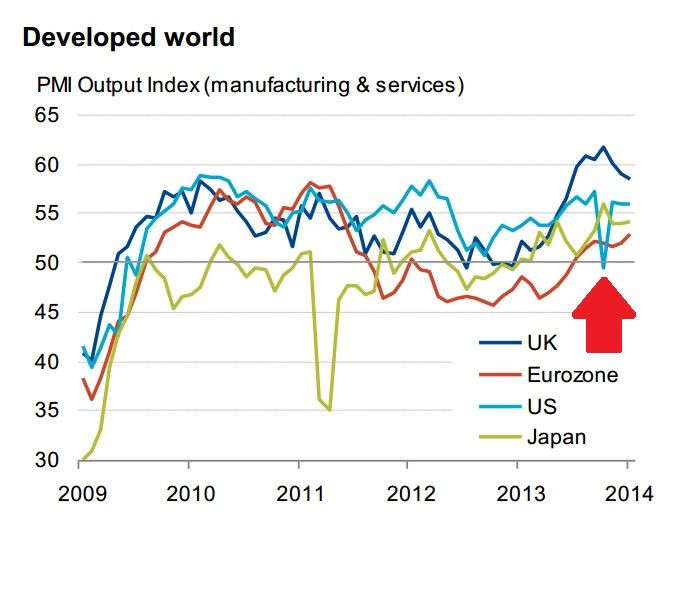

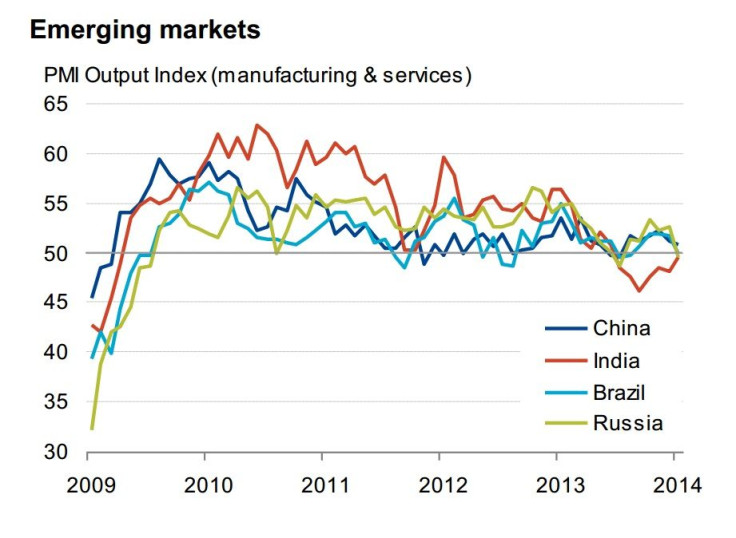

Manufacturing Data Shows BRICs (Brazil, Russia, China, India) Economies Contracting As Developed Economies (US, UK, Eurozone, Japan) Gaining

The global economy is expanding at a decent pace, but business surveys in recent months show a growing divergence between business conditions in the BRIC economies — Brazil, Russia, India and China — and the major developed countries. The BRICs are the weather vane of economic conditions of emerging markets.

“The developed world has registered a stronger improvement in business conditions than the emerging markets over each of the past nine months,” Chris Williamson, chief economist for London-based global financial information provider Markit, said in a research note on Monday. “Historically strong rates of growth in the U.K., U.S. and Japan, plus a recovering euro zone, contrasted with near-stagnation across the four BRIC economies, which collectively saw the second-worst month since March 2009.”

Here’s a summary of what’s happening in the major developed and emerging economies, according to Markit Economic Research’s analysis of global Purchasing Manager Indexes, regular surveys that gauge sentiment among producers in different countries.

The Developed World

United Kingdom: The country could see 0.8 percent GDP growth in the first quarter if conditions continue as they have amid the most rapid growth seen since the 2009 global economic downturn.

United States: The U.S. is on track for 0.6 percent growth in the first quarter. Markit says U.S. business surveys have “signaled ongoing robust employment growth broadly consistent with nonfarm payrolls growing at 200,000 per month approximate pace seen prior to December’s surprise slowdown.” However, monthly jobs data released Friday showed the U.S. economy added 113,000 jobs in January, far below the average of 194,000 a month added throughout 2013. If the U.S. economy is seeing “robust employment growth,” it hasn’t happened yet, according to official jobs data.

Japan: The country saw the strongest rise in manufacturing production in January since Markit began monitoring the activity in 2001. Slower growth in the services sector wasn’t enough to bring down Japan’s composite PMI output index.

Euro zone: The 18-member states of the European currency bloc, which have been reeling from debt crises and recessions, saw in January the strongest pace of expansion in 30 months. Conditions improved in even the worst-stricken countries: Italy, Spain and Greece.

The Emerging Markets

Brazil: Combined manufacturing and services contracted for the first time in five months.

Russia: Combined manufacturing and services contracted for the first time in six months.

India: Business conditions have contracted for the seventh consecutive month.

China: The country’s manufacturing PMI for January showed contraction for the first time in six months. Services saw the second-worst month since Markit began tracking this data in 2005. The slowdown could mean China might struggle to match the 7.5 percent annual growth rate it saw last year. February’s output will be adversely impacted by the Chinese New Year holiday.

© Copyright IBTimes 2024. All rights reserved.