specific OTC services. To show its dedication to security and user preparation before live trading, the platform offers a mock trading environment for testing needs.

OKX keeps many incentive programs for business development, including an affiliate program with up to 50% commission, a referral program with prizes up to 10,000 USDT, and a lead trader program with profit-sharing ratios up to 30%. Its customer support system includes thorough documentation, FAQ resources, and API user-specific support.

Cryptopocket

Cryptopocket is a fiat on/off ramp service provider with Euro-based crypto transactions. Under the Bank of Spain's control, the platform offers API integration tools for websites, apps, dApps, and blockchain projects. Its market span includes gaming tokens, token presales, NFT markets, DeFi FinTech, and institutional businesses.

Regarding security and compliance, Cryptopocket stresses its regulated standing with the Bank of Spain and uses safe payment and collecting technologies. With operations through significant DEX liquidity pools, the platform offers both fiat currencies—specifically Euros—and several cryptocurrencies, including BTC, ETH, BNB, USDT, and USDC.

Emphasizing quick transaction processing "in few minutes," Cryptopocket provides white-label solutions. For Launchpads, DApps, and DeFi apps, among other use cases, the platform offers several integration choices, including API, widget, and customized solutions. User custody control—which enables consumers to use their own hot or cold wallets—is a main benefit.

© Copyright IBTimes 2024. All rights reserved.