Lyft Files S-1, Expects Up To $25 Billion From IPO In April

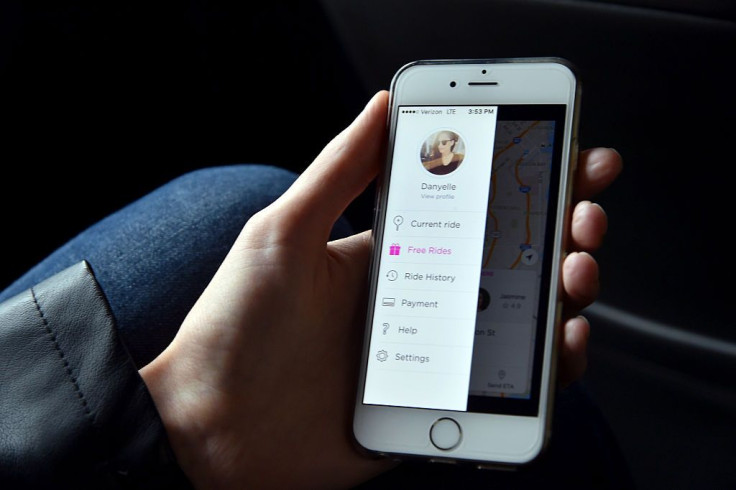

California-based on-demand transport firm, Lyft, which controls 39 percent of the ride-hailing market in North America, is set to launch its much awaited IPO as early as April. It will go public at the NASDAQ Composite under the “LYFT” ticket symbol.

Rival Uber, the world’s largest ride-hailing firm, is expected to do so later this year,

Lyft got its IPO party rolling over the weekend by filing its Form S-1 with the U.S. Securities and Exchange Commission (SEC). The filing also made public Lyft’s hitherto undisclosed operating results.

Lyft revealed a loss of $911 million in 2018, but doubled its revenue to $2.2 billion from 2017. It had $8.1 billion in bookings in 2018, a 78 percent jump from $4.6 billion in 2017. Lyft lost $688.3 million in 2017 and $682.8 million in 2016.

Other interesting information revealed in the S-1 -- its 1.1 million drivers in North America ferried over 18.6 million “active riders” from October to December 2018. Lyft drivers earned more than $10 billion since Lyft debuted in 2012. The company says its service is active in more than 300 markets in the U.S. and Canada.

Lyft, however, didn’t reveal how much it wants to raise in the IPO but left a placeholder figure of $100 million in its S-1 with the SEC. It’s said to be targeting a valuation ranging from $20 billion and $25 billion when it goes public. In 2018, Lyft was valued at $15 billion in a funding round.

Even at $25 billion, Lyft’s IPO pales in comparison to Uber. Its rival’s IPO might hit a staggering $120 billion, the largest in history in any country.

Lyft is working with a bevy of 29 banks led by JPMorgan Chase & Co. Inc., Credit Suisse and Jefferies Financial Group Inc. as lead bankers on the IPO.

Lyft will meet with prospective investors over the next two weeks in its IPO roadshow starting March 18,. After the roadshow, the timing of Lyft's IPO will be left to its team and the performance of Wall Street.

In its S-1, Lyft said “financial condition and results of operations could be adversely affected," if it’s unable to efficiently develop its own autonomous vehicle technologies or develop partnerships with other companies to offer autonomous vehicle technologies on its platform in a timely manner.

It also said "we may not be able to achieve or maintain profitability in the future," while hinting it might not be able to maintain its market share given intense market competition.

© Copyright IBTimes 2024. All rights reserved.