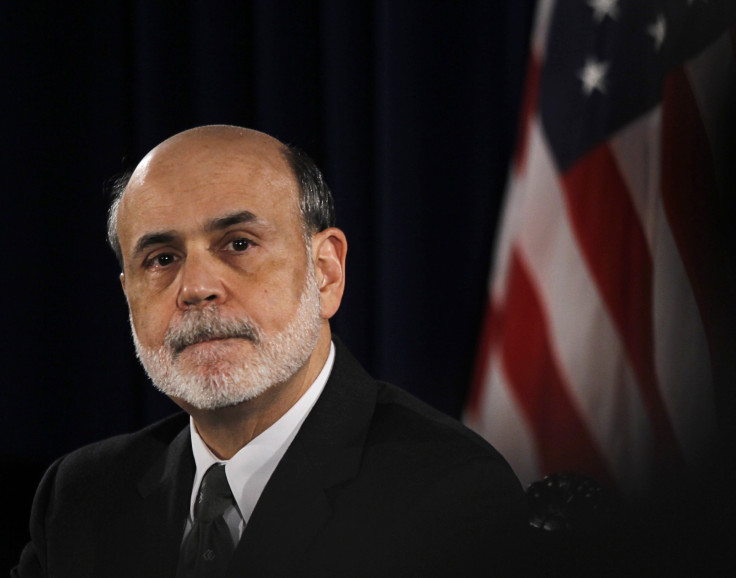

Live Blog: Fed Chairman Ben Bernanke Press Conference, September FOMC Meeting, QE Tapering Decision [VIDEO]

Hello and welcome to our live coverage of the Federal Reserve's interest rate decision and the press conference that Ben Bernanke, the Fed's chief, will give a bit later in Washington, D.C.

The Federal Reserve's powerful rate-setting committee concludes its fifth meeting of the year today. The official statement -- along with the updated survey of economic projections from FOMC participants -- will come out at 2 p.m. EDT Wednesday, followed by Bernanke’s press conference at 2:30. The news conference will be broadcast live on the Federal Reserve's UStream channel.

The questions on everyone’s mind right now: Will today be the beginning of the end for the Fed’s ultra-easy monetary policy?

CLICK HERE To Refresh This Page For LIVE Updates.

****

Update 3:57 p.m.: And that’s a wrap. Thanks for tuning in. Bernanke's next post-FOMC press conference will take place on Dec. 18.

To sum up, the Fed decided to keep up the current $85-billion-per-month pace of asset purchases today. The committee still views economic activity as expanding at a moderate pace, with labor market indicators improving recently, household and business spending advancing and the housing market strengthening. However, the committee noted concerns about the recent rise in mortgage rates (from their own taper talk) and concerns about how fiscal policy could restrain the economy. It also recognized the fact that Fed was falling short of its 2 percent inflation target.

The only dissent from the decision was Esther George, who for the sixth meeting in a row, has wanted the Fed to slowly end its bond buying over concerns about financial imbalances and inflation.

Update 3:50 p.m.: Reactions from IHS Global Insight U.S. Economist Paul Edelstein:

The payroll numbers looked a bit better in June (when the Fed established a roadmap for tapering QE3) than they do today. Given recent developments in interest rates and fiscal policy, the committee wasn’t ready to pull the trigger. But we suspect that the bias on the committee remains against a long-lasting QE program.

Barring a really bad outcome from the upcoming battles over fiscal policy in the fall and winter, we expect the Fed to taper at the December meeting.

Update 3:45 p.m.: Capital Economics’ Paul Ashworth now expects the Fed to wait until the December FOMC meeting before seriously considering again whether to begin tapering or not, which is the next time the forecasts will be updated and a press conference is scheduled.

Update 3:31 p.m.: Bernanke has left the stage.

To wrap up, the Fed decided not to trim its asset purchases at today's meeting because the economy isn't strong enough.

Update 3:17 p.m.: Bernanke is not worried about its bloated balance sheet. He points out that the Fed has developed a variety of tools and the Fed has numerous tools that can be used to both manage interest rates and to ultimately unwind the balance sheet when the time comes.

“I feel quite comfortable that we can raise interest rates at the appropriate time, even if the balance sheet remains large for an extended period.”

Update 3:05 p.m.: A very good question: Does the Fed need a meeting with a press conference to make a big decision?

The short answer is “no.”

Bernanke said policy decisions can be taken at any of the eight FOMC meetings during the year. If needed, he added, “we certainly could arrange public on-the-record conference call or some other way of answering the media's questions.”

So, "Octaper" is possible. The October FOMC meeting isn't followed by a press conference.

Update 2:50 p.m.: Here comes the widely anticipated retirement question. And the usual “mumble, mumble, mumble” from Bernanke.

Steve Liesman with CNBC: Mr. Chairman, one question, just three parts, if you don't mind. Have you indicated to President Obama you did not want to serve a third term? If so, when? Or did President Obama indicate to you he did not want you to serve a third term? And those two parts notwithstanding, with you serve a third term if asked, either wholly or in part?

Bernanke: It's convenient because I have the same answer to all three parts of your question. (Laughter). If you will indulge me just a little longer, I prefer not to talk about my plans at this point. I hope to have more information for you at some reasonably soon date, but today I want to focus on monetary policy. I'd prefer not to talk about my own plans.

Update 2:54 p.m.: The Fed “could begin [tapering] later this year,” but even if they take the first step, the subsequent steps will still be dependent on continued progress in the economy.

"There's not any magic number that we're shooting for," he said.

Update 2:50 p.m.: Regarding the tightening in financial conditions, Bernanke said he had no choice.

“I think there's no alternative in making monetary policy but to communicate as clearly as possible, and that's what we try to do,” Bernanke said.

Update 2:47 p.m.: Pedro da Costa from Reuters: “How high do you think the jobless rate would be if it were not for the decline in participation?”

Bernanke says he believes most of the improvement in the unemployment rate in the past year is due to job creation rather than lower participation.

That said, he agree that unemployment rate is -- while perhaps the best single indicator of the state of the labor market, -- not by itself a fully representative indicator.

Update 2:46 p.m.: Bernanke is taking questions.

Update 2:45 p.m.: Bernanke, still in his opening statement, says economic conditions the Fed has set out as preceding any future rate increase are thresholds, not triggers.

For example, a decline in the unemployment rate to 6.5 percent would not lead automatically to an increase in the federal funds rate target but would, instead, indicate only that it had become appropriate for the committee to consider whether the broader economic outlook justified such an increase.

Update 2:42 p.m.: Bernanke reiterates that “asset purchases are not on a preset course.”

Update 2:40 p.m.: While acknowledging improvements, Bernanke believes conditions in the job market today are still far from what the central bank would like to see.

Policymakers have some concern that the rapid tightening of financial conditions in recent months could have the effect of slowing growth -- a concern that would be exacerbated if conditions tighten further.

Finally, the extent of the effects of restrictive fiscal policies remain unclear, and upcoming fiscal debates may involve additional risks to financial markets and to the broader economy.

“In light of these uncertainties, the committee decided to await more evidence that the recovery's progress will be sustained before adjusting the pace of asset purchases,” Bernanke said.

Update 2:34 p.m.: Bernanke, in his introductory comments, said he will explain the rationales for the Fed’s decision in a moment. Stay tuned.

Update 2:30 p.m.: Here he comes.

Update 2:25 p.m.: Bernanke is on in less than 5.

Wardwell has a handful of questions he said he’d like to ask the chairman. With the former Princeton economics professor leaving the Fed in January, Wardwell asked the question that’s on everyone’s mind -- “Will we ever see you in a classroom again?”

“A lot of people will and a lot of people won’t. Both Bushes went radio silent after they left the presidency,” Wardwell said. “Is he [Bernanke] planning to be radio silent for the next 10 years, or is he going to actually talk about what he learned and try and educate people on what the lessons were?”

Update 2:23 p.m.: In an interview prior to today’s statement, Sam Wardwell, investment strategist at Pioneer Investments, said: “If Fed continues to buy $85 billion a month in bonds every month, it incentivizes people to make decisions they would not make under normal circumstances. Those are therefore probably not good decisions.”

“The first mistake is starting it, the second mistake is not stopping it,” Wardwell added.

Update 2:17 p.m.: The markets are reacting violently to the news. The S&P 500 climbed above its record Aug. 2 closing high of 1,709.67.

Update 2:10 p.m.:

No big changes today.

There was no taper, no change in threshold for how low the unemployment rate will have to fall before the Fed will consider raising interest rates, no change in the Fed's tolerance for inflation and not a single hint about when they will start to scale back their bond-buying. There are only two FOMC meetings left this year – October and December.

Update 2:00 p.m.: The Fed statement arrives.

Looks like the folks over at Bank of America Merrill Lynch got it right. The Fed decided to continue buying bonds at an $85 billion monthly pace for now. Fed expects to raise interest rates in 2015.

The FOMC "decided to await more evidence that progress will be sustained before adjusting the pace of its purchases," the statement read.

Read the full text here.

The Fed has also released updated economic projections.

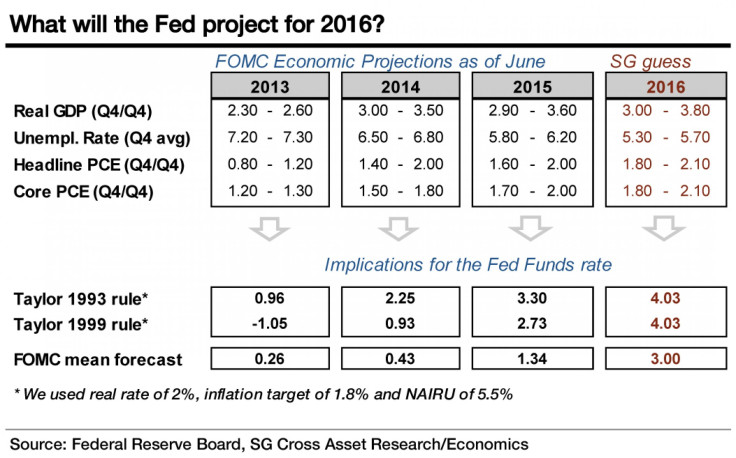

The U.S. economy is expected to grow at a rate of 2.5 percent to 3.3 percent in 2016. Jobless rate is projected to fall under 6 percent by 2016 and the Fed sees inflation below 2 percent until end of 2016. Policymakers cut their predictions for this year’s growth to 2.0 percent from 2.3 percent.

For the full breakdown, see here.

Update 1:49 p.m.: Leading up to the Fed’s pivotal decision, a Reuters poll found that only 27 percent of Americans know what quantitative easing is. Twelve percent of respondents thought QE was a computer-assisted program that the Fed uses to manipulate the dollar. “The fact that 73 percent of respondents can’t define the critical program suggests the Fed has a serious communications challenge,” Reuters’ Ann Saphir wrote.

Update 1:41 p.m.: From Societe Generale:

Update 1:32 p.m.: Any decision today by the Fed to taper will have wide-spread implications. The housing market could take a big hit as mortgage rates rise, American companies would no longer be able to borrow cheaply and the stock market rally could sound the retreat after flirting with record levels.

Yields on 10-year Treasuries, a benchmark for everything from corporate bonds to mortgages, have risen to 2.85 percent from 1.76 percent on Dec. 31.

(Read more: Tapering Likely To Hit Homeowners Hardest)

Update 1:25 p.m.: In a research note published this morning, analysts at Bank of America Merrill Lynch reiterated their view that the committee is more likely to announce tapering in December rather than today, citing mixed economic data since the June FOMC meeting.

The introduction of the 2016 economic projection would add a new very important piece of information to the market participant's information set, allowing them to understand better the Fed's expectations for the pace of the hiking cycle.

Until now, the focus has been on when hikes might begin, with little guidance on the pace. Putting all together, it is quite clear to us that this meeting represents a significant communication challenge for the Fed: they need to signal that a potential start of tapering will not imply bringing forward the hiking cycle, therefore decoupling the Fed’s two reaction functions (one related to the long end of the curve and the other associated with the short end and the belly). With that in mind, our U.S. economics team expects Chairman Ben Bernanke to de-emphasize the unemployment rate thresholds, indicating that the Fed will likely wait for unemployment to be well below the numerical thresholds to start hiking.

Update 1:13 p.m.: While we wait for the official statement, let's take a look at how the job market is doing.

The U.S. economy created 169,000 jobs last month, up from the 162,000 tally for July, but missed economists’ expectations of 180,000. The jobless rate fell to 7.3 percent, the lowest since December 2008, and less than estimates that it would hold steady at 7.4 percent. However, it fell for the wrong reason. The labor force participation rate, which gauges the proportion of population in the labor force, fell to 63.2 percent from 63.4 percent in July, the lowest since August 1978.

Update 1:02 p.m.: U.S. stocks drifted lower as investors await the Fed’s decision.

The S&P 500 (INDEXSP: .INX) fell 2.77 points or 0.16 percent, to 1,701.99, the Dow Jones Industrial Average (INDEXDJX: .DJI) lost 42.79 points or 0.28 percent, to 15,486.94 and the NASDAQ Composite (INDEXNASDAQ: .IXIC) dropped 3.94 points or 0.11 percent, to 3,741.77.

Update 1:01 p.m.: Most Fed watchers expect the central bank to announce today that they will take a baby step and scale back its $85-billion-a-month bond-buying program by $10 billion. The Fed’s balance sheet has more than tripled to around $3.6 trillion following three rounds of quantitative easing efforts.

As the economy improves, the Fed is trying to shift its focus from bond purchasing, which has uncertain costs and benefits, to the low-rate pledge.

The central bank has pinned short-term interest rates near zero since December 2008 to help lift the U.S. economy out of the Great Recession. Policy makers have pledged to keep interest rates at rock-bottom levels until the jobless rate drops to 6.5 percent, a threshold they currently expect to cross by 2015. The central bank is expected to release its 2016 forecasts for the first time Wednesday.

(Read more on what to expect from the Fed.)

© Copyright IBTimes 2024. All rights reserved.