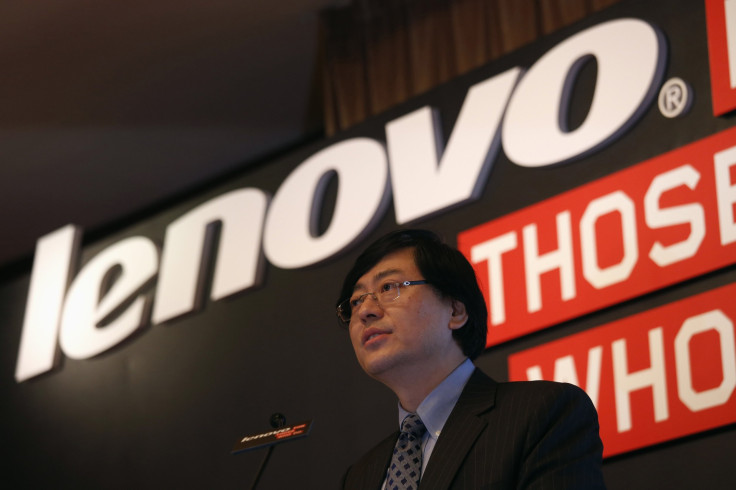

Lenovo Group Ltd. Earnings Preview: Can No. 3 Smartphone Maker Turn Motorola Into A Profit?

Lenovo Group Limited, the world’s largest PC maker, is slated to report quarterly earnings on Thursday, and Wall Street will be watching for two key developments from the Chinese company:

- Investors will be listening in to the conference call to hear how the multinational technology company plans to expand in the smartphone market following its acquisition of Motorola Mobility.

- Investors are looking for the company to sketch a more detailed road map of how it plans to turn its recent acquisition of IBM’s server business into a profit.

For the quarter ended in September, Lenovo is expected to turn in a fiscal second-quarter profit of $260.3 million, or 3 cents per share, on revenue of 11.32 billion, according to analysts polled by Thomson Reuters. Lenovo reported net income of $219.68, or EPS of 2 cents, on sales of $9.8 billion a year ago.

Last week, the company announced it completed its $2.91 billion acquisition of Google Inc.’s Motorola Mobility handset unit, positioning Lenovo as the world’s third-largest maker of smartphones behind tech giants Samsung Electronics Co. Ltd. and Apple Inc. Competition on smartphones, particularly in China, could hit Lenovo’s top-line growth in its core business, as the rivalry is quickly growing. Following the Motorola takeover, Lenovo leapfrogged rival Chinese smartphone company Xiaomi and now ranks third in the global smartphone market share. Investors will be analyzing Lenovo’s earnings report to see how the company plans to expand its growth beyond the PC market.

Developed-market smartphone growth will leverage the Motorola acquisition as Lenovo will pay lower IP royalties with the Motorola brand than for the Lenovo brand, according to investment research firm Morningstar.

"The company has a track record of growing both organically ... Such strength will be tested with the recently announced acquisition of the troubled Motorola smartphone business, as it will be tasked with turning around a business that is losing around $1 billion per annum," Ross MacMillan, senior analyst at Morningstar, said in a note.

Separately, Lenovo in September completed its $2.1 billion purchase of International Business Machines’ low-end x86 server business. As part of the agreement, Lenovo and IBM have also established a strategic alliance where Lenovo will serve as an original equipment manufacturer to IBM and will resell select products from IBM’s storage and software portfolio. The move follows in the footsteps of the sale of IBM’s PC business to Lenovo in 2005.

IBM decided to spin off its low-end server business to focus more on cloud computing after its server unit hurt the company's bottom line. Investors now want to see how the Chinese company can turn a shrinking business at IBM into a profitable one at Lenovo. Morningstar anticipates the overall PC and notebook market will slip back into a decline; however, the investment research firm said Lenovo should be able to maintain its growth in China out to 2019 due to continued gains in market share.

“We assume the IBM Server business earns $4.7 billion in revenue and $260 million in operating earnings in fiscal 2015 with revenue growing at 10 percent for the next two years as Lenovo cross sells these products to its existing client base,” MacMillan added.

Lenovo is scheduled to host a conference call on Thursday with shareholders at 1:30 a.m. EST. Shares of Lenovo closed flat on Wednesday to $11.38 on the Hong Kong Stock Exchange.

© Copyright IBTimes 2024. All rights reserved.