Lower Oil Prices Chip Away At Tax Revenues In America's Top Oil And Natural Gas States

Tax revenue in America’s top crude oil and natural gas-producing states has been sliding, along with the prices of those commodities, for months now. Their state governments have been losing out on hundreds of millions of tax dollars from crude oil and natural gas sales that would normally help to keep their annual operating budgets afloat, federal energy analysts found.

The U.S. Energy Information Administration (EIA) reported Thursday that four of the top five oil and gas-producing states -- Texas, North Dakota, Alaska and Oklahoma -- saw significant declines in tax revenue from energy producers in recent months.

Domestic oil prices plunged to less than $50 a barrel earlier this year from more than $100 a barrel in mid-2014, spurred by a growing glut of crude supply amid tepid global demand. In CME Group futures trading, the U.S. benchmark crude’s price per barrel for April delivery settled at $48.17 Wednesday, and analysts say they don’t expect a return to triple-digit prices anytime this year.

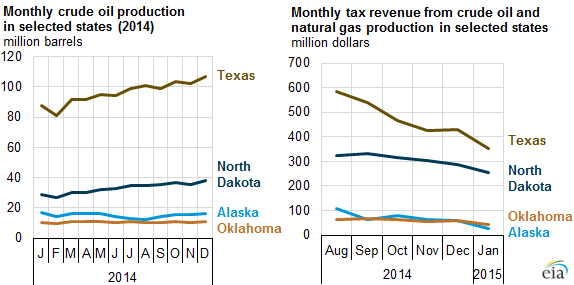

In Texas, the country’s most oil-rich state, monthly oil and gas tax revenue dropped by 40 percent, to $352 million this January from $583 million last August, according to data provided by the state comptroller’s office. That decline came even as Texas producers were churning out more oil. Crude and lease production jumped 22 percent in the state last year, to 107 million barrels in December from 88 million barrels in January, the EIA reported.

North Dakota’s oil and gas production also continues to rise, but not by enough to overcome falling tax revenue. The state took in 21 percent less money, with oil and gas receipts dropping to $254 million in January from $323 million in August, the EIA said.

Alaska funds 90 percent of its operating budget via crude-oil production: It saw oil and gas tax receipts plummet by nearly three-quarters, to just $26 million in January from $108 million in August, according to initial tax receipts counted by the Alaska Tax Accounting System.

In Oklahoma, oil and gas production taxes declined to $43 million in January from $62 million in August, a 30 percent drop, the EIA reported, citing information provided by the Oklahoma Tax Commission.

California, an annual producer of more oil than both Alaska and Oklahoma, was not as badly hit by the drop in global oil prices. The Golden State’s $2.2 trillion economy -- the world’s seventh-largest -- is big enough to absorb ebbs and flows in oil and gas tax receipts.

The tax declines in multiple U.S. states have come on top of widespread layoffs in the oil and gas sector. Major energy companies, ranging from the oil-field service firm Baker Hughes Inc. to the independent oil and gas company ConocoPhillips, have slashed thousands of jobs in U.S. and global operations in recent months to cut their costs during this period of cheaper oil.

American manufacturing companies are similarly bracing themselves. The United States Steel Corp. said in January it would lay off more than 750 workers at its plants in Ohio and Texas amid declining orders for steel pipes and tubes.

© Copyright IBTimes 2024. All rights reserved.